Coinbase stock a ‘ticking time bomb’ on weekly chart: Here’s why

Coinbase stock a ‘ticking time bomb’ on weekly chart: Here’s why

![]() Stocks Jul 18, 2024 Share

Stocks Jul 18, 2024 Share

Even though Cathie Wood’s Ark Invest, which manages several exchange-traded funds (ETFs), has been dumping Coinbase (NASDAQ: COIN) shares en masse, the stocks of one of the largest cryptocurrency exchanges in the world seem to be preparing for a price explosion.

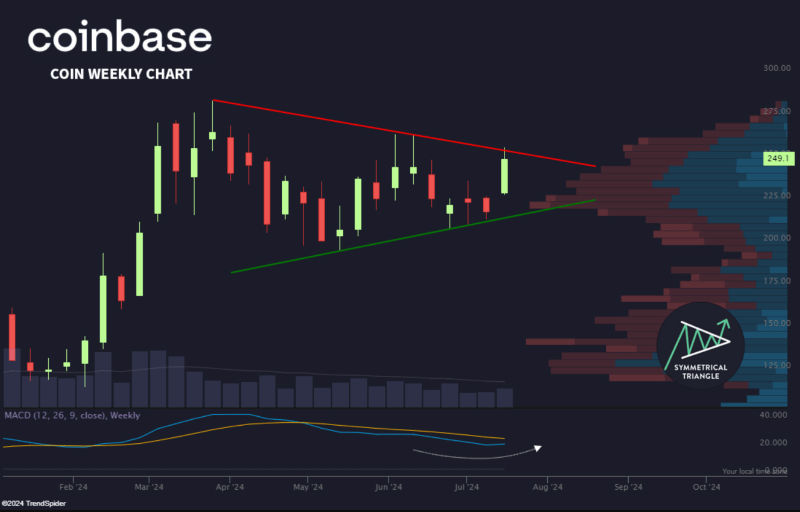

As it happens, the Coinbase stock has been demonstrating a symmetrical triangle chart pattern on its weekly timeframe, which prompted the team at the TrendSpider trading platform to suggest that it “looks like a ticking time bomb” in an X post analysis shared on July 18.

Coinbase weekly chart analysis. Source: TrendSpider

Coinbase weekly chart analysis. Source: TrendSpider

Indeed, according to the above chart, the shares of the popular crypto exchange are currently making a typical bullish symmetrical triangle pattern, which means it is only a matter of time before their price breaks out from it and makes a strong upward movement.

Picks for you

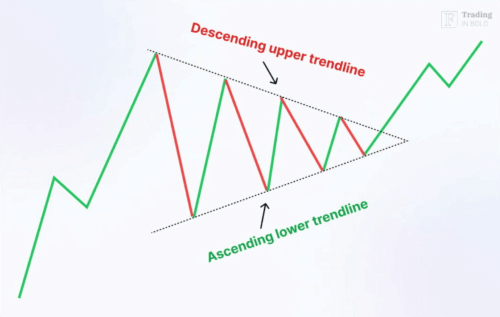

$1 Billion asset manager shorts Trump stock day before assassination attempt 1 hour ago R. Kiyosaki warns AI will put millions out of work 2 hours ago XRP enters ‘qualification mode’ to seek the $36 price target 17 hours ago Crypto insiders turn $5,000 into over $7M with Donald Trump meme coin $FIGHT 17 hours ago  Symmetrical triangle chart pattern. Source: Finbold

Symmetrical triangle chart pattern. Source: Finbold

COIN price analysis

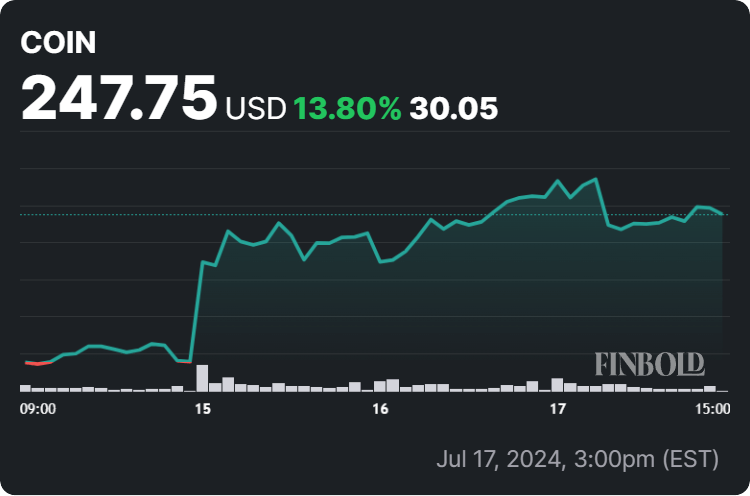

For the time being, COIN shares are changing hands at the price of $247.75, recording an increase of 0.33% on the day, climbing 13.80% across the past week, as well as accumulating a gain of 5.76% on their monthly chart, according to the most recent data on July 18.

COIN stock price 1-week chart. Source: Finbold

COIN stock price 1-week chart. Source: Finbold

All things considered, Coinbase stocks remain a significant holding in Ark Fintech Innovation ETF, suggesting the company’s motive to capitalize on the shares’ recent rally, which might continue even stronger, and not a reaction to the bearish sentiment triggered by Mt. Gox’s massive Bitcoin (BTC) transfers.

As a reminder, the repayment of Mt. Gox creditors has ranked among the most notable events impacting the crypto sector in recent weeks, creating major pressure in the crypto market. However, many crypto assets and related stocks have remained strong in the face of this situation.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.