Tether could need to dump part of its $8 billion Bitcoin holdings – What’s next for BTC and USDT?

Tether could need to dump part of its $8 billion Bitcoin holdings – What’s next for BTC and USDT?

![]() Cryptocurrency Feb 13, 2025 Share

Cryptocurrency Feb 13, 2025 Share

Tether, the issuer of the leading stablecoin USDT and one of the largest Bitcoin (BTC) holders, could now be forced to dump part of its BTC reserves, according to JPMorgan analysts. This raises questions on potential market impacts for both Bitcoin and USDT in 2025.

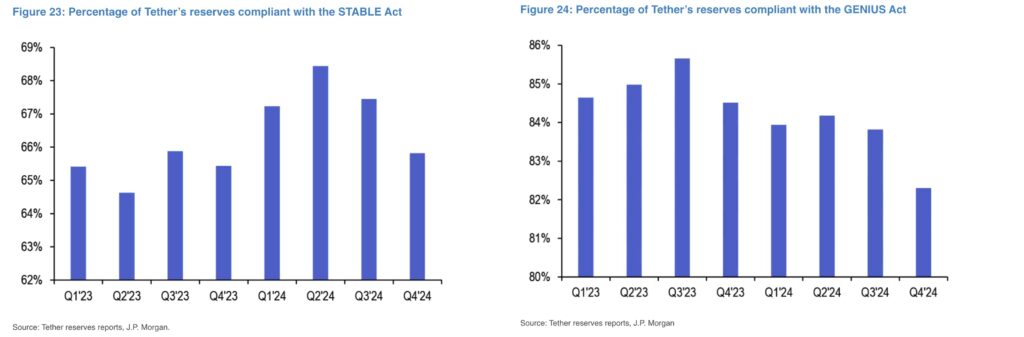

As The Block reported this morning, JPMorgan analysts are looking to Tether’s reserves and the recently introduced U.S. bills, regulating stablecoins in the country. According to estimations, only 66% and 83% of the issuer’s reserves comply to each proposed bill at its current state.

Percentage of Tether’s reserves compliant with the STABLE and GENIUS Acts. Source: J.P. Morgan / The Block

Percentage of Tether’s reserves compliant with the STABLE and GENIUS Acts. Source: J.P. Morgan / The Block

Currently, Tether holds around $8 billion worth of 83,758 BTC in its reserves. This represents approximately 5% of all the $142 billion circulating USDT, which the company claims is 1:1 reserves-backed.

Picks for you

Will Gold hit $3,000 in February? 10 mins ago Here’s how Anthony Scaramucci’s crypto portfolio has performed in 2025 so far 1 hour ago R. Kiyosaki warns to ‘prepare for a market crash, depression, and war' 4 hours ago Here’s when XRP could reach $15, according to analyst 4 hours ago

Therefore, it is possible that Tether would need to sell part, if not all, of its Bitcoin holdings to become compliant in the United States.

Tether’s road to compliance with proposed U.S. stablecoin regulations

The bills JPMorgan analysts are referring to are the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act in the House and the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act in the Senate.

Estimations indicate that 44% and 17% of Tether’s USDT reserves are non-compliant to STABLE and GENIUS, respectively. Among the non-compliant assets are Bitcoin, precious metals, corporate paper and secured loans, which will probably need to leave.

It is interesting to note that the compliant percentage of Tether’s reserves are plummeting as more USDT reaches the market. Moreover, the phenomenon happens as BTC’s price surges to new highs, likely increasing its share in USD value.

As things develop, Tether could either sell the 44% and 17% of non-compliant assets, including Bitcoin, or burn USDT tokens. Either way, the cryptocurrency market, especially BTC, could be heavily impacted by both decisions, with a potential significant liquidity outflow.

Bitcoin (BTC) price analysis and Tether’s USDT impacts

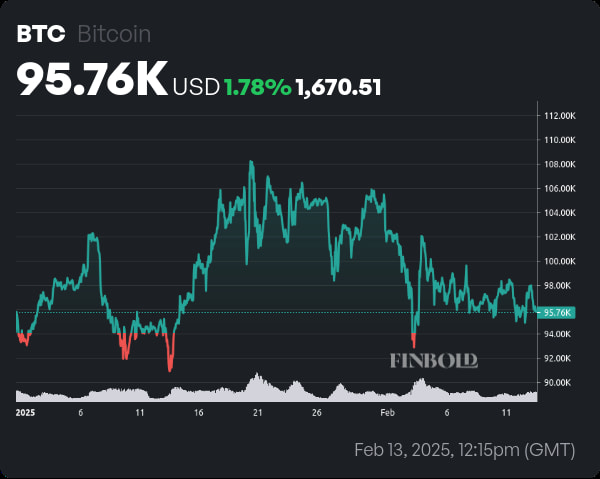

Bitcoin is changing hands by $95,760 at the time of this writing, with modest 1.78% gains year-to-date. With a $50 billion volume in the last 24 hours, according to CoinMarketCap, an $8 billion dump would be relevant.

Bitcoin (BTC) price chart against USDT. Source: Finbold

Bitcoin (BTC) price chart against USDT. Source: Finbold

However, Tether still has time before such a drastic measure could be needed, which the company can use to strategize. USDT is the highest-volume and most-liquid cryptocurrency in the market. Furthermore, BTC surges are often attributed to an increase in USDT units.

The stablecoin has already suffered from delisting in European exchanges by not complying with the Markets in Crypto-Assets (MiCA) rules. On the other hand, companies like xMoney have been positioning in the continent, and in the world, launching MiCA-compliant stablecoins.

Featured image from Shutterstock.