2 ways investors can earn passive income with crypto in 2024

2 ways investors can earn passive income with crypto in 2024

![]() Cryptocurrency Oct 27, 2024 Share

Cryptocurrency Oct 27, 2024 Share

Investors can earn passive income through many different traditional financial products, including government and corporate bonds or stock dividends. Similar opportunities also exist in the crypto sphere, often ignored by mainstream investors, creating potentially better results from yield farming.

In crypto, similarly to other markets, the passive income can come from lending money to institutions in return for an agreed-upon interest rate (bonds) or by becoming a stakeholder and participating in the distributed revenue (dividends).

These would translate into staking tokens as a validator or delegator in proof-of-stake (PoS) networks, being paid by the protocol’s emission and users’ fees, or supplying tokens in decentralized money markets and liquidity pools earning passive income from borrowers’ repaid interests.

Picks for you

Crypto expert names two new Bitcoin catalysts as ‘Uptober’ disappoints 4 hours ago Gold rush: Central banks' gold reserves doubled over a decade to record highs 5 hours ago Crypto trader turns $1,700 into $873,000 in 2 days 6 hours ago AI predicts Bitcoin price for year-end 22 hours ago

On that note, Finbold spotted some recent opportunities for investors to consider and earn passive income with crypto in 2024.

Staking crypto to earn passive income in 2024

When staking as validators or delegators, investors contribute to PoS networks’ decentralization and security while earning passive income.

This income is usually from a combination of tokens’ issuance, inflating the supply, or transaction fees. Yet, each cryptocurrency has a unique model with advantages and disadvantages that investors must consider.

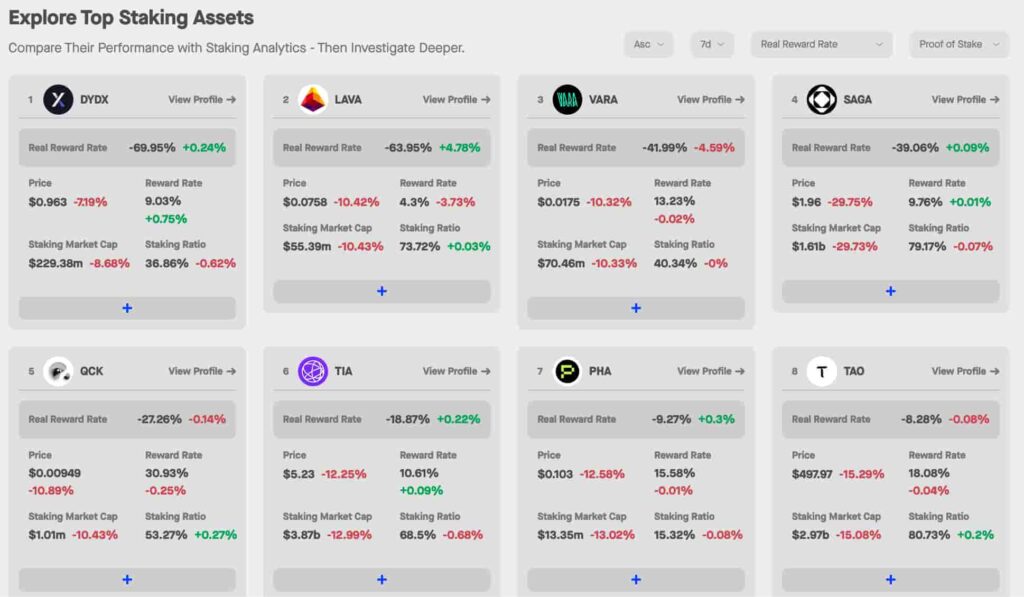

One important aspect is the “Real Staking Reward Rate,” particularly measured by StakingRewards.com, which weights the rewards with inflation. Popular staking cryptocurrencies like DYDX, Celestia (TIA), and Bittensor (TAO) are among the worst to stake, considering this metric.

