Dormant Bitcoin whales activate after 15 years, move millions in BTC

Dormant Bitcoin whales activate after 15 years, move millions in BTC

![]() Cryptocurrency Sep 20, 2024 Share

Cryptocurrency Sep 20, 2024 Share

Bitcoin (BTC) dormant whales are ancient addresses that have remained inactive for an extended period, usually kept by long-term holders. Recently, five 15-year dormant whales activated to move nearly $16 million almost simultaneously, making waves in the cryptocurrency market.

Overall, the five dormant whales moved 250 BTC originating from coinbase transactions dating from 2009 Bitcoin mining rewards. According to the Whale Alert on X, the nominal value sums up to $15.90 million on September 20.

Five Bitcoin 15.6-year dormant whales activation. Source: Whale Alert / Finbold

Five Bitcoin 15.6-year dormant whales activation. Source: Whale Alert / Finbold

Who are the five 15-year dormant Bitcoin whales?

This type of activity usually precedes sales, and traders can interpret them as a bearish signal. However, whales can re-activate for different reasons, including wallet management and security or privacy concerns.

Picks for you

XRP whales make huge splash as price nears $0.60 1 min ago Dogecoin (DOGE) price enters parabolic phase, targets $2 46 mins ago Bybit improves security with AI Risk Engine 3 hours ago Here's how much Michael Burry lost by selling Gold early 4 hours ago

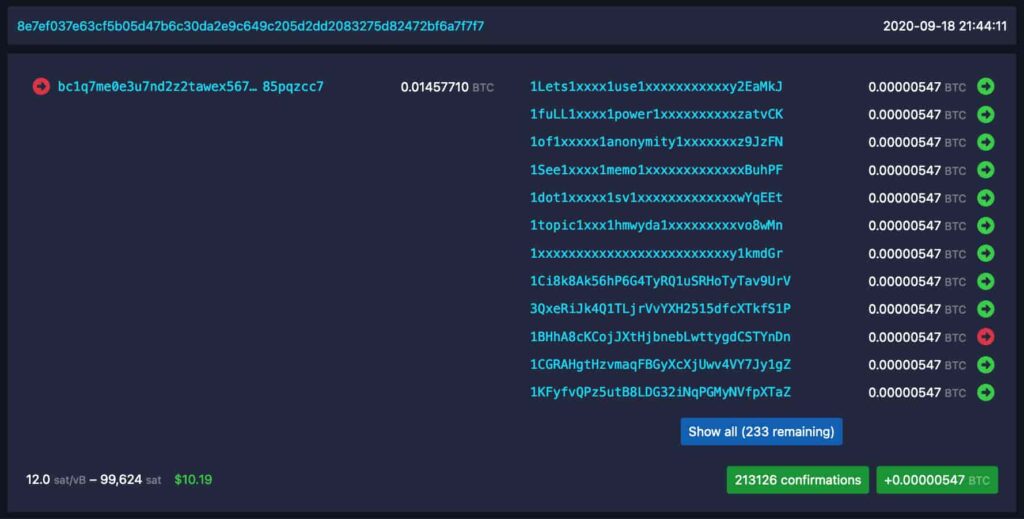

Interestingly, all five addresses did exactly the same thing, dividing the 50 BTC balance into smaller 0.00000547 BTC balances. Given the similar pattern that followed the recent activity, these five addresses likely belong to the same person.

1CGT3Ywaa2upJfWtUtbXonDPNTfZPWqzmA transaction history. Source: mempool.space / Finbold

1CGT3Ywaa2upJfWtUtbXonDPNTfZPWqzmA transaction history. Source: mempool.space / Finbold

The addresses are 1C4rE41Kox3jZbdJT9yatyh4H2fMxP8qmD, 18E5d2wQdAfutcXgziHZR71izLRyjSzGSX, 13J8FkimCLQ2EnP1xRm7yHhpaZQa9H4p8E, 1MBBJBFEaYKHFZAeV7hQ7DWdu3aZktjzFH, 1CGT3Ywaa2upJfWtUtbXonDPNTfZPWqzmA.

Bitcoin (BTC) price analysis

Meanwhile, BTC has just gone through another local drop to $62,740 after briefly trading above $63,700. This was an expected move, as Finbold reported earlier this morning, according to an analysis by crypto trader Ali Martinez.

Bitcoin accumulates over 136% gains year-over-year (YoY) despite displaying a downtrend since March’s all-time high of $73,800, down 15%.

Bitcoin (BTC) YoY price chart. Source: Finbold

Notably, Finbold has consistently reported analysis from reputable traders warning of a short-term bearish trend. Analysts like Credible Crypto had marked the $64,000 level as key resistance that could lead to a drop.

Meanwhile, Martinez shared another insight on X, highlighting a potential long-squeeze right before the squeeze occurred, with BTC at $63,400.

“Nearly $2 billion in Bitcoin futures contracts opened in just 48 hours. We could be looking at a potential long-squeeze!”

– Ali Martinez

Bitcoin (BTC) one-hour price chart and aggregated open interest indicator. Source: TradingView / Ali Martinez

Bitcoin (BTC) one-hour price chart and aggregated open interest indicator. Source: TradingView / Ali Martinez

In closing, the recent 15.6-year dormant Bitcoin whale activity, and technical indicators suggest BTC could be heading to lower levels in the following days. Investors and traders must remain cautious, avoiding high-leveraged positions while the leading cryptocurrency decides on its next big move.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.