2 cryptocurrencies to reach a $10 billion market cap in Q1 2025

2 cryptocurrencies to reach a $10 billion market cap in Q1 2025

![]() Cryptocurrency Jan 21, 2025 Share

Cryptocurrency Jan 21, 2025 Share

Bitcoin (BTC) and the broader cryptocurrency market pulled back from their January 20 highs as the initial wave of optimism following President Donald Trump’s inauguration began to fade.

The global cryptocurrency market cap has slipped to $3.79 trillion, reflecting a 2% decline in the past 24 hours and signaling cooling investor enthusiasm.

Despite this retreat, a handful of cryptocurrencies are emerging as strong contenders, supported by fundamentals and market momentum, positioning them to potentially cross the $10 billion market cap in the first quarter of 2025.

Picks for you

Solana or Cardano? We asked AI which is a better buy now that 2025 started 14 hours ago MicroStrategy extends Bitcoin buying to 11th consecutive week as BTC price surges 14 hours ago Billion dollar asset manager files for DOGE and TRUMP ETFs 15 hours ago This bullish pattern hints Dogecoin to target $15, according to trading expert 15 hours ago

Aave (AAVE)

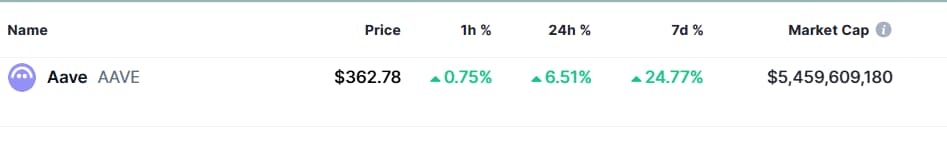

Aave (AAVE) is emerging as a strong contender in the DeFi space, showing clear potential to reach a $10 billion market cap. Currently trading at $362.78 with a market cap of $5.46 billion, the token has seen a 6.51% rise in the past 24 hours and a 24.77% surge over the past week.

Aave market cap. Source: CoinMarketCap

Aave market cap. Source: CoinMarketCap

Institutional interest is evident, with Donald Trump’s World Liberty Financial (WLFI) recently increasing its AAVE holdings by $4.8 million.

Derivatives data also highlight increasing market activity, with AAVE’s open interest up by 13.54% to $427.78 million, reflecting growing interest in leveraged positions. The long/short ratio for the past 24 hours is 0.9841, showing a relatively balanced sentiment. However, the top trader long/short position ratio on Binance stands at 2.1038, indicating a stronger bias toward long positions by major traders.

Rekt data shows liquidations over various timeframes, with $3.41 million liquidated in the past 24 hours. Long liquidations accounted for $2.37 million, while shorts contributed $1.04 million, reflecting the recent market volatility favoring short-term bullish momentum.

This activity coincides with broader market movements and developments in Aave’s ecosystem, such as its v3.2 Liquid eModes launch on Arbitrum (ARB) and Base, as well as its growing Total Value Locked (TVL).

Analysts are optimistic about Aave’s price action, with a price target of $500, suggesting a strong upward trajectory driven by both technical and fundamental factors.

Litecoin (LTC)

Litecoin (LTC) appears to reach a $10 billion market cap as market dynamics show growing investor confidence, supported by ETF optimism and strong institutional activity.

Bloomberg analyst Eric Balchunas has suggested that Litecoin could be the next cryptocurrency to receive ETF approval, following the recent filing by CanaryFunds.

Historically, such developments have driven significant market interest, and approval could unlock new liquidity and adoption.

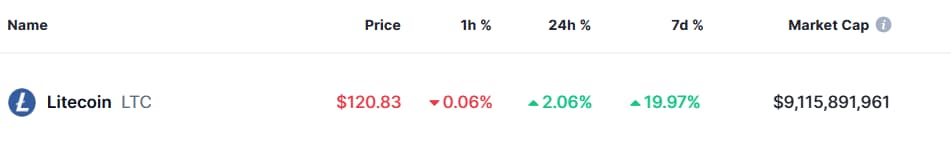

Litecoin market cap. Source: CoinMarketCap

Litecoin market cap. Source: CoinMarketCap

Whale activity has also surged, with addresses holding over 10,000 LTC accumulating 250,000 coins since January, signaling strong confidence.

Despite a 44.74% drop in derivatives trading volume to $1.29 billion, open interest rose 2.91% to $583.41 million, indicating sustained market engagement.

Bullish sentiment dominates the derivatives market, with the Binance LTC/USDT top trader long/short position ratio at an impressive 6.2273.

Currently trading at $120.83 with a market cap of $9.11 billion, Litecoin needs to reach approximately $132.56 to achieve a $10 billion valuation. Given its 2.06% gain in the past 24 hours and 19.97% increase over the past week, this target is well within reach.

For investors and traders, both Aave and Litecoin present attractive opportunities, supported by strong fundamentals and promising technical indicators.

Keeping a close eye on key price levels, derivatives market data, trading volumes, and ecosystem updates will be crucial for those seeking to maximize gains as these assets advance toward their next growth phase.

Featured image via Shutterstock