This is important because a high supply inflation or unlocks can offset the protocol’s promoted reward rate with strong selling pressure, diluting the stakeholders’ value over time, similarly to how a country’s inflation can offset investments’ raw results.

Other examples are Solana (SOL), Sui (SUI), and Aptos (APT), with real reward rates of 1%, -5%, and -4%, respectively. Finbold has reported how Sui’s monthly unlocks can punish unaware investors, suggesting SUI is overbought.

Staking assets ranked by the worst Real Reward Rate. Source: StakingRewards.com / Finbold

Best cryptocurrencies to earn passive income through staking in 2024

On the other hand, better-designed economic models can offer a sound way to earn passive income through staking. Moreover, investors should look to the best combination between the real reward rate and higher staking capitalization for solid allocations.

Among them, we can mention MultiversX (EGLD), Ethereum (ETH), Algorand (ALGO), Near (NEAR), and with a relevant market cap. Their real reward rate is, respectively, 2%, 2.93%, 3.1%, and 3.93%. MultiversX was deemed the “technology Holi Grail of crypto” by experts, being a promising Ethereum rival.

Lending cryptocurrencies in DeFi protocols

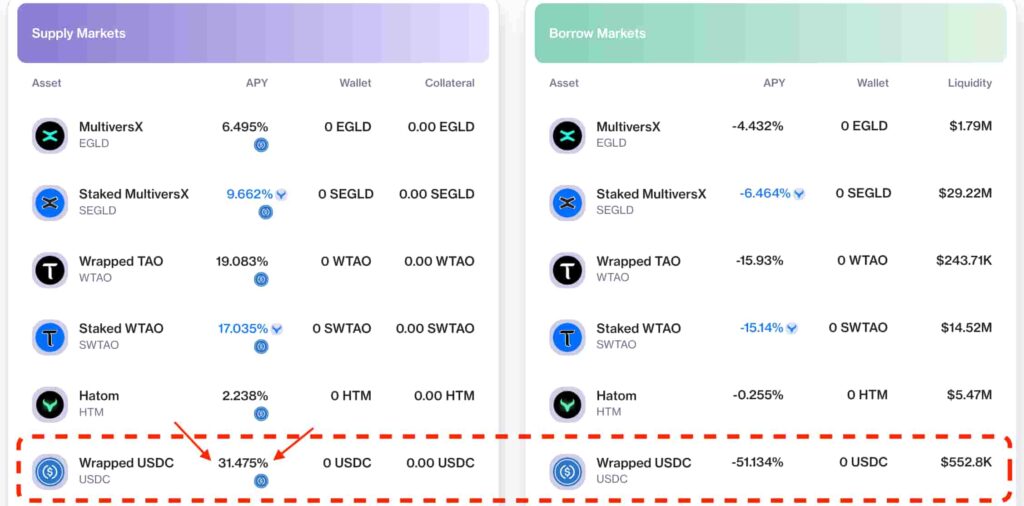

Besides staking, crypto investors can also put their tokens to work and generate yield via decentralized finance (DeFi) protocols. These platforms allow anyone to supply assets for decentralized lending operations, earning passive income from the borrowers who pay interest.

Notably, most of these protocols work through a rule of supply and demand in their money markets. Therefore, the expected yield can vary, increasing in markets with a higher borrowing demand and decreasing while facing opposite dynamics.

Examples include Hatom (HTM) on MultiversX, Aave (AAVE) on Ethereum, Folks Finance on Algorand, and Burrow Finance (BRRR) on Near.

Essentially, investors holding Circle’s regulated stablecoin USDC can deposit the token in these protocols, earning dynamic passive income from borrowers. USDC’s APY can vary from over 30% on Hatom by press time to 11% on Folks Finance, 5% on Burrow Finance, and 4.64% on Aave.

Hatom money markets, supply and borrow markets. Source: app.hatom.com/lend

Nevertheless, investing opportunities always come with risks and require knowledge to navigate properly, with the best possible results. This is no different from earning passive income with crypto in 2024, requiring investors to have a clear strategy.