AI predicts Chainlink (LINK) price for year-end

AI predicts Chainlink (LINK) price for year-end

![]() Cryptocurrency Dec 3, 2024 Share

Cryptocurrency Dec 3, 2024 Share

Chainlink (LINK) has captured the spotlight with a remarkable rally, surging 26% on December 3 to hit $26.32, its highest level since January 2022. This rise has sparked speculation about the token’s year-end potential, fueled by bullish market sentiment, whale activity, and institutional adoption.

At the time of writing, LINK was trading at $24.71, posting a 24% gain in the past 24 hours. On a broader scale, the token has soared 127% this month, pushing its market capitalization to an impressive $15 billion.

Link one-day price chart. Source: Finbold

Link one-day price chart. Source: Finbold

What’s driving LINK’s momentum?

The recent price spike for Chainlink is partly attributed to the success of XRP, which surged to $2.7 on December 2 before stabilizing. XRP’s momentum, fueled by optimism around Ripple’s stablecoin initiatives and expectations of improved U.S. regulatory conditions, has indirectly drawn attention to LINK.

Picks for you

Beware: This pattern could trigger a Bitcoin crash below $90,000 12 mins ago What’s next for Terra Classic after LUNC’s 80% rally 26 mins ago Uranium.io, a uranium trading dApp powered by Tezos, goes live 40 mins ago Orbitt unveils a staking program with $2 million in rewards 2 hours ago

According to Aylo, an advisor at Kamino Finance, XRP’s rally may spotlight Chainlink’s partnerships with traditional finance, reinforcing the notion that LINK could act as a bridge between blockchain and capital markets.

Adding to the bullish sentiment, fintech firm 21X announced the adoption of Chainlink’s infrastructure for tokenized securities in Europe. This integration highlights Chainlink’s pivotal role in advancing blockchain adoption in one of the most regulated financial markets globally.

Chainlink’s positioning as a universal gas token, enabling fee payments in LINK with a 10% discount for high-volume users, is also increasing its utility and demand. Solutions like CCIP v1.6 streamline payments for developers, reinforcing LINK’s importance in the blockchain ecosystem and driving its future growth.

Whale activity and derivatives data

Data from LookonChain reveals a notable Chainlink whale bagged nearly $6 million worth of the token, sparking optimism about the asset’s future movements.

The price of $LINK has surged 36% today!

A whale bought 269,861 $LINK($6.68M) in the past 12 hours.

The whale spent $2.6M to buy 107,838 $LINK at $24.1 on DEX and withdrew 162,024 $LINK($4.08M) from #Binance.https://t.co/Zuxgpk23Sm pic.twitter.com/hNQ65oZkfi

