Something Big Coming? Whales Accumulate Bitcoin Like Never Before

Bitcoin accumulation addresses have seen massive inflows in the past week, leveraging retail sell-offs to stack the pioneering cryptocurrency extensively.

Despite Bitcoin’s recent struggles, whales are still keen on the premier asset. Large holders have seen price fluctuations as an opportunity to buy the fears predominant in the market.

Notable reporter Vivek Sen recently shared a positive accumulation trend among Bitcoin whales. In a tweet today, he noted that inflows into whale wallets have seen an uptick amid market uncertainties.

Accumulation Wallets Sees Inflows

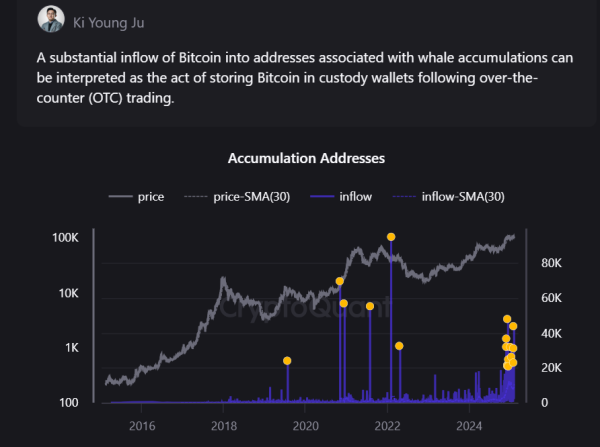

The data cited analytical insight from on-chain data provider CryptoQuant. Further analysis indicates that the inflows were to Bitcoin accumulation addresses.

CryptoQuant revealed that on February 4, these whale accumulation wallets accrued 31,226 BTCs, worth $3 billion at the current market price. This massive inflow follows a trend of enormous acquisitions by these addresses in the past week.

Ki Young Ju, the analytical firm’s CEO and founder, stated that the immense accrual into these wallets could be interpreted as an act of stacking Bitcoin in custody wallets after over-the-counter (OTC) trading.

Ki Young Ju on Bitcoin Accumulation

Ki Young Ju on Bitcoin Accumulation

Whales Buying Retail Fears

Market intelligence firm Santiment confirmed the growing Bitcoin accumulation from whale addresses. It highlighted the typical sentiments from these large holders, who tend to buy more of the pioneering cryptocurrency during mid-sized dumps and market volatility.

Per today’s post, addresses with at least 100 BTC have increased by 135 in February alone. The whales have borrowed Baron Rothschild’s “the time to buy is when there’s blood in the streets” sentiment to increasingly gain exposure to the premier asset.

Meanwhile, the whales have bought Bitcoin at the expense of retail traders. Santiment’s data shows that the large holders stacked the dumps from small retail traders who panicked during the market fluctuation.

Specifically, sub-100 BTC addresses have reduced by 138,680 wallets so far in February following the intense market fluctuation. The analysis suggested that a majority of these sales came from freshmen, particularly those who bought in the last six months.

Bitcoin Accumulation Trend

Nonetheless, Santiment’s commentary highlighted that, more often than not, the market rebounds under such conditions. The firm asserted that a bullish drive is on the cards, noting that it may take a few weeks or even months to materialize.

In the meantime, Bitcoin continues to wallow under $100,000, presenting more opportunities to buy. The asset trades at $98,266, down 6% in the past seven days.