2 decentralized exchanges for 2025 as DEX/CEX volume ratio reaches an all-time high

2 decentralized exchanges for 2025 as DEX/CEX volume ratio reaches an all-time high

![]() Cryptocurrency Jan 8, 2025 Share

Cryptocurrency Jan 8, 2025 Share

Decentralized exchanges (DEX) are increasing their relevance on the cryptocurrency trading landscape, approaching the centralized platforms (CEX) in volume. In this context, Finbold selected three DEX projects to keep an eye for 2025.

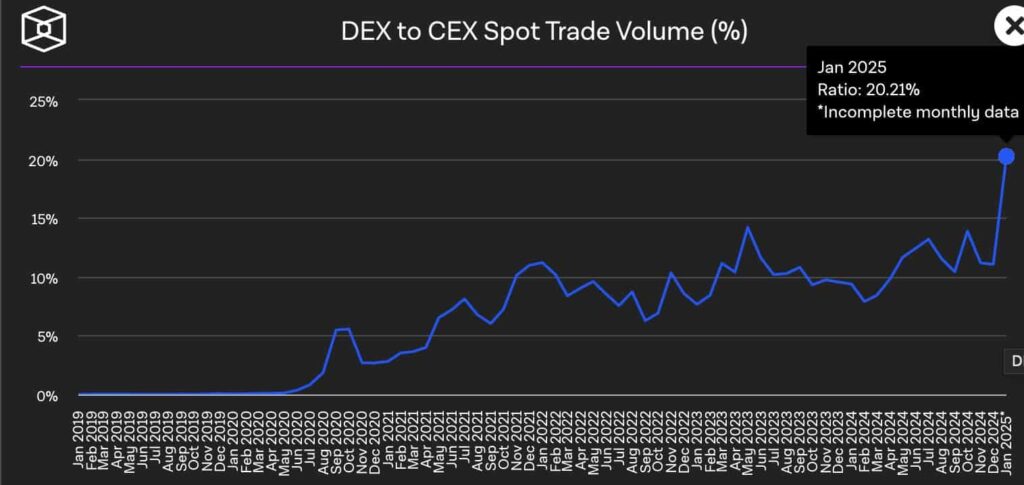

As of January 7, the DEX/CEX volume ratio reached an all-time high, with over 20% of all crypto trading happening on decentralized exchanges. This data is from IntoTheBlock, shared on X by Hayden Adams, inventor of the Uniswap protocol, a leading decentralized exchange.

DEX to CEX Spot Trade Volume (%). Source: IntoTheBlock / Hayden Adams

DEX to CEX Spot Trade Volume (%). Source: IntoTheBlock / Hayden Adams

Uniswap (UNI) as the leading DEX for the EVM ecosystem

Among the top projects to keep an eye for 2025, Uniswap (UNI) stands out as the leading decentralized exchange for the Ethereum Virtual Machine (EVM) ecosystem.

Picks for you

Bitcoin analyst predicts BTC top will hit this price as the bull cycle ends 3 hours ago Bitcoin could crash to $40,000, according to trading expert 6 hours ago XRP price prediction for Trump’s Inauguration Day 6 hours ago AI picks 2 altcoins to buy and add to your crypto portfolio in January 7 hours ago

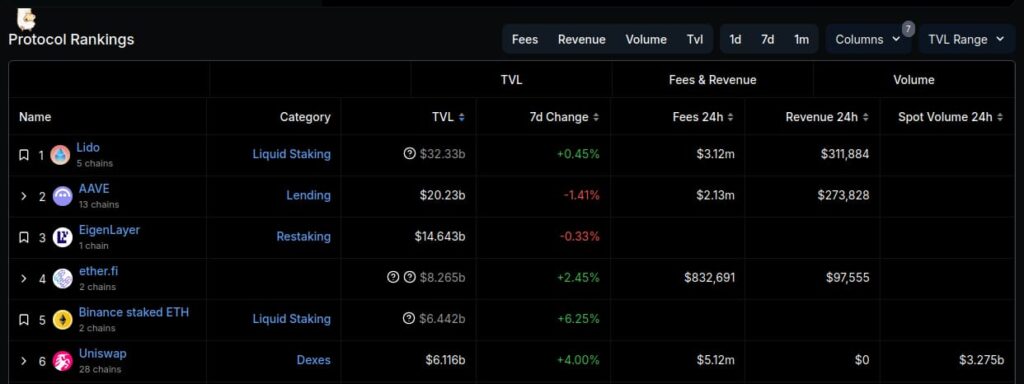

According to DefiLlama, Uniswap is also the biggest DEX in total value locked (TVL) among all ecosystems, with $6.11 billion. Its TVL has increased by 4% in the last seven days, despite the recent market crash, suggesting a healthy ecosystem.

In the last 24 hours, Uniswap has seen $3.275 billion in trading volume, collecting over $5 million in fees.

Protocol Rankings from 1 (Lido) to 6 (Uniswap). Source: DefiLlama.

Protocol Rankings from 1 (Lido) to 6 (Uniswap). Source: DefiLlama.

Raydium as the trading heart on Solana

In second, there is Raydium (RAY), the trading heart giving life to Solana (SOL)’s decentralized finance ecosystem, especially memecoins. Solana got the spotlights in the past few years thanks to the memecoin boom, bringing demand and capital there.

Raydium is the most-used decentralized exchange by Solana traders who swap among the different utility tokens of the ecosystem, but also speculate on the active memecoin market, winning and losing huge sums of money.

With that, Solana’s leading DEX has $2.29 billion in TVL, up 8.66% in the last seven days. Raydium has generated over $2.79 billion in volume and $7.4 million in fees, in the last 24 hours.

Protocol Rankings from 17 (Rocket Pool) to 21 (Kamino). Source: DefiLlama.

Protocol Rankings from 17 (Rocket Pool) to 21 (Kamino). Source: DefiLlama.

UNI and RAY price analysis

As of this writing, UNI is trading at $12.59 and RAY at $4.87, both experiencing losses. In the last seven days, UNI dropped 6.16% and RAY 1.74%, with the most significant losses happening in the last 24 hours.

While some traders see the market crash as a threat, losing over $630 million to liquidations, others believe it is an opportunity.

Uniswap (UNI) & Raydium (RAY) seven-day price chart. Source: Finbold

Uniswap (UNI) & Raydium (RAY) seven-day price chart. Source: Finbold

With solid use cases and a growing DEX/CEX volume ratio, these decentralized exchanges could have strong long term fundamentals, that could lead them to shine in 2025, if demand continues increasing.

Nevertheless, the cryptocurrency industry is a dynamic environment, constantly changing and innovating. Uniswap and Raydium will need to keep improving in order to face the competition, that is only getting better with time, shaping the market’s future.

Featured image from Shutterstock