AI predicts XRP price for June 1, 2025

AI predicts XRP price for June 1, 2025

![]() Cryptocurrency May 12, 2025 Share

Cryptocurrency May 12, 2025 Share

Summary:

⚈ XRP rose 15% in a week, boosted by Ripple’s court deal with SEC

⚈ AI predicts XRP may reach $2.85 by June 1 amid strong momentum

⚈ Experts’ forecasts range widely, but technicals slightly favor continued bullish trend

XRP broke out towards the end of last week and has been climbing ever since managing a 15% rally in the last week to its press time price of $2.43.

The most important development in the time for the token was the agreement reached in the Ripple Labs vs. Securities and Exchange Commission (SEC) court case.

Though the upsurge triggered significant bullishness in the community and XRP accrued strong positive momentum, history shows that the cryptocurrency market can always create unexpected volatility and that major rallies tend to lead to substantial corrections.

Under the circumstances, Finbold consulted advanced artificial intelligence (AI) about whether the current patterns and circumstances indicate XRP can sustain the trend until June, or if a bearish reversal is in the cards.

AI sets XRP price target for June 1, 2025

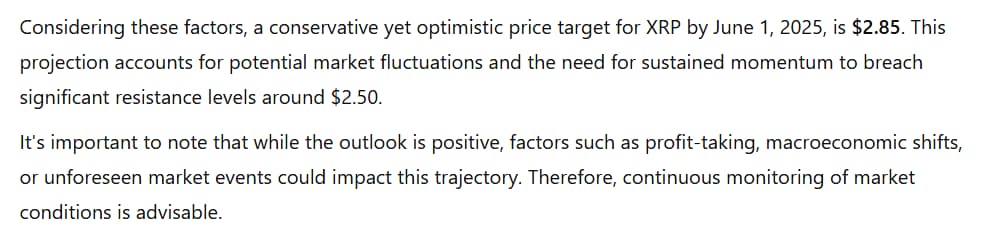

When setting the price target for XRP for June 1, 2025, ChatGPT-4.5 reflected on the token’s recent momentum and technical setup, but also identified the deal reached with the SEC and the associated regulatory clarity as important factors.

The AI also matched the noted community sentiment driven by the optimism that emerged from Bitcoin’s (BTC) rally toward $105,000, pulling the cryptocurrency market upward when forecasting XRP’s price for the start of next month.

Specifically, ChatGPT explained that $2.85 is the most plausible June 1, 2025, price target. According to the AI, the 17.28% rally in the coming three weeks is reasonable as it accounts for the prevailing optimism, but also for the need for the token to breach the strong resistances near $2.50, and factors such as profit-taking, macroeconomic shifts, or wider unforeseen events.

AI sets XRP price target for June 1, 2025. Source: Finbold & ChatGPT 4o

AI sets XRP price target for June 1, 2025. Source: Finbold & ChatGPT 4o

ChatGPT is significantly more conservative than most noted on-chain experts and community analysts, despite providing a bullish target.

XRP experts’ technical outlook

For example, Ali Martinez published an X post on May 11 stating that a symmetrical triangle chart pattern governs XRP and that a breakout could lead to $15 for the token, more than five times the digital asset’s current value which would see its market cap hit over $700 billion.

XRP symmetrical triangle. Source: Ali Martinez

XRP symmetrical triangle. Source: Ali Martinez

Dark Defender, another prominent voice on the social media platform, proved somewhat less bullish when they revealed that the cryptocurrency is likely targeting the $3.3330 Fibonacci level after pushing past the previous critical zones at $2.2222 and $2.3620.

Good Morning, Legends!#XRP is on the way to the $3.3330 Fibonacci Level.

You have experienced how important $2.2222 and $2.3620 were, and precisely addressed!

Have a wonderful week ahead.

Cheers,

Dark https://t.co/4zAI1AsoDc— Dark Defender (@DefendDark) May 12, 2025

Interestingly, not all recent analyses have been bullish. A prolific TradingView member and analyst known as ovvnyou believes that the cryptocurrency market may be in a ‘double fakeout from H&S’ (head-and-shoulders pattern), according to a post from May 10.

Though they refrained from giving a price target, they opined that a crash could come within one or two weeks, in the second half of May.

The XRP ‘double fakeout from H&S’. Source: ovvnyou via TradingView

The XRP ‘double fakeout from H&S’. Source: ovvnyou via TradingView

Why a continued rally for XRP is more likely than a correction

Lastly, the technical setup for XRP reveals the token is at a crossroads. The relative strength index (RSI) of 59.67 demonstrates there is no particularly strong bullish or bearish pressure on the cryptocurrency, which is, at its press time price of $2.43, aiming for the nearest resistance level at $2.45.

On the flip side, similar technical analysis (TA) reveals that there is more support for an optimistic attitude. XRP has covered significant ground from its nearest support zone near $2.31 and would need to plunge 4.94% to even risk a bearish breakout.

Featured image via Shutterstock