Bitcoin Price Struggles: Hints of Strategic Acquisition Ignite a Potential BTC Price Surge?

The dynamic world of Bitcoin is witnessing intriguing shifts as the market battles price struggles while key figures like Michael Saylor hint at game-changing strategic acquisitions. This evolving crypto landscape features renewed strategic Bitcoin buying, a surge in altcoin performance, and fluctuating ETF trends—all of which may signal a potential BTC price surge. In this comprehensive overview, we delve into the factors shaping Bitcoin’s price dynamics, from Strategy’s strategic maneuvers to the contrasting strength of altcoins.

By TradingView – BTCUSD_2025-02-23 (YTD)

By TradingView – BTCUSD_2025-02-23 (YTD)

Michael Saylor and Strategy’s Strategic Bitcoin Acquisition

Michael Saylor is once again in the spotlight, as he hints at Strategy gearing up for its next major Bitcoin acquisition. This strategic move underscores a potential resumption of Strategy’s Bitcoin buying spree, which could play a pivotal role in supporting Bitcoin’s price despite current struggles. Emphasizing a disciplined approach to Bitcoin buying, Saylor’s strategy signals confidence in Bitcoin’s long-term value, potentially setting the stage for a significant price surge amid market volatility.

Bitcoin Volatility and Altcoin Market Strength

In an environment where Bitcoin’s implied volatility has neared record lows, strategic Bitcoin buying becomes even more critical. The current low volatility scenario provides a stabilizing backdrop for Bitcoin, offering a haven for investors even as the BTC price struggles. Meanwhile, leading altcoins such as Ethereum, Binance Coin, Monero, and TAO are demonstrating robust performance. The interplay between stable Bitcoin fundamentals and the dynamic growth of altcoins creates a compelling narrative that could eventually drive a surge in Bitcoin’s price, reinforcing its role as the flagship asset in the crypto market.

Bitcoin vs. Gold and Bitcoin ETF Performance Challenges

As Gold prices approach the $3,000 mark, questions arise as to why Bitcoin has not yet mirrored this upward trend. Despite these price struggles, the strategic acquisition signals championed by Michael Saylor offer a beacon of hope. Conversely, the Bitcoin ETF landscape has faced its share of challenges, marked by consecutive red days that have dampened investor sentiment. The contrast between traditional assets like gold and the innovative strategic moves within Bitcoin highlights a complex market scenario where Bitcoin’s price struggles coexist with potential catalysts for a future surge.

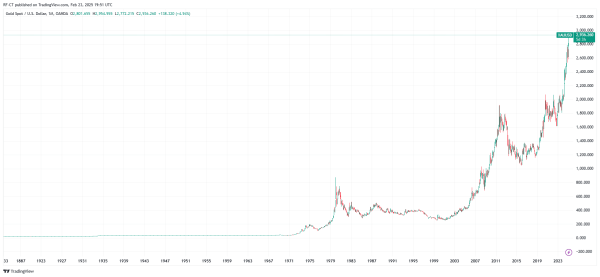

By TradingView – XAUUSD_2025-02-23 (All)

By TradingView – XAUUSD_2025-02-23 (All)

The evolving Bitcoin market presents a paradox of price struggles intertwined with strategic acquisition signals. With Michael Saylor and Strategy at the helm of renewed Bitcoin buying efforts, the market may soon see a turning point. While Bitcoin currently faces volatility and ETF performance issues, the strategic focus on Bitcoin acquisition, coupled with strong altcoin performance, could spark a much-needed surge in BTC price. Investors are advised to monitor these developments closely as they could redefine Bitcoin’s trajectory in the rapidly changing crypto landscape.

By TradingView – Gold vs Bitcoin 2025-02-23 (YTD)

By TradingView – Gold vs Bitcoin 2025-02-23 (YTD)

Source