Six-Figure Bitcoin Rally Triggers Rare Price Inversion in South Korea

Over the past 24 hours, bitcoin has drifted between $103,133 and $104,841, while South Korea’s notorious premium quietly inverted, dipping into discount territory for several days this month.

Bitcoin’s Comeback Inverts South Korea Premium to 0.76% Below Global Average

Bitcoin has experienced an eventful week, buoyed by renewed appetite and reclaiming the $100,000 milestone for the first time since February. However, following these fresh price peaks, the premium on South Korean exchanges reversed into a discount. As of Sunday, May 11, 2025, rates on Bithumb and Upbit align almost identically with international exchanges.

Data from cryptoquant.com show the inversion began on May 2, falling 0.43% below the global average, then deepening on May 9 and 10 to reach a 0.76% shortfall on the latter date. Between May 2 and 9, premiums climbed to as high as 3% on May 6. Such discounts in South Korea are an uncommon occurrence.

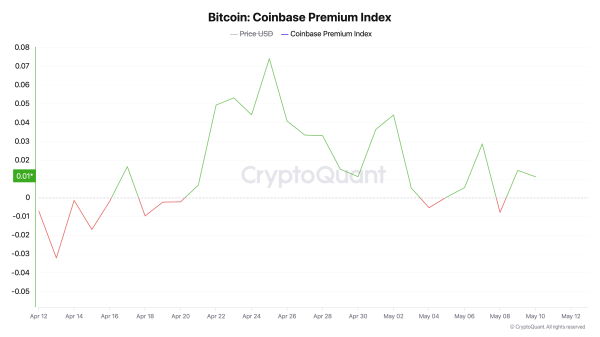

The previous inversion dates to April, when prices dipped 1.19% under the weighted global average, marking an even deeper discount. Prior to that episode, the last won discount was recorded in December of last year. Meanwhile, since April 20, Cryptoquant’s Coinbase Premium Index has predominantly remained in premium territory.

There have been two brief, modest reversals—on May 4 and again on May 8. In essence, the Coinbase Premium Index from Cryptoquant calculates the percentage gap between Coinbase Pro and Binance, with elevated premiums indicating vigorous buying pressure from U.S. investors. Conversely, a won discount may signal subdued demand, surplus supply, or heightened local uncertainty in the South Korean market.