CryptoQuant CEO: Crypto Market Now Favors Speculation Over Conviction

Bitcoin continues to climb, gaining over 10% in the past week. Yet beneath the surface, a deeper transformation is underway in the crypto market. As observed by Ki-Young Ju, CEO of CryptoQuant, the era of value-driven investment seems to have faded.

He observes that since 2018, many original long-term crypto believers have either left the market or shifted to seeking short-term profits.

https://twitter.com/ki_young_ju/status/1912491882028102127

The focus now, Ju argues, involves fast, speculative capital chasing quick returns across a volatile landscape, with potentially less commitment to the long-term vision for many projects beyond Bitcoin itself.

Ki-Young Ju: Has Crypto Investing Shifted From Conviction to Speculation?

Ju points out that over the years, Web3 projects have struggled to achieve meaningful adoption. Consequently, builders and investors alike face increasing pressure. Most projects no longer attract dedicated backers, and even the strongest believers are showing signs of fatigue.

With the flow of capital moving rapidly between assets, often with little fundamental support, the nature of crypto investing has become transactional. Ki-Young Ju notes that today’s environment rewards speed over conviction, creating an atmosphere that leaves little room for patient innovation.

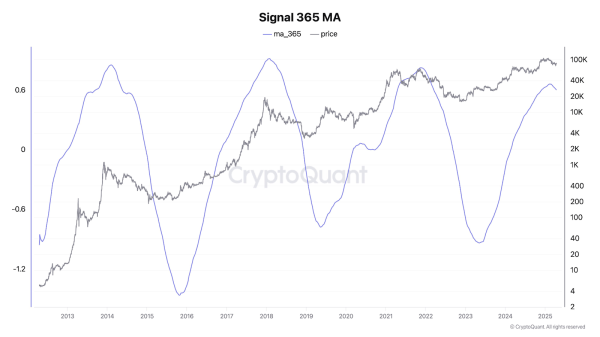

Additionally, the cyclical nature of Bitcoin’s supply and demand further complicates things. Historical analysis of Bitcoin’s price versus its 365-day moving average signal reveals a predictable rhythm. Peaks near the 0.6–0.8 signal range have consistently marked overbought phases.

Source: X

Source: X

In contrast, troughs around -1.2 tend to precede major rallies, marking accumulation zones. The current upward trajectory in this signal suggests increasing demand. However, it has not yet reached historically significant peaks, hinting that Bitcoin could still have room to grow, possibly toward the $100,000 level.

Bitcoin Consolidation Hints at Upward Breakout

According to analyst Ali Martinez, Bitcoin is currently trading within a horizontal channel. The price recently bounced off the key support level of $83,200. This reaction suggests strong buying interest and may lead to a retest of resistance near $84,500.

Should momentum continue, Bitcoin could break toward the upper boundary near $85,800. A confirmed move beyond that level would indicate a bullish trend continuation.

As of press time, Bitcoin trades at $84,830.17 with a daily volume exceeding $23 billion. The current trend shows resilience, even as broader investor behavior shifts.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.