Ripple v. SEC case update: November 1, 2024

Ripple v. SEC case update: November 1, 2024

![]() Cryptocurrency Nov 1, 2024 Share

Cryptocurrency Nov 1, 2024 Share

Though the long-standing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) appeared over in August, the ever-tenacious regulator has continued the dispute by appealing the final ruling, particularly the elements concluding that the company’s programmatic sales of XRP do not constitute securities violations.

Despite this reignition of tension, parties monitoring the conflict are now unlikely to see further developments until early 2025.

Specifically, a filing from October 31 shows that the U.S. Court of Appeals for the Second Circuit has set January 15 as the deadline for the SEC’s principal brief.

Picks for you

2 cryptocurrencies to reach 100 billion market cap by year-end 2 hours ago Here’s what awaits gold after the U.S. presidential elections 5 hours ago Analyst reveals when to catch the next buying opportunity for Bitcoin 5 hours ago Nvidia stock could crash if major client is delisted 7 hours ago

#XRPCommunity #SECGov v. #Ripple #XRP The Second Circuit Court of Appeals has entered an Order that the @SECGov’s brief must be filed on or before January 15, 2025. pic.twitter.com/E3TE5tBDAy

— James K. Filan 🇺🇸🇮🇪 (@FilanLaw) November 1, 2024

Furthermore, the Court will fulfill Ripple’s desire to dismiss the case should the deadline be breached. It also warned the parties that no extensions to the deadline will be granted.

There has been some speculation that the date was set to be after the next President of the United States is inaugurated. Should Kamala Harris win, the SEC’s current approach is likely to persist, while a Donald Trump administration would probably seek to replace Gary Gensler and, by extension, alter the watchdog’s stance on various cryptocurrencies.

Ripple remains adamant XRP’s status is not in question

Perhaps the most contentious – and impactful – point of contention is that the summer ruling ordered Ripple to pay $125 million – much less than the $2 billion the SEC requested – but declared XRP does not fit the definition of a security and that some of the sales of the token are not in violation of the securities laws.

Additionally, Ripple has called into question the validity of the Howey Test for measuring novel assets such as cryptocurrencies. Indeed, the test to determine if an asset is a security was introduced in 1946.

On the other hand, the method has been defended precisely because of its flexibility, which makes it a widely applicable tool. This enables regulators to tackle potential issues as they arise without waiting for legislative and judicial decisions that could take years to be taken.

Whatever the arguments for and against the Howey Test may be, Ripple maintains the fact that XRP has legal clarity unique in the world of cryptocurrency that is shared only with Bitcoin (BTC) and that it is not a security as a point of particular importance.

Additionally, in an X post that accompanied Ripple’s October 24 Form C filing, Chief Legal Officer Stuart Alderoty accused the SEC of simply trying to sow confusion within the industry:

As we go through this process, please remember the SEC’s broader strategy: try to create distraction and confusion for Ripple and the industry. But honestly, it’s just background noise now. The hard part of the fight is behind us. Ripple’s business is growing and getting stronger every day even as this appeal process plays out.

XRP keeps trading lower as the legal battle drags on

Beyond its importance for Ripple and potentially the applicability of the traditional securities test to digital assets, the protracted legal battle has had a significant impact on XRP investors.

