Over $3 Billion in Bitcoin and Ethereum Options Expire Today Ahead of Volatile Weekend

The crypto market braces for significant movements as more than $3 billion in Bitcoin and Ethereum options expire today.

With substantial contracts and maximum pain points identified, how will these expiring options affect the market’s volatility?

Crypto Markets Brace for $3 Billion Options Expiry

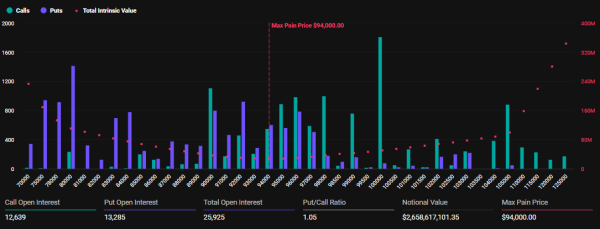

According to Deribit data, approximately $2.65 billion in Bitcoin options are set to expire today. The maximum pain point for these options is $94,000, accompanied by a put-to-call ratio of 1.05.

This expiration includes 25,925 contracts, slightly fewer than last week’s 26,949 contracts.

Expiring Bitcoin Options. Source: Deribit

Expiring Bitcoin Options. Source: Deribit

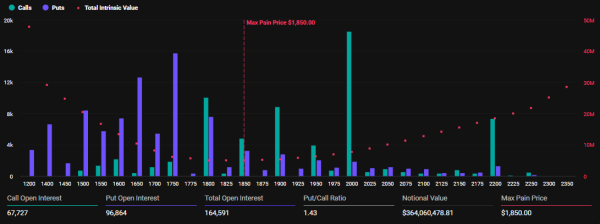

Ethereum also sees the expiration of 164,591 contracts, lower than last week’s 184,296 open interest. These expiring contracts have a notional value of $364.06 million. The maximum pain point for these contracts is $1,850, with a put-to-call ratio of 1.43.

Expiring Ethereum Options. Source: Deribit

Expiring Ethereum Options. Source: Deribit

With Bitcoin and Ethereum sales exceeding purchase calls, analysts at Greeks.live cite a predominantly bearish market sentiment.

“The group seems to be leaning bearish with traders positioning for potential downside moves,” wrote Greeks.live.

For Bitcoin, this sentiment becomes more apparent with its max Pain level well below its current price of $102,570. Based on the Max Pain theory, prices tend to draw towards these strike prices as the options near expiration.

Based on this, analysts at Greeks.live note that some traders are watching Bitcoin’s $93,00000 to $99,000 price level. They also cite a lack of enthusiasm about BTC’s foray past the $100,000 milestone.

“Market described as boring chop with traders looking to capitalize on time decay while maintaining downside exposure,” the analysts added.

Positioning Skews Bearish, Max Pain Sits Below Price

Meanwhile, with put-to-call ratios above one for both Bitcoin and Ethereum, there are more Put options (bearish bets) than Call options (bullish bets). More traders are betting that the price will go down.

The histograms in the images above confirm this. The BTC open interest chart shows a significant concentration of option contracts at strike prices below the current BTC price of $102,570, particularly between the $93,000 around $100,000 prices.

This clustering of option contracts at lower strikes indicates that traders are positioning for a potential price drop, hence the bearish skew.

It comes amid the expectation of a volatile weekend, which could threaten Bitcoin’s upside potential. As BeInCrypto reported, envoys from China and the US will meet in Switzerland over the weekend for trade talks.

However, concerns linger at the risk of a breakdown in the tariff talks. The meeting would mark the first official trade talks since President Trump escalated tariffs on Chinese imports to 145%.

However, Treasury Secretary Scott Bessent articulated that the US does not look to decouple. Meanwhile, in a Thursday announcement, the Chinese Embassy in Washington said it would not allow any attempt to pressure or coerce China.

China has committed to safeguarding its legitimate interests and upholding international fairness and justice. General sentiment is that Beijing is deeply skeptical of US intentions.

“In any potential dialogue or talks, if the US does not rectify its erroneous unilateral tariff measures, it would demonstrate a complete lack of sincerity and further undermine mutual trust. Saying one thing while doing another, or even attempting to use talks as a cover for coercion and blackmail, will not work with China,” China’s embassy in the US stated.

With neither side offering concrete concessions ahead of the meeting, crypto traders fear the summit could end in another diplomatic stalemate.

Against this backdrop, any hint of escalation could act as a volatility catalyst, derailing Bitcoin’s upside potential. On the other hand, a positive development in the meeting could provide tailwinds for Bitcoin, as it happened when Trump announced a major deal with the UK.

“Donald Trump just dropped a massive new trade deal with the UK, his first since rolling out global tariffs. The markets are exploding. Bitcoin just shot past $100,000 for the first time since February,” a user observed on X (Twitter).