— Lookonchain (@lookonchain) December 3, 2024

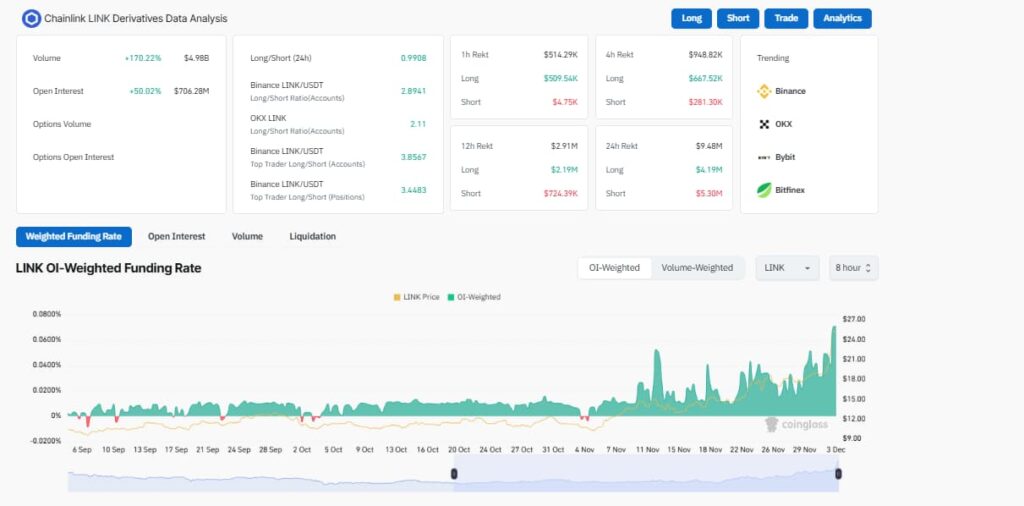

Derivatives data from CoinGlass also paints a bullish sentiment for Chainlink based on key market metrics. Open interest has surged by 50.02% to $706.28 million, accompanied by a massive 170.22% increase in trading volume, reaching $4.98 billion. These metrics suggest strong trader activity and significant market interest.

Derivatives data. Source: CoinGlass

Derivatives data. Source: CoinGlass

Moreover, long positions are dominating the market, with Binance’s long/short ratio at 2.89 and similar trends visible across other platforms.

A positive weighted funding rate further signals trader optimism, as market participants are willing to pay premiums to hold long positions. In the last 24 hours, $5.30 million in short positions were liquidated compared to $4.19 million in longs, reinforcing the bullish sentiment.

With LINK’s price breaking above $25 and derivatives activity at elevated levels, the market shows strong confidence in continued upward movement.

AI predicts LINK’s year-end price

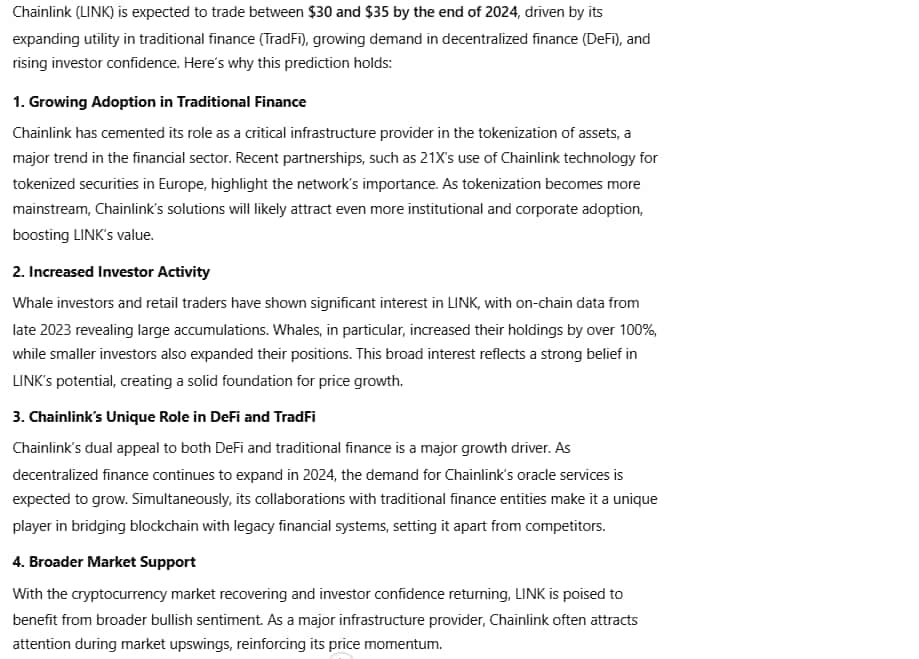

For a detailed projection of LINK’s potential, Finbold leveraged market data and consulted ChatGPT-4o to analyze Chainlink’s prospects as it reached new highs.

According to the AI model, Chainlink is expected to trade between $30 and $35 by the end of 2024. This projection is driven by LINK’s expanding utility in both decentralized finance and traditional finance, coupled with rising investor confidence and strong technical indicators.

Factors driving LINK price. Source: ChatGPT/Finbold

Factors driving LINK price. Source: ChatGPT/Finbold

The token’s growing use cases, from its role as a universal gas token to its integration into tokenized securities, highlight its potential for sustained growth.

If bullish momentum persists and adoption accelerates, LINK could edge toward the upper range of predictions, closing the year with a strong market performance.

Featured image via Shutterstock