2 stocks set to benefit from post-election Bitcoin rally

2 stocks set to benefit from post-election Bitcoin rally

![]() Stocks Nov 12, 2024 Share

Stocks Nov 12, 2024 Share

In the wake of Donald Trump’s presidential victory, investor optimism has surged across the cryptocurrency market, driving notable gains in major crypto-related stocks.

Shares of Coinbase Global (NASDAQ: COIN) and Robinhood Markets (NASDAQ: HOOD) have experienced significant gains, driven by renewed bullish sentiment surrounding digital assets.

With Trump’s pro-crypto stance and the Republican Party regaining control of the Senate, investors are increasingly hopeful for supportive policies that could further boost the valuations of these stocks, solidifying their positions within a rapidly evolving market.

Picks for you

Smart trader buys $34M in ETH as Ethereum Foundation sells $340k 56 mins ago This is the event that will force MicroStrategy to sell Bitcoin, warns expert 2 hours ago Planning on shorting Bitcoin? Here’s the latest BTC short ratio 2 hours ago Is buyer confidence in Gold fading as bears loom on the horizon? 4 hours ago

Coinbase (NASDAQ: COIN) stock

Coinbase has surged as a prominent benefactor of the post-election crypto rally. The stock gained an impressive 19.7% on Monday, reaching $324, marking its first time above the $300 mark since 2021.

Currently trading at $324.24, the stock boasts a monthly gain of 65% and a year-to-date gain of 106%.

Coinbase five-day stock price. Source: Google Finance

Coinbase five-day stock price. Source: Google Finance

With Bitcoin surpassing $80,000, Coinbase stands to benefit from heightened trading volumes and increased investor interest.

As a leading cryptocurrency exchange, Coinbase reported Q3 2024 revenue of $1.2 billion with a net income of $75 million, marking seven consecutive quarters of positive EBITDA. While total revenue decreased 17% quarter-over-quarter, Coinbase saw transaction growth from stablecoin integration and improvements to its Base network.

Coinbase’s strategic positioning as a custodian for nearly all spot Bitcoin ETFs, including BlackRock’s (NYSE: BLK), shows its potential to benefit from increased institutional adoption. This expanding reach gives Coinbase a competitive edge in attracting institutional and retail investments, especially as Trump aims to make the U.S. the “Crypto Capital.”

Analysts are mostly optimistic, with Barclays recently raising its price target on Coinbase to $204, according to TipRanks, reflecting optimism about the potential impact of pro-crypto policies.

Robinhood Markets (NASDAQ: HOOD) stock

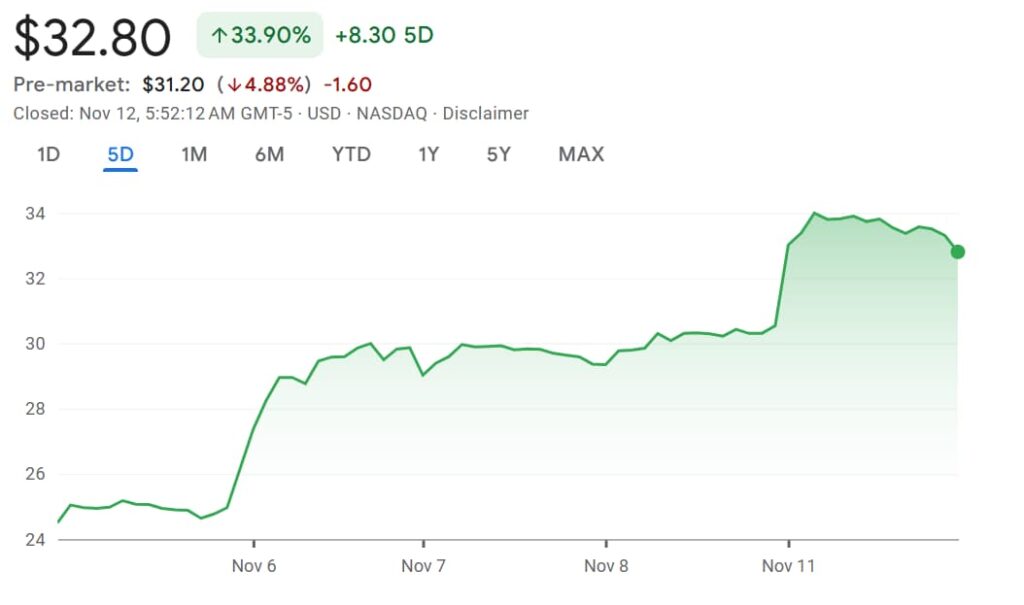

Robinhood has effectively tapped into the recent surge in crypto optimism, with its shares reaching a new 52-week high of $33, marking an impressive 40% gain since early November.

This momentum reflects strong investor confidence, fueled by Donald Trump’s election victory, which propelled Bitcoin to an all-time high and sparked renewed interest in crypto-related stocks.

The platform’s diverse offerings, including plans to expand into futures trading for Bitcoin and Ether as reported by Yahoo Finance, along with international expansion initiatives, position Robinhood well to capture increased trading activity.

For instance, Robinhood’s cryptocurrency revenues reached $268 million in the first three quarters of 2024.

Robinhood five-day stock price chart. Source: Google Finance

Robinhood five-day stock price chart. Source: Google Finance

Currently trading at $32.80, Robinhood has posted a five-day gain of 33% and a year-to-date gain of 165%. The company’s diversification strategy includes its planned acquisition of Bitstamp, a move that will enhance its product lineup and extend its international market reach, particularly in Europe and Asia.

Nonetheless, Robinhood continues to face regulatory challenges in the U.S., including a recent $3.9 million settlement with the California Department of Justice and a Wells notice from the SEC in May.

Despite these headwinds, Robinhood’s increased trading activity is evident in its rising assets under custody (AUC), which reached $159.7 billion at the end of October, up 5% from September 2024 and an impressive 89% year-over-year, demonstrating solid performance in the current market environment.

With Trump’s election win, investors are hopeful for regulatory stability, which could alleviate some of these headwinds and provide a more supportive environment for the crypto sector overall.

As Bitcoin reaches new highs, these two stocks stand out as prime opportunities in the evolving crypto landscape, with strong growth outlooks fueled by both market momentum and anticipated regulatory clarity.

Featured image via Shutterstock