Bitcoin Surges to New ATH Amidst $425M Binance Outflows

The Bitcoin market continues to rise; as it is recording a new all-time high of $79,000+. This major development is attributed to increased investor attention with increased trading volume and increased institutional and retail client base. This enhances BTC’s capability and adherence to the market and the community regardless of the effects of movements in the market and regulatory policies.

The price of $BTC has broken through $79,000, setting a new ATH again!

In the past hour, another 5 fresh wallets withdrew 745.5 $BTC($59M) from #Binance.

Since Nov 6, a total of 32 fresh wallets have withdrawn 5,364 $BTC($425M) from #Binance.https://t.co/xM6pfgMJgT pic.twitter.com/cJWPm2or9w

— Lookonchain (@lookonchain) November 10, 2024

Major Outflows from Binance Wallets

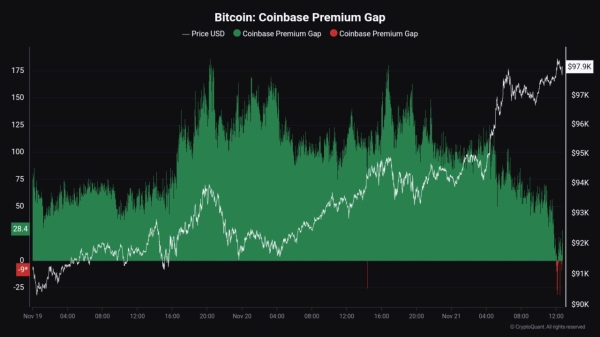

As per blockchain analytics platform Lookonchain, new wallets have been constantly withdrawing large sums of Bitcoin from Binance, one of the world’s biggest crypto exchange platforms. Five new wallets recently withdrew 745.5 BTC, which is roughly $59 million. This is in line with a trend observed in last week’s period starting November 6, where 32 new wallets overall pulled out a total of 5,364 BTC, which is equivalent to $425 million.

Whales Increase Accumulation

Consequently, Lookonchain has concluded that the long-term holders of Bitcoin, popularly referred to as “whales,” are continuing to accumulate even more Bitcoin. The latest withdrawals imply the fact that whales are transferring their coins off exchanges for safety or for expecting changes in the prices. The shift of Bitcoin from Binance’s hot wallets to private wallets demonstrates the increasing trend of those with large capital investing in self-custody.

Potential Implications for Bitcoin’s Price Stability

When Bitcoin is purchased or mined, the amount of it that is stored in exchanges usually goes up. When the market sees big outflows during a bull run, that is usually considered a good sign because it decreases the selling pressures in the open market. Since substantial volumes of BTC are exiting Binance, the supply within the exchange is reducing, and should demand persist to be high, the prices are likely to rise further.

The current BTC price elevation and large-scale withdrawals from Binance prove that the trend is bullish from the investor’s side, particularly whales. This pattern of high-value withdrawals can be sustained if the upward trajectory of Bitcoin prices is sustained since investors want to lock down their portfolios, anticipating another increase in the price.

Altogether, this trend proves that the cryptocurrency market remains active which is good for both retail investors and institutional ones.