AI predicts Bitcoin price ahead of interest rate decision meeting

AI predicts Bitcoin price ahead of interest rate decision meeting

![]() Cryptocurrency Jul 28, 2024 Share

Cryptocurrency Jul 28, 2024 Share

On July 31, the Federal Open Market Committee (FOMC) will meet to decide on the Federal Reserve interest rate target. Expecting macroeconomic impacts, Finbold turned to artificial intelligence (AI) models for insights on Bitcoin (BTC) price and the cryptocurrency market.

In each new meeting, the FOMC approaches the day it will finally start cutting the interest rate, as previously promised. Analysts expect this upcoming event will be positive for risk assets like cryptocurrencies and stocks, including Bitcoin.

As of this writing, Bitcoin trades at $67,500, and the total crypto market cap is at $2.36 trillion.

Picks for you

ChatGPT-4o weighs in on BlackRock’s ‘only 2 cryptocurrencies worth buying’ 12 mins ago Opportunity: Analysts predict Ethereum massive run beyond $4,000 soon 2 hours ago XRP or Stellar (XLM)? We asked ChatGPT-4o which crypto is a better buy for 2024 3 hours ago 2 cryptocurrencies to reach $50 billion market cap in August 19 hours ago

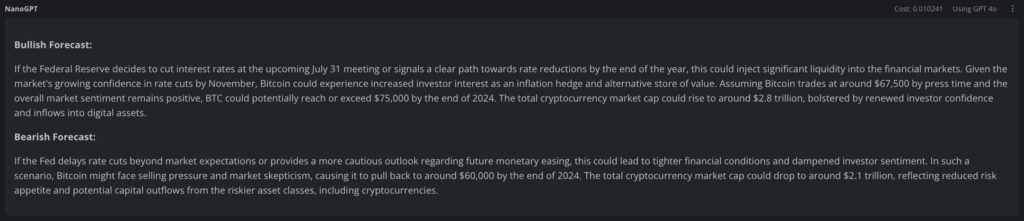

ChatGPT-4o bearish and bullish Bitcoin price prediction

Looking forward to the FOMC meeting, the OpenAI‘s advanced model ChatGPT-4o has traced two Bitcoin price predictions.

The bullish forecast sees a potential for Bitcoin to exceed $75,000 by the end of 2024. Therefore, driving cryptocurrencies to around $2.8 trillion in capitalization, bolstered by renewed investors’ confidence and inflow into the space.

On the other hand, a bearish forecast sees a pullback to around $60,000 – a key psychological support. This scenario would play out if the Fed delays rate cuts beyond market expectations, according to the AI model.

ChatGPT-4o bearish and bullish Bitcoin price prediction. Source: NanoGPT / Finbold

ChatGPT-4o bearish and bullish Bitcoin price prediction. Source: NanoGPT / Finbold

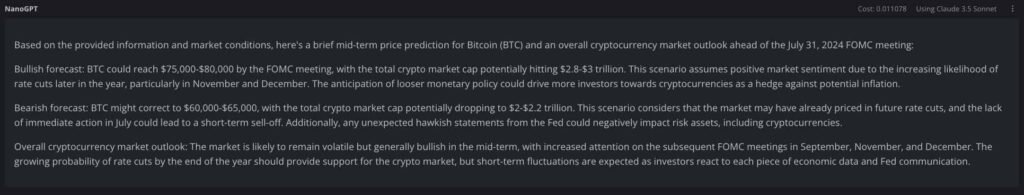

Claude 3.5 Sonnet forecasts ahead of Fed’s interest rate decision

Finbold also consulted Anthropic‘s most advanced AI model, Claude 3.5 Sonnet, known for surpassing ChatGPT-4o in most benchmarks. Interestingly, Claude AI’s Bitcoin price prediction is similar to that of its competitor, although slightly more optimistic.

The bullish forecast draws a range between $75,000 and $80,000 for the leading cryptocurrency. It also sees a $2.8 and $3 trillion market cap range for the total index.

Conversely, Claude 3.5 Sonnet’s bearish scenario puts BTC between $60,000 and $65,000 in a $2 trillion to $2.2 trillion market.

Claude 3.5 Sonnet bearish and bullish Bitcoin price prediction. Source: NanoGPT / Finbold

Claude 3.5 Sonnet bearish and bullish Bitcoin price prediction. Source: NanoGPT / Finbold

2024 FOMC meetings: Interest rate decision expectations

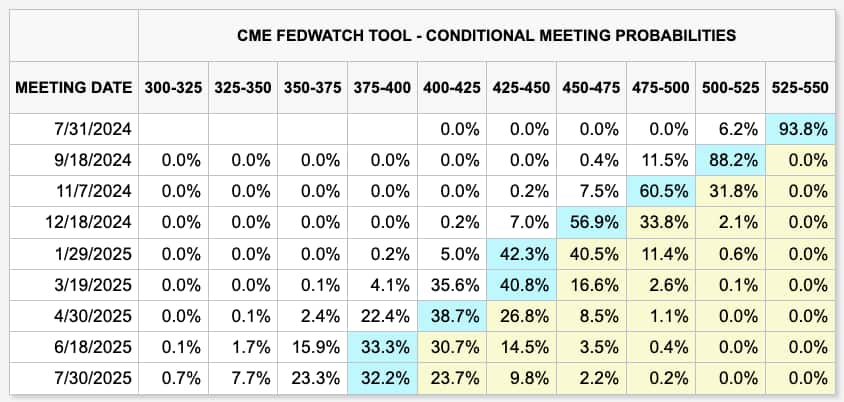

Following July 31’s meeting, the FOMC will have three other meetings to further decide on the United States interest rates. The following meetings will happen in September, November, and December, with a high chance of a few rate cuts.

Notably, the market says it has a 6% chance of a 25 bps rate cut on July 31’s meeting and a 100% chance for the following meetings to have an interest rate lower than the current 525-550 bps, with an increasing chance of having a lower than 500 bps interest rate by the end of the year.

CME FedWatch Tool – Conditional Meeting Probabilities. Source: CME

CME FedWatch Tool – Conditional Meeting Probabilities. Source: CME

Moreover, the popular prediction market Polymarket bets there is a 35% and 37% chance of the Fed cutting rates by 50 bps and 75 bps, respectively, in 2024. Prediction markets have been proven to be accurate tools for forecasting future events.

How many Fed rate cuts this year? Source: Polymarket

How many Fed rate cuts this year? Source: Polymarket

Nevertheless, it is important to understand that markets tend to price things in advance and not after the events occur. Thus, it is possible that these reported expectations are already priced in for Bitcoin and cryptocurrencies. A deviation from these predictions, however, could have a massive impact on the charts.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.