$100,000 per Bitcoin ‘around the corner,’ says expert

$100,000 per Bitcoin ‘around the corner,’ says expert

![]() Cryptocurrency Nov 21, 2024 Share

Cryptocurrency Nov 21, 2024 Share

Since the beginning of November, the wider cryptocurrency market has entered a renewed bull run.

The continued and rapid rise of institutional adoption, geopolitical and inflationary tensions, and the election of Donald Trump, who is widely seen as the first pro-crypto President are providing strong tailwinds for digital assets.

It comes as no surprise that the biggest beneficiary has been Bitcoin (BTC). Over the course of the last thirty days, BTC prices have risen by 45.53% — bringing year-to-date (YTD) gains up to 123.86%. At press time, one Bitcoin was worth $98,010 — analysts are generally euphoric, setting ever-higher price targets.

Picks for you

Solana killer Sui Network is down, no new blocks in the last 1.5 hours 1 hour ago Satoshi Nakamoto is now the 18th richest person in the world 3 hours ago SHIB bull flag could trigger 48% price explosion 4 hours ago If you invested $1k in BTC when Hillary Clinton said crypto can 'destabilize nations,' you'd have this much 5 hours ago  Bitcoin price YTD chart. Source: Finbold

Bitcoin price YTD chart. Source: Finbold

However, a notable number of experts are reminding investors that such phases tend to last a couple of months before being followed by a pullback. Similar sentiments were echoed by renowned crypto researcher Michaël van de Poppe in an X post on November 21.

van de Poppe predicts BTC flash crash followed by multi-month altseason

Although bullish, the expert, who has since shifted his focus toward altcoins, predicts that BTC reaching $100,000 is around the corner, he is also cautioning that a flash crash might soon follow.

He forecasts that a rapid drop in Bitcoin price and subsequent rapid recovery will be followed by a multi-month altseason — during which the returns on smaller cryptocurrencies will outperform those of BTC.

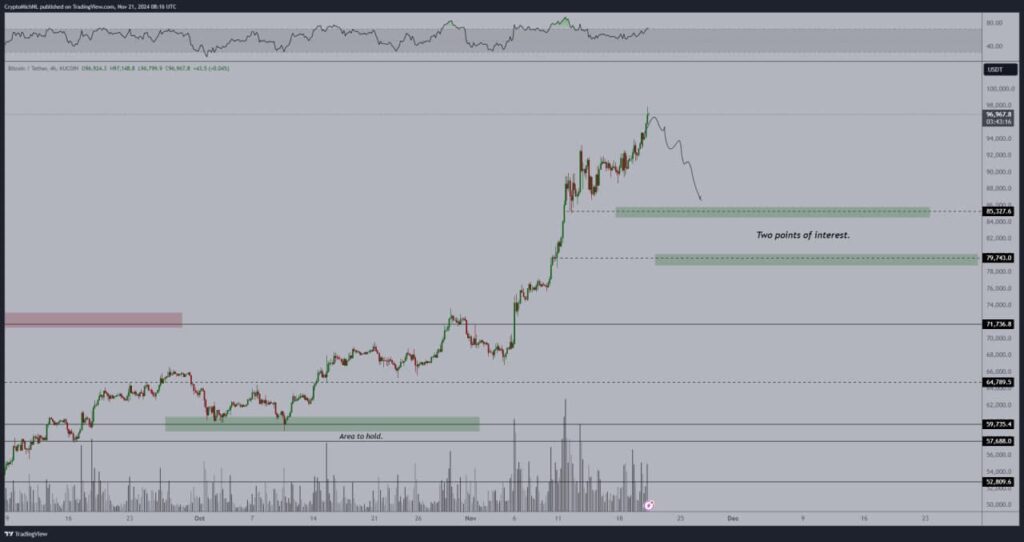

The analyst also outlined two points of interest that could serve as opportunities to buy the dip. Depending on the severity of the predicted flash crash, investors should keep an eye out for prices at $85,000 and $79,400, as noted in a chart provided in the X post.

Bitcoin chart outlining buying opportunities. Source: Michaël van de Poppe

Bitcoin chart outlining buying opportunities. Source: Michaël van de Poppe

His bullish sentiments are far from fringe views. Renowned technical analyst Ali Martinez is even more optimistic, predicting that the price of the digital asset could reach $135,000 by the end of 2024, based on parallels with Bitcoin’s December 2020 rally. The key support level stands at $91,913.60 — while the current short-term resistance level is at $98,000.

Will altcoins outperform Bitcoin?

While altcoins started the year strong, they have since lost steam — with some notable exceptions including Dogecoin (DOGE), Solana (SOL), and Sui (SUI), all of which have provided triple-digit returns since the beginning of the year.

Granted, the current trajectory of BTC seems unstoppable — but sooner or later, investors and traders will take their profits and move on to other opportunities seen as more lucrative.

Alex Becker, CEO of Hyros, doubled down on his stance that altcoins with real utility present the best opportunity for 10x to 30x growth. Numerous commentators have outlined a bullish case for Cardano (ADA), while Finbold’s own analysts have identified two assets — Starknet (STRK) and JasmyCoin (JASMY) as buying opportunities that are poised to receive significant capital inflows.

Ultimately, only time will tell which of the two avenues ends up being the more profitable one — readers should note that the institutional adoption of Bitcoin provides the maiden cryptocurrency with a significant advantage over altcoins.

Featured image via Shutterstock