Crypto has ‘inklings of the dot-com bubble,’ warns commodity strategist

Crypto has ‘inklings of the dot-com bubble,’ warns commodity strategist

![]() Cryptocurrency Feb 8, 2025 Share

Cryptocurrency Feb 8, 2025 Share

Bloomberg Intelligence senior commodity strategist Mike McGlone has warned that the cryptocurrency market could be approaching a tipping point similar to the 2000 Dot-com bubble.

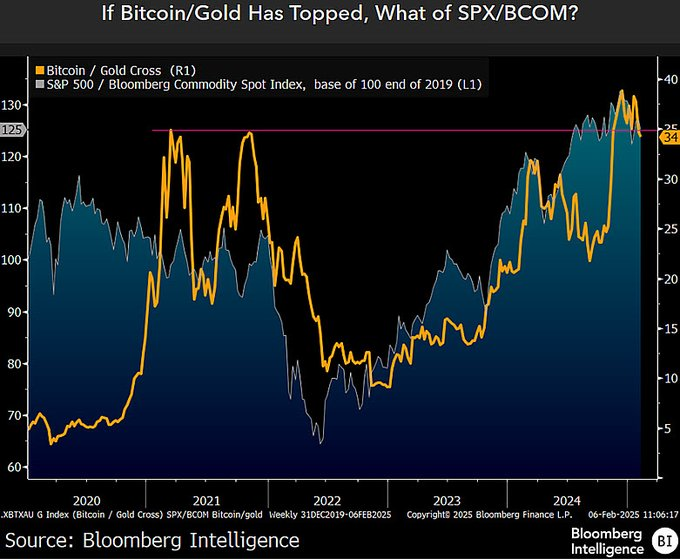

In issuing his cautionary note, McGlone based his analysis on the relationship between Bitcoin (BTC) and gold, stating that the precious metal’s recent ability to outperform the S&P 500—despite competition from the maiden digital asset—could signal the start of a broader market pullback, he said in an X post on February 7.

Bitcoin and gold cross chart. Source: Bloom Intelligence

Bitcoin and gold cross chart. Source: Bloom Intelligence

It’s worth noting that gold has resumed its bullish momentum from 2024, recently hitting new highs above the $2,800 spot price in search of another record high at $3,000.

Picks for you

Michael Saylor’s Strategy: Selling Bitcoin merch, but not for BTC 21 hours ago ChatGPT says XRP price will hit this target by Q1 2025 22 hours ago This chart pattern sets Bitcoin’s next short-term price targets 1 day ago This Solana prediction has traders talking—and it’s big 1 day ago

This dominance coincides with a period when Bitcoin has struggled to maintain its valuation above $100,000 amid broader market volatility affecting equities, as investors remain concerned about the impact of trade wars.

While Bitcoin has previously exhibited parabolic growth, its recent price plateau relative to gold has raised red flags for market players wary of inflated valuations across risk assets.

Interestingly, McGlone also raised the possibility that gold’s price is overextended. However, his bias leans toward risk assets—particularly cryptocurrencies—facing increased downward pressure.

“Gold outperforming the S&P 500 in 2024, despite strong competition from #Bitcoin, may suggest an endgame for lofty risk assets. Or is the metal getting too hot? My bias is the former as the roughly 11 million cryptocurrencies listed on Coinmarketcap could have inklings of the dot-com bubble,” he said.

Bitcoin and gold’s next price target

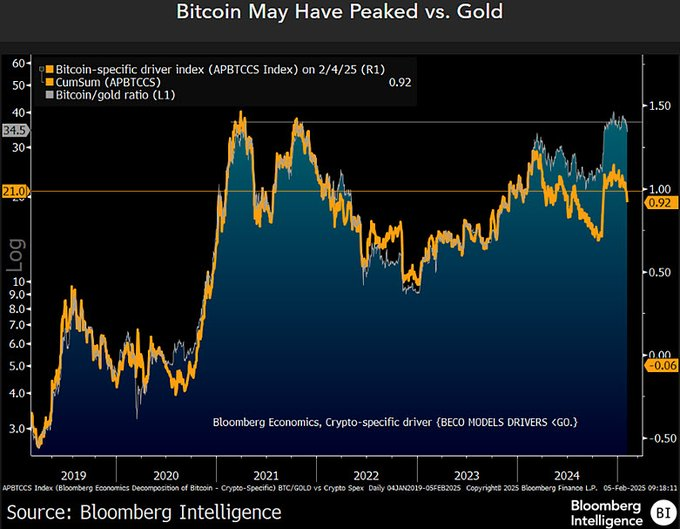

Before issuing his latest analysis, McGlone had pointed out on February 5 that Bitcoin could face further declines while projecting increased price growth for the yellow metal.

Using the Bloomberg Economic Model data, the strategist noted that gold could hit $3,000 while Bitcoin could soar to $70,000.

McGlone stated that the current Bitcoin-to-gold ratio, standing at approximately 34x as of February 5, could be at risk of dropping toward 21x, signaling a potential shift in market dynamics.

Bitcoin and gold ration chart. Source: Bloom Intelligence

Bitcoin and gold ration chart. Source: Bloom Intelligence

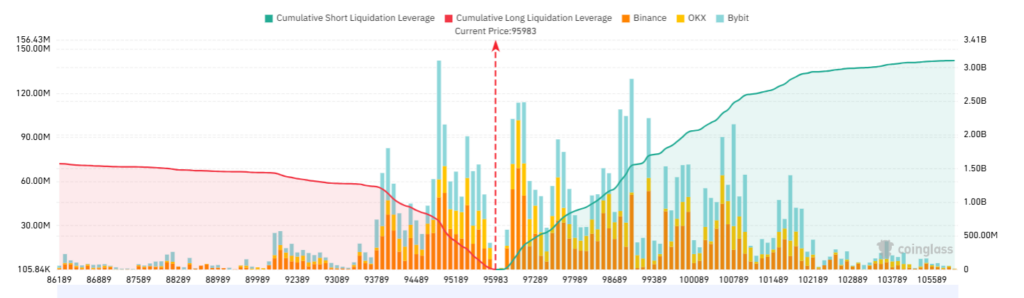

At press time, Bitcoin was experiencing notable downward pressure, trading at $95,964 with daily losses of almost 4%. On the weekly chart, the asset was down over 3%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Bitcoin’s main challenge remains to avoid a drop below the $93,000 support zone while maintaining the $95,000 level to have a real shot at reclaiming $100,000.

If Bitcoin falls below $93,000, data indicates it could trigger almost $1.3 billion worth of leveraged long liquidations across all crypto exchanges, according to Coinglass.

Bitcoin Exchange Liquidation Map. Source: Coinglass

Bitcoin Exchange Liquidation Map. Source: Coinglass

It’s worth noting that Bitcoin and other risk assets remain under pressure amid macroeconomic uncertainty. However, escalating US-China tensions have heightened the asset’s volatility, which has also impacted the equities market.

In this environment, investors are seemingly turning to safe-haven assets, with gold being the biggest beneficiary. It was trading at $2,861 as of press time, with year-to-date gains of almost 9%.

Featured image via Shutterstock