Bitcoin price levels to watch as $100,000 target becomes more realistic

Bitcoin price levels to watch as $100,000 target becomes more realistic

![]() Cryptocurrency Nov 16, 2024 Share

Cryptocurrency Nov 16, 2024 Share

As Bitcoin (BTC) consolidates above the $90,000 mark, an analyst has suggested that the chances of the leading cryptocurrency hitting a new high of $100,000 are becoming more realistic.

To reach this level, the analyst has identified key price targets that investors need to monitor in the short term.

In this context, Bitcoin could target the $95,000 to $100,000 range, provided the asset maintains its current valuation after rallying from a nine-month accumulation phase, RLinda stated in a TradingView post on November 16.

Picks for you

How the market is pricing Donald Trump’s election promises 2 hours ago Why XRP could hit $8 after reclaiming a 3-year high 6 hours ago Here’s why this crypto startup founder is on the Socialist Party’s ‘Wall of Shame’ 7 hours ago Buy signal for two strong cryptocurrencies this week 24 hours ago  Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

The analysis shows that Bitcoin is forming an ascending price channel, signaling bullish momentum. According to RLinda, Bitcoin’s upside potential remains intact despite its recent drop from an all-time high, which she attributed to profit-taking.

Bitcoin’s key levels to watch

Looking ahead, she stated that there are no fundamental or technical signs of bearish pressure. To this end, the expert highlighted key resistance levels to monitor at $91,650 and $93,250, while support levels lie at $90,300, $89,200, and $87,500. A successful breakout above $91,650 could ignite the next leg of the rally, potentially propelling Bitcoin to the $95,000-$100,000 range.

At the same time, technical analyst Gareth Soloway also shared price levels to watch for Bitcoin, although he warned of the potential for the asset to correct below the $80,000 mark.

In his analysis, Soloway acknowledged that Bitcoin rallied 35% in November, driven by Donald Trump’s election and his pro-crypto stance, as well as the possible resignation of Gary Gensler as SEC Chair.

Soloway noted that after consolidating since March 2024—when it fell from a high of $74,000 to $49,000—Bitcoin broke out when it surpassed its previous record high of $74,000. The rally has pushed Bitcoin to major resistance at $90,000-$93,000. This zone aligns with trendlines from key highs in 2021, 2022, and 2024, reinforcing its significance.

A breakout above this level could allow Bitcoin to target $100,000-$101,000, with no significant resistance in between.

However, he warned that if Bitcoin fails to push to these levels, the next support will be $74,000.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Indeed, with most analysts pointing to the possibility of $100,000, the main question remains when this level will be attained. Some market participants anticipate the six-figure level by inauguration day in 2025.

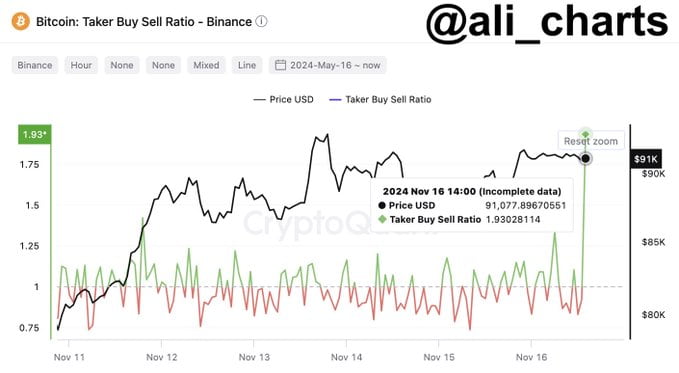

On-chain metrics are supporting the possibility of this breakout. Data shared by crypto analyst Ali Martinez on November 16 noted a spike in Bitcoin buying pressure on Binance. This surge suggests increased interest in the asset, indicating a possible continuation of the current bull run.

Bitcoin taker buy sell ratio chart. Source: CryptoQuant

Bitcoin taker buy sell ratio chart. Source: CryptoQuant

Initially, as reported by Finbold, Martinez stated that Bitcoin has the potential to surpass the $250,000 mark during the current cycle. He observed that Bitcoin formed a bullish cup-and-handle pattern, which could drive the leading digital asset into a parabolic rally if backed by key fundamentals.

Bitcoin price analysis

Bitcoin was trading at $90,473 by press time, rallying almost 3% in the past 24 hours. On the weekly chart, BTC is up 18%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Overall, Bitcoin’s technical indicators support a possible push toward $100,000. However, for this target to be reached, Bitcoin must hold above the $90,000 support zone.

Featured image via Shutterstock