With over $500 million in options expiring today, traders are bullish on this crypto

With over $500 million in options expiring today, traders are bullish on this crypto

![]() Cryptocurrency Jun 20, 2025 Share

Cryptocurrency Jun 20, 2025 Share

Over $546 million worth of Ethereum (ETH) options contracts are set to expire today, representing 216,922 individual contracts according to data from Deribit.

Expiring ETH Options. Source: @DeribitOfficial

Expiring ETH Options. Source: @DeribitOfficial

The options data reveals a notably bullish sentiment among Ethereum traders. Deribit statistics show a put-to-call ratio of 0.68 for the expiring contracts, indicating that call options significantly outnumber puts. This suggests traders are positioning for upward price movement rather than hedging against declines.

The maximum pain price for today’s Ethereum options expiration sits at $2,600. With ETH currently trading around $2,550, the cryptocurrency is positioned just below this critical level where the most options would expire worthless.

This bullish positioning stands in stark contrast to Bitcoin’s (BTC) options data from the same expiration. Bitcoin showed a balanced put-to-call ratio of 1.16, suggesting a slightly bearish sentiment among traders.

Ethereum’s price analysis

The bullish options positioning coincides with institutional demand that has surged dramatically in recent weeks. Spot Ethereum ETFs recorded net inflows totaling $861.3 million from June 2, representing the strongest performance since their launch.

The price action itself has created a compelling technical setup. Ethereum recently reached a four-month high of $2,880 on June 11 before correcting to current levels around $2,550. Analysts have identified $2,800 as a key resistance level that needs to be flipped to support for sustained upward momentum.

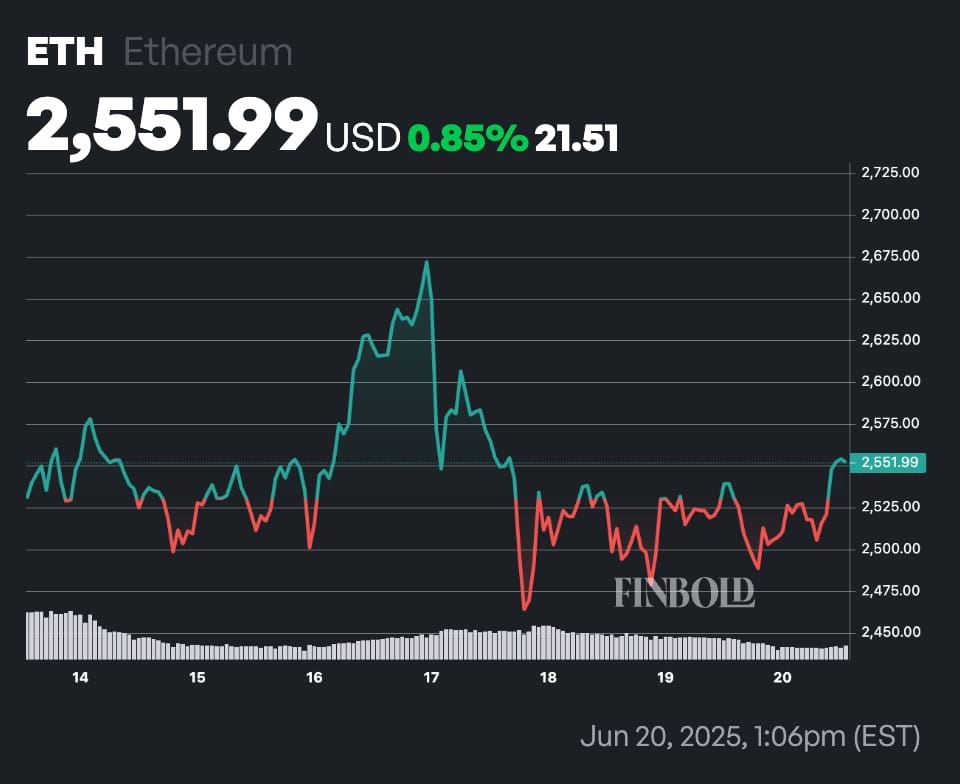

ETH 7-day price chart. Source: Finbold

ETH 7-day price chart. Source: Finbold

Currently, ETH is trading between its 200-day simple moving average at $2631.13, acting as resistance, and the 50-day simple moving average at $2435.54, providing support. Notably, the maximum pain price aligns closely with this key technical resistance level.

Featured image via Shutterstock.