$18,344,996,366 Bitcoin Sell Wall Suppressing ATH Rebound

Bitcoin (BTC), the first macro asset in 150 years, is experiencing stagnation after it breached the psychological $100,000 price.

As reported by U.Today, despite over seven days of trading above this level, the asset has not been able to retest its all-time high (ATH).

Bitcoin resistance wall

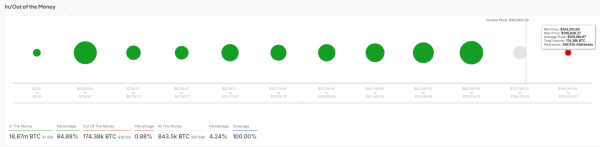

IntoTheBlock data has shared insights on the barrier potentially preventing Bitcoin from posting a new ATH.

Notably, 174,380 BTC worth $18.34 billion have created a sell wall for Bitcoin, as these coins are currently “Out Of The Money.”

This volume of Bitcoin comes from 296,520 addresses that bought Bitcoin when the price was between $104,310 and $106,839. This places the average purchase price for these investors at $105,169.

Hence, these out-of-the-money traders are anticipating a breakout in Bitcoin’s price to the level at which they bought it so they can sell.

These investors also hope to make a profit, like others who bought the asset at a much lower price.

The development has prevented Bitcoin from attaining new heights as traders sell off once the price rises.

Market sentiment dampened by profit-taking

The current situation could discourage potential buyers as they consider the sell wall a huge resistance level for Bitcoin to surmount.

As of press time, trading volume is up by 13.37% to $49.87 billion in the last 24 hours. This suggests that investors are not rushing to accumulate the coin due to the prevailing sell wall.

Meanwhile, Bitcoin is changing hands at $103,689.18, a 1.62% increase within the same time frame.

According to the IntoTheBlock chart, about 94.88% of investors are “In The Money.” These traders account for 18.87 million BTC, valued at $1.96 trillion. This suggests that they are profit-taking at the moment.

Only 4.24% of investors holding 843,500 BTC valued at $87.4 billion are “At The Money,” as they are neither making a profit nor a loss.