Bitcoin poised to hit $263,000 after reclaiming this level, according to analyst

Bitcoin poised to hit $263,000 after reclaiming this level, according to analyst

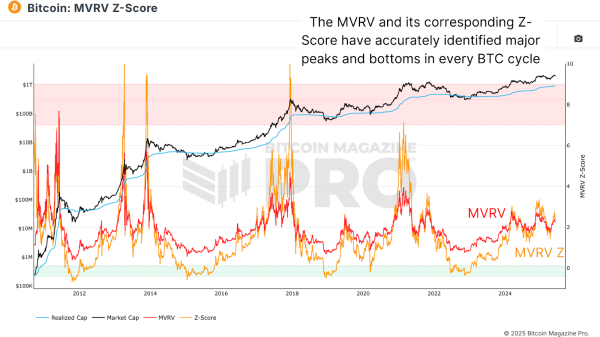

![]() Cryptocurrency Jul 24, 2024 Share

Cryptocurrency Jul 24, 2024 Share

As Bitcoin (BTC) battles key resistance positions, an analyst has pointed out that if the maiden crypto breaches notable levels, it would be in line for a new record high.

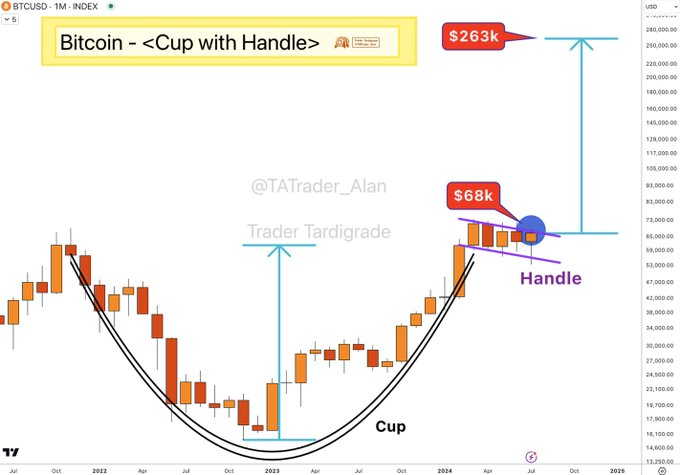

As per analysis shared by Trader Tardigrade in a post on X on July 23, Bitcoin could reach a high of $263,000 based on the “Cup and Handle” pattern, a classic technical analysis indicator.

Notably, the “Cup with Handle” is used to identify bullish continuation signals. This pattern typically forms during a longer-term uptrend and indicates a potential continuation once it is completed.

Picks for you

Cardano breakout alert: ADA’s key support and resistance levels to watch 3 hours ago Here’s when XRP could hit $5.85, according to analyst 3 hours ago Donald Trump’s net worth revealed: How rich is the 45th President of the United States? 4 hours ago U.S. will pay $1.14 trillion in interest payments on debt this year 4 hours ago

The cup formation started around July 2021 and concluded in April 2023, followed by the handle, which is currently in its final stages.

Trader Tardigrade emphasized two critical levels in his analysis: $68,000 and $263,000. The $68,000 mark is identified as the breakout point. Once Bitcoin’s price decisively moves above this level, it would signify a breakout from the handle portion of the pattern, initiating a strong bullish phase.

Bitcoin price analysis chart. Source: TradingView/Trader Tardigrade

Bitcoin price analysis chart. Source: TradingView/Trader Tardigrade

According to the analyst, the measured target for this pattern is $263,000. This target is calculated by measuring the distance from the bottom of the cup to the breakout point and then projecting that distance upwards from the breakout point.

“Take note on these numbers: $68k and $263k. Once $BTC breaks out $68k, indicating a BREAKOUT from the handle. This triggers the Bullish phase with this Cup with Handle,” the analyst stated.

If Bitcoin successfully breaches the $68,000 level, it could embark on a significant rally toward the $263,000 target, driven by increased investor confidence and substantial buying pressure.

It’s worth noting that Bitcoin initially climbed to $68,000 earlier in the week following news that President Joe Biden had withdrawn from the presidential campaign.

In the meantime, investors are projecting the bullish sentiment to resume with the spot Ethereum (ETH) exchange-traded fund (ETF) trading rollout in the United States. Indeed, an inflow of capital into these products will likely positively influence the market, impacting other assets such as Bitcoin.

Bitcoin flashes buy signal

On the other hand, analysts are also pointing out that Bitcoin is flashing buy signals in the short term. For instance, an analysis by Mikybull Crypto indicated that Bitcoin triggered a rare Hash Ribbon ‘Buy’ signal, indicating the potential for a significant price rally in the near future.

This technical indicator, which analyzes Bitcoin’s network hashrate, is highly regarded for predicting explosive price movements. Historically, a Hash Ribbon ‘Buy’ signal has often preceded substantial upward trends in Bitcoin’s value.

Bitcoin price analysis chart. TradingView/Mikybull Crypto

Bitcoin price analysis chart. TradingView/Mikybull Crypto

Notably, the current chart analysis aligns with a Wyckoff Accumulation schematic, suggesting that Bitcoin may be in the final stages of accumulation before a strong bullish breakout. Bitcoin’s hashrate has shown signs of recovery, marking the end of a capitulation period where mining profitability was low.

Bitcoin price analysis

By press time, Bitcoin was trading at $66,356 with daily losses of less than 0.1%. On the weekly chart, Bitcoin is up over 2%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Based on the recent price movement, investors should monitor the $65,000 support zone, with $70,000 resistance as the main target.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.