Expert outlines Bitcoin’s path to $135,000 in December

Expert outlines Bitcoin’s path to $135,000 in December

![]() Cryptocurrency Nov 20, 2024 Share

Cryptocurrency Nov 20, 2024 Share

Bitcoin (BTC) appears poised to end 2024 on a high note, with historical patterns suggesting the maiden digital asset is destined for a record high in December.

According to crypto trading expert Ali Martinez, there are striking parallels between Bitcoin’s current price action and its December 2020 rally, hinting that the asset could reach $135,000 by December 2024, as per analysis shared in an X post on November 20.

Bitcoin price analysis chart. Source: TradingView/Ali_charts

Bitcoin price analysis chart. Source: TradingView/Ali_charts

Martinez’s prediction highlighted identical price structures and Relative Strength Index (RSI) levels between December 2020 and November 2024, suggesting a continuation of the bullish trend.

Picks for you

2 cryptocurrencies to reach $1 billion market cap by year-end 9 hours ago This is the ‘easiest and surest’ 10x to 30x play in crypto, says investor 9 hours ago AI predicts Ethereum (ETH) price for year-end 11 hours ago What next for gold as bears set to 'provoke further decline' 11 hours ago

In both cases, Bitcoin has formed a sequence of higher highs and higher lows, supported by an upward RSI trajectory.

Martinez anticipates a rally to $108,000 in the near term, followed by a brief correction to $99,000 before Bitcoin climbs to $135,000. This outlook aligns with Martinez’s previous prediction that Bitcoin will likely climb to $138,000 before experiencing a pullback.

Bitcoin’s path to $100,000

This projection has gained credibility as the likelihood of Bitcoin hitting $100,000 has increased after the asset breached its $94,000 all-time high.

CrypNuevo’s analysis also suggested Bitcoin could approach $96,000 but cautioned against expecting a clean breakthrough of the psychological $100,000 mark on the first attempt.

The analyst predicted a reversal in the mid-to-high $90,000 range, presenting an opportunity for a healthy pullback. The focus will then shift to identifying the next optimal buying zones during this retracement before the asset pushes toward the $100,000 milestone.

“Not expecting to break $100k in the first attempt so looking for a reversal from mid-high $90ks, around $96k zone. Then, focus on the next buying opportunities during the pullback,” the expert said.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Bitcoin’s bullish momentum is backed by the positive outlook following Donald Trump’s election. The ongoing buying pressure has propelled the asset to become the world’s seventh-largest asset, with a market capitalization of approximately $1.8 trillion.

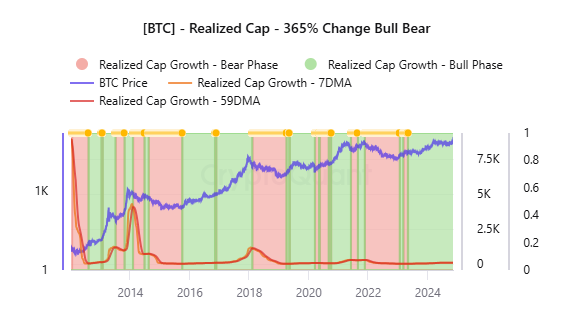

However, the push toward $100,000 might face challenges. CryptoQuant data indicates that Bitcoin’s Realized Cap is no longer increasing, suggesting insufficient new money inflows and potential signs of weakness.

Bitcoin Realized Cap chart. Source: CryptoQuant

Bitcoin Realized Cap chart. Source: CryptoQuant

Amid these concerns, other on-chain metrics point to further growth potential toward the $100,000 level.

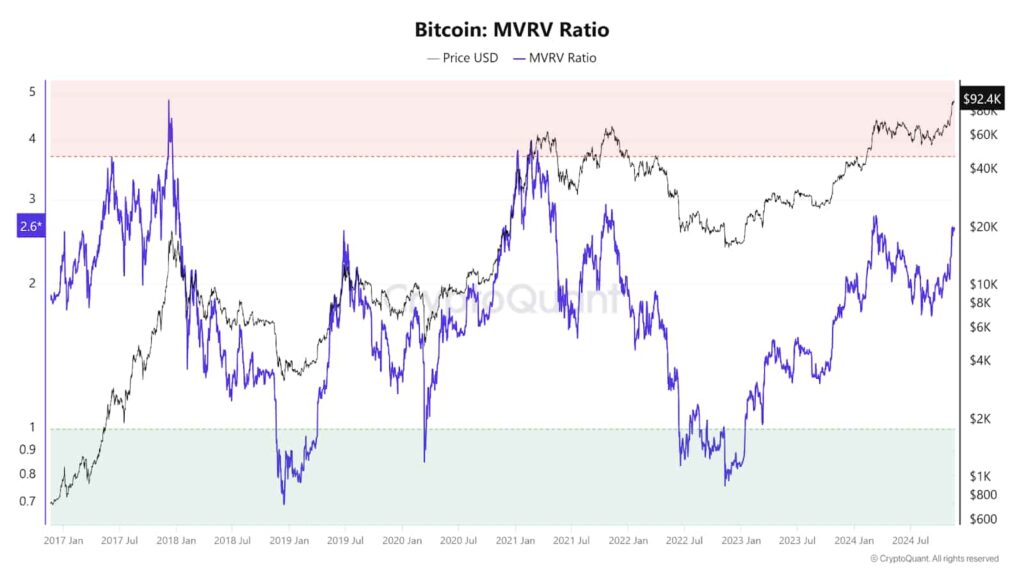

Specifically, Bitcoin’s Market Value to Realized Value (MVRV) currently stands at 2.6, indicating notable unrealized profits. Historically, an MVRV of 4 signals a potential market peak.

Bitcoin’s Market Value to Realized Value (MVRV). Source: CryptoQuant

Bitcoin’s Market Value to Realized Value (MVRV). Source: CryptoQuant

Bitcoin price analysis

At press time, Bitcoin was trading at $93,821, up nearly 1% in the last 24 hours. On the weekly chart, Bitcoin’s consolidation above the $90,000 level is evident, with the asset gaining about 1.6%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Considering all factors, Bitcoin is showing potential for a bullish continuation. However, the asset needs to decisively claim the $95,000 resistance zone to pave the way toward the $100,000 target; even as optimism remains high, a $200,000 milestone will be attainable.

Featured image via Shutterstock