DoJ Gets Clearance to Offload 69,000 $BTC, Sparking Speculations in Crypto Market

The United States Department of Justice (DoJ) has reportedly obtained the clearance to offload 69,000 Bitcoins ($BTC). As per Glassnode, this potential Bitcoin ($BTC) liquidation raises concerns about a likely impact on the wider crypto market. This development has reportedly gained substantial attention in comparison with the former big-scale $BTC sell-offs. Additionally, it also pushes the market onlookers to look for the likely market response. However, it remains to be seen whether the potential selloff leads to a positive or negative sentiment.

The U.S. Department of Justice (DoJ) is cleared to sell 69,000 $BTC – worth over $6B. How does this compare to past major Bitcoin sell-offs? Let’s break down the scale and potential impact 🧵👇 pic.twitter.com/q5wq9EcDP0

— glassnode (@glassnode) January 10, 2025

DoJ Offloads 69K $BTC, Raises Concerns about Probable Influence on Market

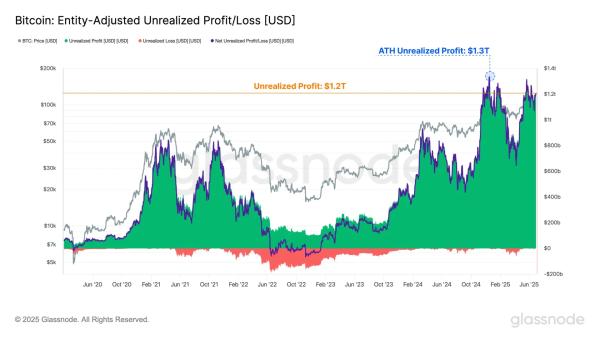

Glassnode asserted that the U.S. Department of Justice has received the authorization to sell more than $6B in Bitcoin. The on-chain analytics platform compared this likely selloff with the former move by the German government. In July last year, they sold 56,000 $BTC, increasing apprehensions about a likely market destabilization. Nonetheless, as opposed to the expectations, the market effectively tackled the sales pressure. Subsequently, the top crypto asset’s price surged from $53,000 to nearly $68,000. This market resilience displays the capacity to tackle substantial liquidations in line with favorable conditions.

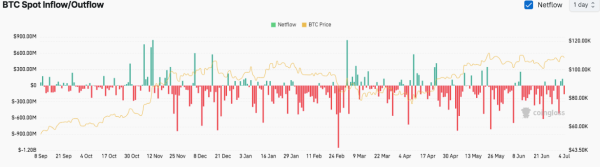

To measure the likely effect of the selloff by DoJ, market experts are analyzing Bitcoin’s 30-day simple moving average in terms of exchange netflows. Based on this, they focus on gauging the sell-side pressure. In this respect, the big netflows have paralleled noteworthy market events. Formerly, in March 2021, net inflows touched 70.5K $BTC while the Net Unrealized Profit/Loss metric stood at 0.72, highlighting market euphoria. Following that a correction occurred, paving the way for a market rebound within months.

Liquidity and Sentiment Shape Market Response

Following that, 68.7K $BTC in inflows took place in June 2022 during a capitulation phase. At that point, NUPL indicated a 0.21 spot, with LUNA collapse exacerbating it. This ignited a year-long bearish momentum in the market. According to Glassnode, the likely Department of Justice (DoJ) sale underscores that the market response will take into account liquidity conditions and wider sentiment.