SOL price prediction as Solana surpasses Ethereum in ‘real economic value’

SOL price prediction as Solana surpasses Ethereum in ‘real economic value’

![]() Cryptocurrency Nov 13, 2024 Share

Cryptocurrency Nov 13, 2024 Share

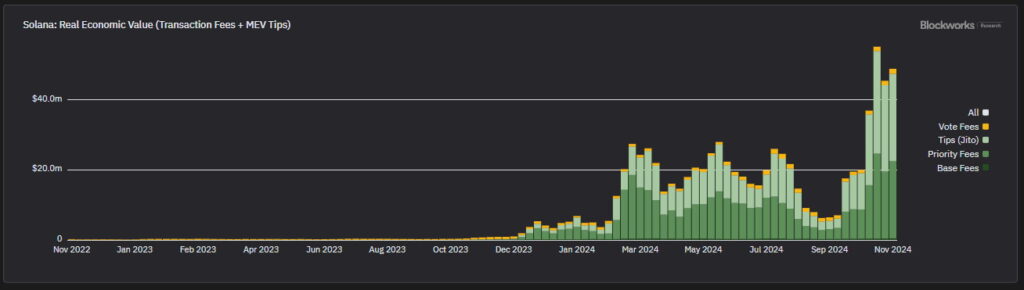

Solana (SOL) surpassed Ethereum (ETH) in Real Economic Value (REV) as both chains achieved new revenue all-time highs this Monday. With that, market participants speculate and predict SOL’s price potential for what could be “the biggest crypto bull run ever.”

Real Economic Value is an important fundamental analysis metric that gives insights into a blockchain’s demand and use. It is arguably a better metric than active addresses, as it is more expensive to manipulate but still requires caution.

On November 11, Solana and Ethereum reached a daily revenue ATH of $12.1 million and $11.2 million, respectively. Weekly, the networks made a total of $48.7 million and $39.0 million, respectively, consolidating the third consecutive week of Solana generating more revenue than Ethereum – as Dan Smith, Blockworks Research analyst, reported.

Picks for you

Why Spotify stock is surging today 20 mins ago Andrew Tate’s crypto ‘Daddy Tate’ crashes over 60% since launch 48 mins ago This Bitcoin mining stock just rocketed 300% in a day 1 hour ago AI sets date when Dogecoin will hit $0.5 2 hours ago  Solana: Real Economic Value (Transaction Fees + MEV Tips). Source: Blockworks Research / Dan Smith

Solana: Real Economic Value (Transaction Fees + MEV Tips). Source: Blockworks Research / Dan Smith

Essentially, Blockworks Research calculates REV by summing up the total network fees with the Maximum Extractable Value (MEV) tips. This means that Solana users have been generating more economic value for its validators despite Ethereum having more market capitalization.

Fundamental analysis using REV plus market cap

On that note, analyzing REV and other fundamental metrics could help investors and traders build price prediction models. These indicators can be used as a benchmark for comparing different chains, forecasting potential growth, and spotting value asymmetries.

In particular, Santiago R Santos, founder of Inversion Capital and Ethereum’s CryptoPunk #9159 owner, commented on the matter this Tuesday. Santos questioned the market capitalization asymmetry between ETH and SOL, with the latter having less than one-third of the former.

“Solana is 30% of Ethereum’s market cap and I can’t think of a compelling reason why it shouldn’t be worth at least 100%.”

– Santiago R Santos

Solana (SOL) price prediction

According to the investor, Solana’s fair value would be the same as Ethereum, at approximately $385 billion.

This would mean a price of $815 per token, considering the current circulating supply of 472 million SOL. If using Solana’s fully diluted value, having Ethereum’s market cap would mean a price of $653 per SOL.

As of this writing, Solana is trading at $207.60, up 104% year-to-date. Therefore, a rally to these potential prices would mean gains in a range between 214% and 292%.

Solana (SOL) year-to-date price chart. Source: Finbold

However, there is no guarantee that Solana will ever reach the same capitalization of Ethereum currently has. Moreover, Ethereum’s market cap itself will change overtime, requiring the analysis to adapt as things develop.

In the meantime, Solana has gained the spotlight after surpassing BNB Chain (BNB) to become the fourth most valuable cryptocurrency. Smart money traders have also shown optimism about Ethereum, buying over $34 million of ETH, as Finbold reported yesterday.