PNC Bank Expands Bitcoin ETF Holdings to $67M as Market Sees Outflows

PNC Bank has significantly increased its investment in spot Bitcoin exchange-traded funds (ETFs), according to recent SEC filings. The bank, which manages $325 billion in assets, now holds $67 million in Bitcoin ETFs. This marks a substantial rise from its $10 million exposure reported in the first quarter of 2024.

Bitcoin ETFs Suffer From Outflows Despite Institutional Influx

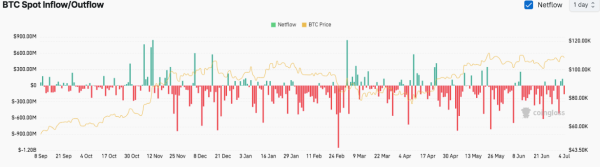

Despite this institutional growth, spot Bitcoin ETFs in the U.S. experienced net outflows on Feb. 6. Data from SoSoValue indicates that the 12 Bitcoin ETFs saw $140.3 million in withdrawals, reversing a two-day inflow streak that had totaled $407 million.

Fidelity’s FBTC led redemptions, with investors pulling out $103.25 million. Grayscale’s GBTC followed, recording $42.21 million in outflows. In contrast, Bitwise’s BITB was the only ETF to attract new investments, adding $5.15 million. Other funds, including BlackRock’s IBIT, reported no net flow changes for the day.

Trading volume for the 12 spot Bitcoin ETFs surged to $2.45 billion on Feb. 6, an increase from $2.04 billion recorded the previous day. The shift in ETF flows came as Bitcoin and other digital assets remained under selling pressure on Feb. 5. Market sentiment was impacted by stronger-than-expected private payroll data from ADP, the largest payroll processing company in the U.S.

The ADP report was released ahead of the official nonfarm payrolls report, which economists anticipate will show job growth slowing to 154,000 in January, compared to 256,000 in December. U.S. employment figures are closely watched by financial markets, as they influence the Federal Reserve’s stance on interest rates. A resilient labor market could support prolonged high rates, potentially affecting expectations for the two rate cuts projected for 2025.