National Bank of Canada Invests $2M in Bitcoin ETFs

The National Bank of Canada has made a notable move in the crypto market by purchasing Bitcoin exchange-traded funds (ETFs) valued at $2 million.

This development follows increased institutional engagement in Bitcoin investment products and signals growing interest from traditional financial entities.

Market participants view the move as a potential signal of growing institutional interest in Bitcoin. Accordingly, some suggest that other Canadian banks could follow suit.

A Start of a Broader Trend?

Some interpret the purchase as the start of a broader trend, with institutions increasing their exposure to Bitcoin through regulated investment vehicles. The move aligns with the ongoing shift in traditional finance, where banks and asset managers gradually integrate Bitcoin into their portfolios.

However, skepticism remains within the crypto community. Some critics question why banks are opting for ETFs rather than holding Bitcoin directly. They argue that ETFs do not provide the same benefits as self-custody.

Others view the reliance on ETFs as a cautious approach that allows institutions to gain exposure to Bitcoin while mitigating regulatory and security concerns.

Meanwhile, BlackRock’s Bitcoin ETF launch in Canada has expanded options for investors seeking exposure to Bitcoin through regulated financial instruments.

Institutional Interest in Bitcoin ETFs Grows

BlackRock Asset Management Canada Limited recently introduced the iShares Bitcoin ETF. It trades under the tickers IBIT and IBIT.U on Cboe Canada, a primary stock exchange in the country.

The ETF provides a regulated method for investors to access Bitcoin through traditional brokerage accounts. Designed to track Bitcoin’s price movements, the fund allocates most of its assets to the U.S.-based iShares Bitcoin Trust ETF (U.S. IBIT), primarily consisting of long-term Bitcoin holdings.

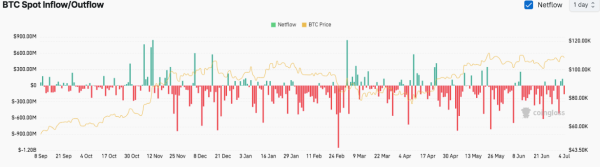

The launch of the iShares Bitcoin ETF comes amid increasing institutional involvement in Bitcoin-related investment products. As spot Bitcoin ETFs gained traction, U.S. spot Bitcoin ETFs recorded a streak of inflows in January.

Central Banks and Bitcoin Considerations

Reports suggest that central banks are evaluating potential Bitcoin investments. Standard Chartered’s Geoffrey Kendrick noted that U.S. President Trump’s discussions on crypto reserves could influence central banks to consider holding Bitcoin. The U.S. government currently holds over 198,000 Bitcoins and could expand its holdings.

In response, Czech National Bank Governor Ales Michl proposed allocating up to 5% of the central bank’s reserves into Bitcoin, with a meeting to discuss the proposal. Meanwhile, Bitcoin proponents in Switzerland advocated for a national vote to include Bitcoin in the Swiss National Bank’s reserves.

Bitcoin ETFs Gain Market Presence

Notably, crypto research firm Ecoinometrics recently highlighted the rising prominence of Bitcoin ETFs in the broader ETF market. According to data released on February 6, three Bitcoin ETFs have entered the top 100 by assets under management.

As of the release, BlackRock’s IBIT ranked 31st with approximately $56.5 billion in assets. Meanwhile, Fidelity’s FBTC ranked 89th with $20.4 billion, and Grayscale’s GBTC held 94th with $19.5 billion.