Dominance: Bitcoin at its highest over Ethereum since 2021

Last night the dominance of Bitcoin rose above 58%, and its price in Ethereum rose to the highest levels since 2021.

These are very high values, typical of a pre-bullrun period.

Summary

- Bitcoin on Ethereum: dominance at all-time highs

- The supreme dominance of Bitcoin over Ethereum and altcoin

- A good sign? Let’s prepare for the altseason

- The altcoins

- The effect of the halving

Bitcoin on Ethereum: dominance at all-time highs

Today the price of Bitcoin of Ethereum is around 25.5 ETH.

It had not been this high since April 2021, so much so that at the beginning of 2024 it was only at 18.7 ETH.

Even during the second part of the bullrun of the same 2021, it had dropped to the lowest levels of recent years, that is, below 12.3 ETH.

In other words, when the altseason of the first part of 2021 began, more or less around March/April, the price of Bitcoin in Ethereum started to fall, reaching its annual low shortly after the two cryptocurrencies marked new all-time highs of the era, at the end of the year.

At that point, there was a trend reversal that seems to be still ongoing.

It must be said, however, that until September 2022 that trend reversal was only temporary, and it started to become solid and consistent only from the beginning of 2023. During that period, one BTC was worth 13.7 ETH, and in just one year it rose to 18.7.

During the course of 2024, it rose again, reaching above 25.5 ETH just last night.

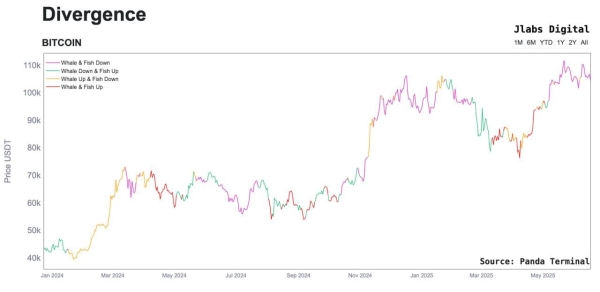

The supreme dominance of Bitcoin over Ethereum and altcoin

This growth is obviously having repercussions also on the dominance of Bitcoin. In fact, altcoins tend to follow Ethereum more than Bitcoin, so it is not surprising that BTC appreciates even against many altcoins.

The last time that, according to Trading View data, the dominance of Bitcoin was above 58% in the past was April 5, 2021, that is, before Coinbase went public, marking the new all-time high of the era at $64,000.

Due to the subsequent and immediate altseason, it also dropped below 40%, and until November 2022 it more or less stayed there.

The rise began in 2023, and it seems to be still ongoing. Last year it went from 42% to 51%, and this year it has risen again to 58%.

In particular, the current phase of recovery in the short term began on Monday, September 9, when the price of BTC returned above $54,800.

A good sign? Let’s prepare for the altseason

In the past, such a dynamic has marked the end of the capitulation of altcoins, and an awakening of the crypto market led by Bitcoin.

Although it is by no means certain that history can repeat itself, this indicator of a probable rise in the price of BTC should be added to others that go in the same direction.

To tell the truth, in the short term between Wednesday and Thursday, volatility could also increase negatively, given that there is a lot of anticipation for the Fed’s decision on cuts, and especially for the subsequent reaction of the markets.

But in the medium/short term, many are expecting the approach of October, historically a rather good month for Bitcoin. Additionally, in all three previous occasions when there were presidential elections in the USA with Bitcoin in existence (i.e., from 2009 onwards), the price of BTC entered a phase of strong growth, either shortly before or shortly after the elections.

A clear and substantial rise in dominance, and a strongly suffering altcoin market, seem to indicate that there are ideal conditions for the price of Bitcoin to rise again.

The altcoins

In the past in these cases the crypto market has been dominated by Bitcoin for several months, with the altcoin that have awakened afterwards.

For example, after the November 2020 elections, the price of BTC first returned to the highs of that time, and then continued to rise until April 2021.

The altcoin, on the other hand, moved en masse only between March and April 2021, that is, five months after BTC, although with some exceptions. Moreover, that altseason lasted less than two months.

On the other hand, the crypto market is always dominated by Bitcoin, or at most in some periods by Ethereum, with the altcoins often following closely. The exceptions are actually many, but given that there are thousands of altcoins, any individual exceptions remain such even if they are dozens or hundreds.

The effect of the halving

In the three past occasions, either the U.S. elections have led to a declining phase of the dollar, or there has been a strong injection of liquidity into the crypto markets in the election year.

In both cases, this has generated an increase in demand for BTC on the market.

To this must be added that previously in those same years (2012, 2016, and 2020) there had been the halving of Bitcoin, that is, a halving of the BTC reward given to miners, which had generated a reduction in supply.

When the reduction of BTC supply in the crypto markets, caused by the halving, is combined with the increase in demand, due for example to a drop in the dollar, the only reasonably possible consequence is an increase in price.

This year too there was the halving that reduced the selling pressure, even though for now there hasn’t been an increase in buying pressure. On the contrary, the recent drops are due to a reduction in buying pressure greater than that of selling. However, if this time as well the US elections were to indirectly lead to an increase in buying pressure of BTC, its price will very likely increase.