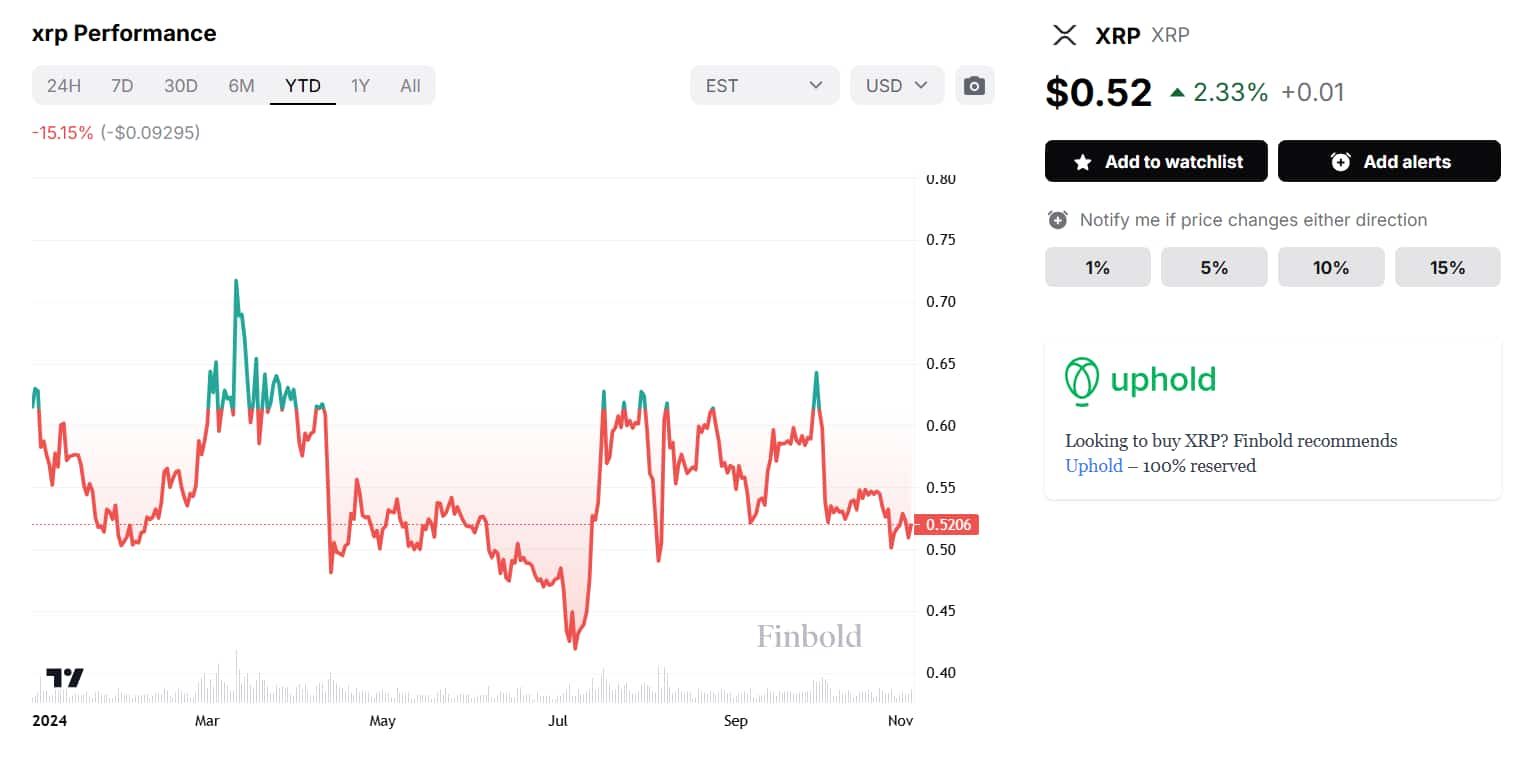

Specifically, the token’s price has remained volatile and depressed in 2024 – a relatively unique situation for a major cryptocurrency given the year’s bull market. In the year-to-date (YTD) chart, XRP is down 15.15%.

XRP YTD stock price. Source: Finbold

XRP YTD stock price. Source: Finbold

On the other hand, the October 31 filing, likely due to the promise of few surprises in the coming two months and the possibility the SEC may breach the deadline, helped the token rise 2.33% in the last 24 hours.

Finally, the most recent move of Ripple’s escrow system, the November 1 unlocking of 1 billion XRP, had no discernable effect on the cryptocurrency’s price.

Featured image:

Koshiro K. Ripple logo seen in an iPhone screen on SEC. Digital image. Vancouver, CANADA – Apr 30 2024. Shutterstock, April 30, 2024. Date retrieved: November 1, 2024.