U.S. government takes action after hacker returns $19 million stolen crypto

U.S. government takes action after hacker returns $19 million stolen crypto

![]() Cryptocurrency Oct 25, 2024 Share

Cryptocurrency Oct 25, 2024 Share

The United States government has taken action after an unidentified hacker returned part of the funds stolen in cryptocurrency from a government-linked wallet.

For context, about $20 million was drained from this wallet on October 24 in a high-profile heist attributed to bad actors.

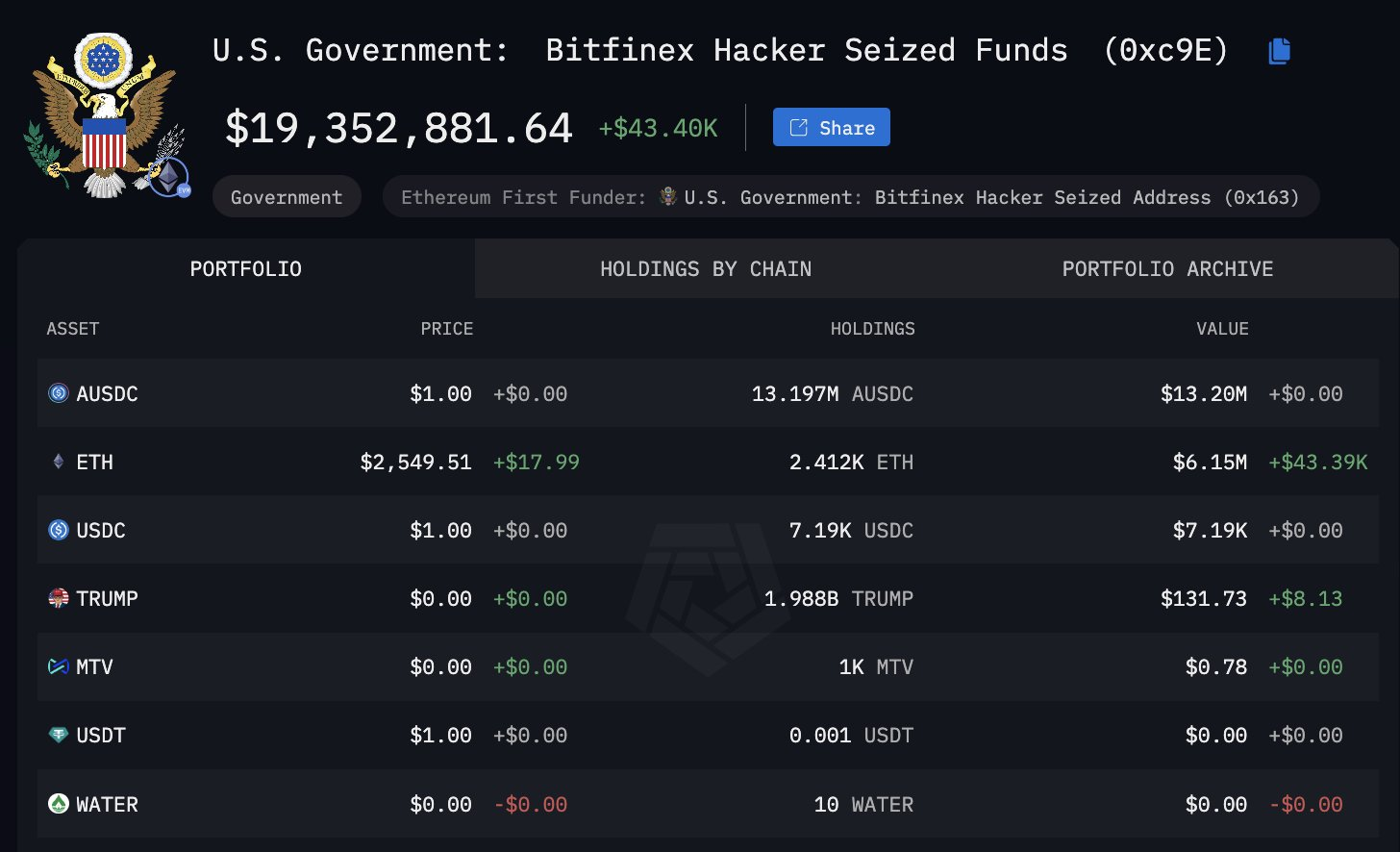

Following the incident, approximately $19.3 million was remitted back to the wallet, according to on-chain data shared by Arkham Intelligence on October 25.

