R. Kiyosaki warns ‘we are fu–ed’ regardless of who wins U.S. election

R. Kiyosaki warns ‘we are fu–ed’ regardless of who wins U.S. election

![]() Finance Sep 13, 2024 Share

Finance Sep 13, 2024 Share

Although Robert Kiyosaki has not hidden his preference for former United States President Donald Trump over U.S. Vice President Kamala Harris, he believes a massive economic crash is inevitable regardless of who wins the presidential election in November.

As it happens, the popular investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad’ opined that “it really makes little difference if Trump or Harris win,” as the U.S.’s troubles are beyond repair regardless of who wins, according to his X post on September 13.

Specifically, in Kiyosaki’s view, neither Trump nor Harris can solve the colossal problem of the U.S. debt, which has already surpassed $35 trillion and goes up by $1 trillion every 100 days, and the interest on which he referred to as “America’s biggest expense.”

Picks for you

AI predicts XRP price if ETF is launched 14 mins ago XRP price rockets as Grayscale announces XRP Trust 20 hours ago Crypto trader turns $80K into $1.2 million 22 hours ago Here’s why ‘Solana killer’ skyrocketed 18% today 22 hours ago

“Simply said, we are fu–ed. The dollar is trash. Stop saving dollars, fake money… & start saving gold, silver & Bitcoin… real money.”

Indeed, to protect their wealth in the looming financial crisis, the ‘Rich Dad Poor Dad’ author has advised his followers to focus on investing in and saving what he believes are “real” assets, including precious metals like gold and silver and the world’s largest cryptocurrency, Bitcoin (BTC).

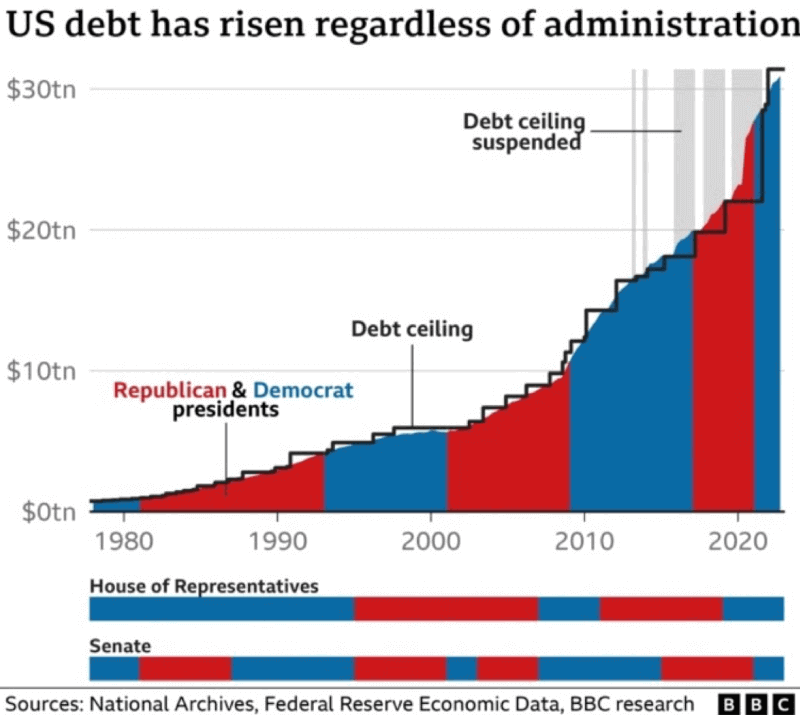

U.S. debt grows regardless of president

Interestingly, agreeing with Kiyosaki, the host of ‘THE Bitcoin Podcast’ known as Walker, shared a chart that demonstrates that the U.S. national debt has been continuously rising regardless of the administration – Republican or Democrat, since the early 1980s.

U.S. national debt throughout administrations. Source: Walker

U.S. national debt throughout administrations. Source: Walker

As a reminder, the renowned finance educator has long warned about the upcoming critical financial times, the declining value of the U.S. dollar, and fiat money in general, and that the only way to circumvent all this was to invest in alternative assets like gold, silver, and Bitcoin.

In addition, Kiyosaki invests in lithium mines and carbon credits, as well as other cryptocurrencies besides the flagship decentralized finance (DeFi) asset, including Ethereum (ETH) and Solana (SOL), both of which he has been recommending for some time now.

Back in late August, he also highlighted that the U.S. continued to sink deeper into debt, shackling itself with another $1 trillion every 100 days, explaining that this was why one must buy gold, silver, and the largest asset in the crypto sector by market capitalization, as Finbold reported on August 23.

Featured image via Ben Shapiro’s YouTube

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.