3 cryptocurrencies to avoid trading as sell-offs take over

3 cryptocurrencies to avoid trading as sell-offs take over

![]() Cryptocurrency Aug 24, 2024 Share

Cryptocurrency Aug 24, 2024 Share

Sentiment has shifted from bearish to bullish in the cryptocurrency market following a dovish speech by Fed’s chair Jerome Powell. While most cryptocurrencies are seeing increased buying pressure, three digital assets may suffer from impending sell-offs this week.

Concerns about crypto selling activity started as on-chain analysts spotted the Ethereum Foundation moving 35,000 Ethereum (ETH) to Kraken. As Finbold reported, the community demanded an explanation for the $100 million worth of ETH on August 23.

Notably, Aya Miyaguchi explained that it is a usual treasury management activity within the Foundation’s yearly budget. It is also worth mentioning that the amount equal to 0.03% of Ethereum’s circulating supply can hardly significantly impact the token’s price, distributed throughout the rest of the year.

Picks for you

2 cryptocurrencies to reach $1 billion market cap by September 5 hours ago Bitcoin eyes $110,000 for an year-end rally – Here’s why 7 hours ago Trading expert names altcoin to 'keep your eyes on' as Bitcoin starts moving 7 hours ago Solana's 'Adam and Eve' pattern outlines path to $220 8 hours ago

On the other hand, Finbold identified three cryptocurrencies with incoming potential sell-offs representing a larger percentage of their circulating supplies. Traders should cautiously observe these projects in the following days and weeks as the selling activities take place.

XRP’s impending $120 million sell-off

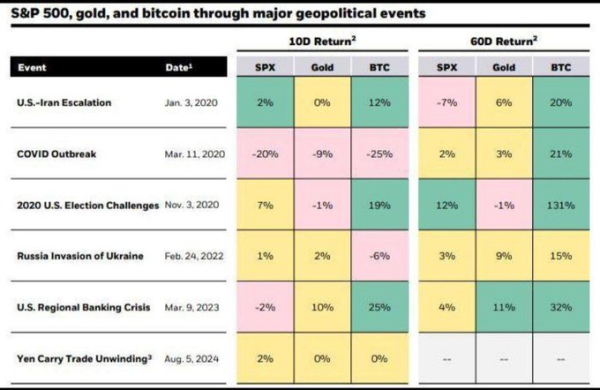

The first and most notable impending sell-off is from Ripple regarding the XRP Ledger (XRP). Usually, the company moves over 200 million XRP every month from its treasury account, supposedly selling most of these tokens.

According to a previous Finbold study, Ripple has moved 1.826 billion XRP in likely sell-offs year-to-date. As of this writing, 200 million XRP worth approximately $124 million still sit in ‘Ripple (1)’ – on-chain data shows.

Ripple (1) transaction history. Source: XRPScan

Ripple (1) transaction history. Source: XRPScan

Optimism (OP)