Picks for you

S&P 500 rallies to best 12-month performance since 1954 — What’s next? 49 mins ago Tesla stock price prediction if Kamala Harris wins Presidency 3 hours ago Top 3 most shorted stocks in the S&P 500 Index 4 hours ago Perplexity AI predicts Microsoft stock price amid Bitcoin investing proposal 4 hours ago  U.S. government Bitfinex seized funds. Source: Arkham Intelligence

U.S. government Bitfinex seized funds. Source: Arkham Intelligence

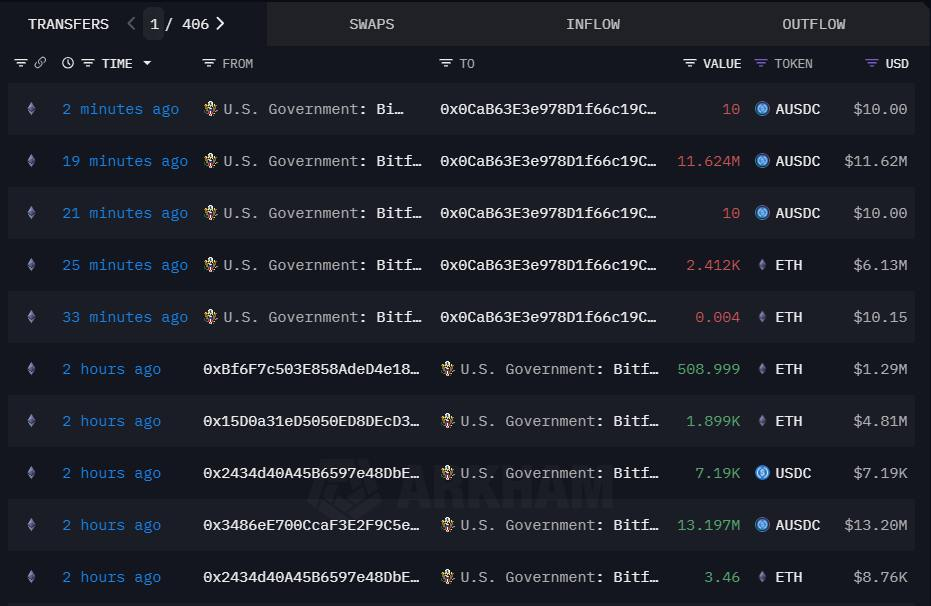

Although only 88% of the funds were recovered, the U.S. government has since transferred the assets to a new wallet.

Cryptocurrency transactions involving U.S. government-linked wallets. Source: Arkham Intelligence

Cryptocurrency transactions involving U.S. government-linked wallets. Source: Arkham Intelligence

Interestingly, this is one of the recent high-profile incidents in which hackers have opted to refund stolen funds. As reported by Finbold, in May, a hacker returned $71 million worth of cryptocurrency to a phishing victim.

How the hack unfolded

Initial analysis indicates that the hackers attempted to quickly launder the funds, moving them through suspicious addresses linked to a money laundering service.

According to Arkham data, $1.25 million in Tether (USDT) and $5.5 million in USD Coin (USDC) were initially moved from the DeFi platform Aave. This was followed by approximately $13.7 million in aUSDC and $446,000 in Ethereum (ETH) transferred to a new wallet.

At the same time, almost $320,000 in Ethereum was sent to various exchanges, and $80,000 was distributed to smaller wallets.

Interestingly, the translations and use of platforms like Coinbase have prompted comments about the perceived irony in the U.S. government’s actions regarding cryptocurrencies. For instance, in an X post on October 24, crypto researcher Zack Voell remarked that it’s “funny” considering the government has cases against crypto service providers while simultaneously benefiting from their products.

“It’s pretty funny that the U.S. government is earning yield onchain while they’re suing Coinbase and Kraken for offering access to the same products,” he said.

It’s worth noting that the affected funds stem from those seized by the U.S. government in the 2016 Bitfinex hack. Interestingly, the perpetrators of the heist— Ilya Lichtenstein and his wife, Heather Morgan—are set to be sentenced in November 2024.

During the hack, Lichtenstein stole 120,000 Bitcoin (BTC), valued at over $8 billion at current market prices.

Gaps in Bitfinex forfeiture documents

Notably, an on-chain analysis by Ergo BTC pointed to inconsistencies and security vulnerabilities in the Bitfinex forfeiture documents regarding the management of seized cryptocurrency.

The analyst pointed out discrepancies between the documentation and the custody agencies, as the U.S. Marshals Service (USMS) did not officially report a compromised Ethereum address transfer.

To this end, Ergo revealed that 74 BTC, allegedly seized by the USMS, had already been spent, along with another 3,100 BTC from related transactions.

He highlighted a notable gap between reported seized assets and actual on-chain movements. This indicates that the bad actors likely did not compromise all Bitfinex-seized assets, which, in return, called for more improved security measures.