This is when Bitcoin is programmed to hit $100,000, according to analyst

This is when Bitcoin is programmed to hit $100,000, according to analyst

![]() Cryptocurrency Aug 17, 2024 Share

Cryptocurrency Aug 17, 2024 Share

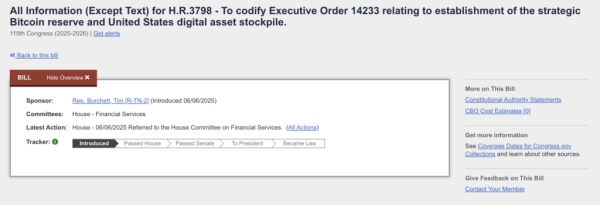

One of the most enduring sentiments in the cryptocurrency market is speculation about when Bitcoin (BTC) will hit the $100,000 all-time high, with much of the speculation focusing on the timing of this milestone.

This sentiment has been further reinforced by crypto trading expert Captain Faibik, who believes that the leading cryptocurrency is primed to reach this position. In a TradingView post on August 17, the analyst noted that Bitcoin is currently in a critical phase that could propel it toward the $100,000 milestone.

Notably, reaching this mark would reward Bitcoin investors with nearly 70% gains from BTC’s current price of around $59,000.

Picks for you

Analyst reveals how high SHIB price can go in the 2025 bull market 46 mins ago Here's how much Wall Street bought and sold of BTC and ETH this week 1 hour ago R. Kiyosaki says 'the Fed cannot save you' amid recession fears, names assets to buy 3 hours ago Solana price analysis as SOL ETF filings disappear from Cboe 4 hours ago

Can Bitcoin reach $100K?

Faibik observed that Bitcoin has been consolidating within a Descending Broadening Wedge pattern since March 2024. This pattern, typically characterized by decreasing lows and increasing highs, suggests a potential breakout to the upside.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Recent price action, following the sharp drop on August 5th, indicates that Bitcoin is recovering well and is currently approaching a crucial resistance zone in the $69,000 to $70,000 range.

The analyst highlighted the significance of this resistance area, noting that a breakout above the $69,000 to $70,000 mark would confirm the wedge’s upside breakout. Once confirmed, Faibik projects a 20-25% bullish rally in the fourth quarter of 2024.

Overall, the expert expressed optimism, forecasting that Bitcoin could achieve the $100,000 mark this year. He asserted that the cryptocurrency is currently in an accumulation phase, typically characterized by sideways market movement and gradual price increases, just before a significant bullish rally.

Bitcoin’s price timeline to $100,000

The analyst further noted that while the market may remain sideways for the next two to three weeks, a massive bullish rally could commence around mid-September. If this rally materializes, it could be the catalyst that pushes Bitcoin toward the $100,000 mark.

“Bitcoin bulls need to clear the $69-70k crucial resistance area to confirm the wedge upside breakout. Once the breakout is confirmed, I’m expecting a 20-25% bullish rally in Q4. 100k is programmed for this year,” the expert noted.

Captain Faibik urged investors to adopt a strategic accumulation approach during this phase. Drawing parallels to a similar period in August-September 2023, when Bitcoin was trading at $17,000 to $18,000, Faibik emphasized the importance of buying during dips. Back then, Bitcoin surged from $18,000 to $74,000 within a few months, rewarding those who followed his advice.

Amid this price projection, Bitcoin is currently consolidating below the $60,000 mark. Notably, investors are waiting for Bitcoin to breach the resistance, which would validate any short-term bullish momentum.

Bitcoin price analysis

As of press time, Bitcoin was trading at $59,268, having gained over 2% in the last 24 hours. Over the past seven days, BTC has been down by 2.4%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Overall, bulls remain key to determining whether Bitcoin can exit the current consolidation phase and reclaim the $60,000 level en route to a new all-time high.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.