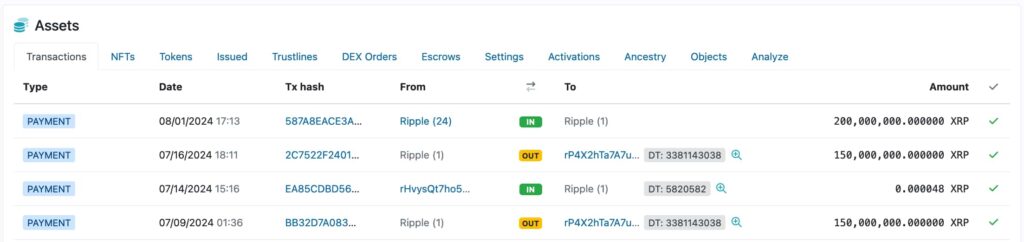

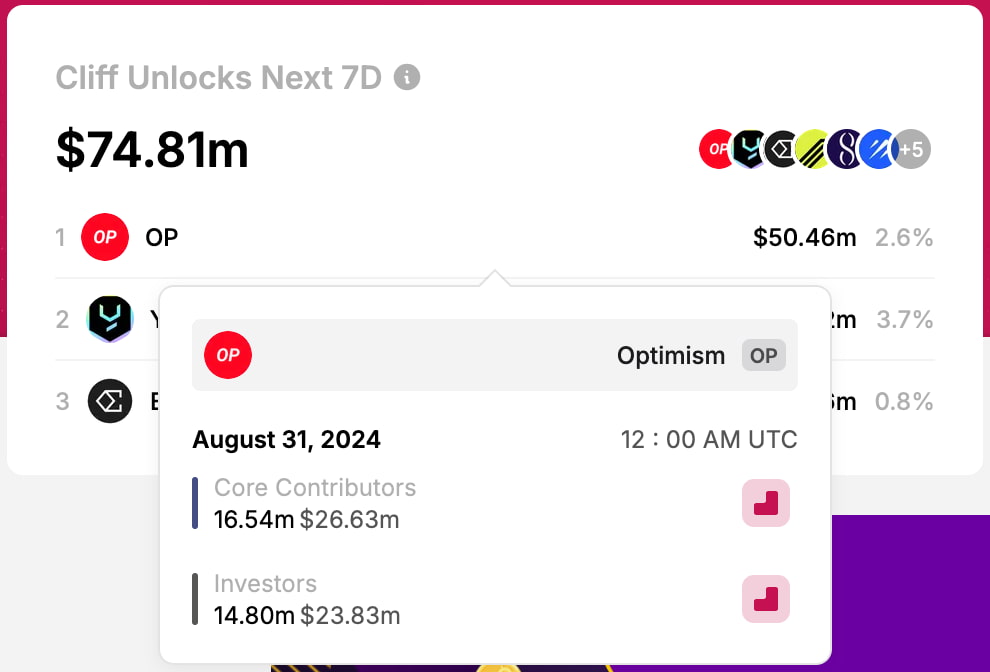

Second, Optimism (OP) stands out amid the cryptocurrencies to avoid trading this week with an incoming unlock on August 31. The Ethereum’s second layer network will release 31.34 million OP, worth $50.46 million, to “Core Contributors” and “Investors.”

This activity will inflate Optimism’s circulating supply by 2.6%, and the project alone represents 67% of all $74.81 million worth of token unlocks expected for the next seven days, according to data from TokenUnlocksApp retrieved on August 24.

Cliff Unlocks Next 7D, Optimism (OP) unlock on August 31. Source: TokenUnlocksApp

Cliff Unlocks Next 7D, Optimism (OP) unlock on August 31. Source: TokenUnlocksApp

Avoid trading Yield Guild Games (YGG)

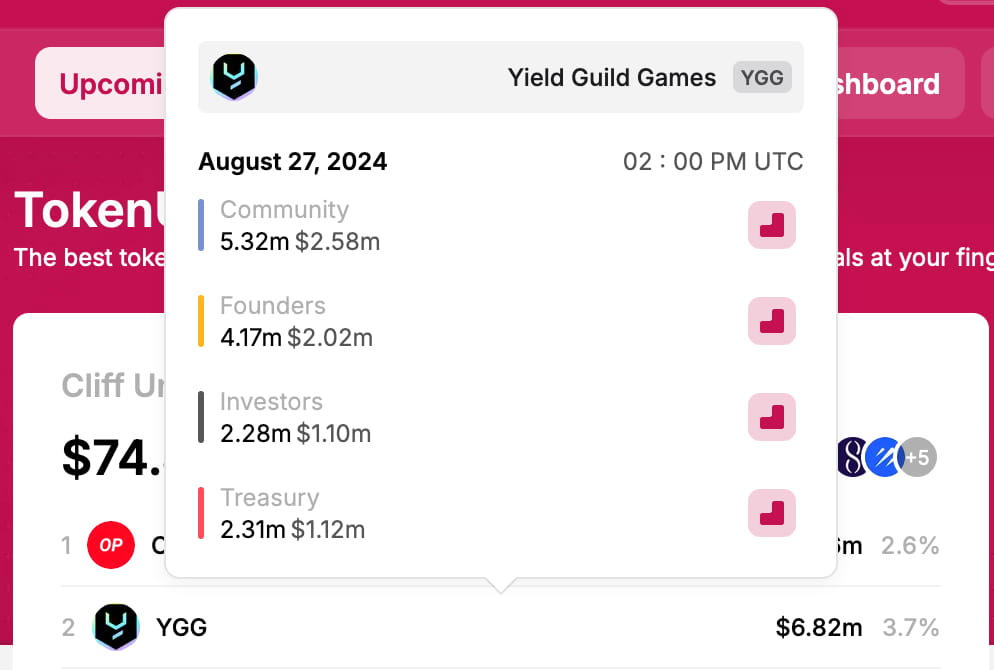

Summing up to the week’s unlocks, Yield Guild Games (YGG) will unlock 14.08 million YGG that are expected to be partially sold in the market by the Community, Founders, Investors, and Treasury.

Interestingly, YGG’s unlock equals $6.82 million at current prices but still represents 3.7% of the token’s circulating supply. Therefore, although comparatively low to other sell-offs, this event can still impact the Web3 gaming project from August 27 onward.

Cliff Unlocks Next 7D, Yield Guild Games (YGG) unlock on August 27. Source: TokenUnlocksApp

Cliff Unlocks Next 7D, Yield Guild Games (YGG) unlock on August 27. Source: TokenUnlocksApp

Investors should properly study and understand tokenomics before deploying capital to cryptocurrencies to avoid being surprised by sell-offs. Nevertheless, an unlock or impending supply pressure may not affect the price if there is enough demand for the cryptocurrency.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.