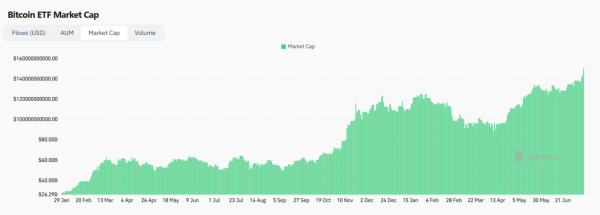

Bitcoin ETFs Surge to $1.76B as Price Hits $109K, Ethereum Struggles to Keep Pace

- Bitcoin ETFs draw $1.76B, pushing $BTC over $109K, while Ethereum ETFs see stagnant $139.4M inflows. Sentiment diverges.

- Bitcoin enters the “early distribution phase” as whales offload to retail. Accumulator addresses rise, adding 495K BTC monthly.

- Ethereum ETFs show signs of recovery, with $166.6M inflow on Jan 16. Yet, $ETH still trades 27% below its all-time high.

Bitcoin ETFs drew $1.76 billion in investments during the first week of Donald Trump’s second term as U.S. President, pushing the price beyond $109,000 for the first time. Ethereum’s price is still 27% below its peak, while Ethereum ETFs had substantially lesser inflows of $139.4 million. Strong institutional interest is demonstrated by Bitcoin’s rising price and consistent inflows. Despite sporadic spikes in ETF investment, Ethereum finds it difficult to sustain momentum.

🇺🇸 Spot ETF: 🟢$1.76B to $BTC and 🟢$139.4M to $ETH

🗓 Week: 20 to 24, 2025👉 Bitcoin ETFs attracted big inflows in the 1st week of President Donald Trump’s 2nd administration, pushing $BTC above $109K.

👉 Meanwhile, Ethereum ETFs saw stagnant flows, with $ETH price still 27%… pic.twitter.com/iT53xWVJqm

— Spot On Chain (@spotonchain) January 26, 2025

Bitcoin Bull Market Enters Early Distribution Phase

According to CryptoQuant, 86% of Bitcoin in circulation is currently profitable. Besides, accumulator addresses are growing at a record pace, adding 495,000 BTC monthly. Ki Young Ju, CEO of CryptoQuant, noted a divergence in Bitcoin holder behavior.

Retail investors owning less than 1 BTC are selling, while larger holders are accumulating. This indicates the late stage of the Bitcoin bull market. Ju identified the current cycle as the “early distribution phase,” where whales and institutional players dominate.

Interestingly, institutions are increasingly holding Bitcoin through ETFs and corporate stocks rather than direct purchases. This shift may delay the final distribution phase, where retail investors are expected to dominate.

Ethereum’s ETF Inflows Show Signs of Recovery

Although Ethereum ETFs lagged behind Bitcoin’s inflows, they displayed a modest recovery in mid-January. In a single day on January 16, ETH ETFs brought in $166.6 million. January 17 and 19 saw net inflows of $70.7 million and $9.2 million, respectively.

In the last week, Ethereum was also down but slightly, ranging just a bit over $3,300. But, according to its network balance, the mining power of Bitcoin has increased by 33%, approximately 800 EH/s, over the past year, which means network security has hit an all-time high. This increase supports Bitcoin’s dominance and is a reflection of increased miner confidence and strong infrastructure.