$500 Million Bitcoin in 24 Hours: ETFs Waking Up

With a net inflow of 7,494 BTC, or roughly $490 million, in just one day as of Oct. 15, 2024, Bitcoin ETFs have experienced a sharp increase in activity. A total of 3,627 BTC, or about $237 million, was deposited into Fidelity, one of the biggest holders of Bitcoin ETFs. With an impressive 183,695 BTC valuation, or $12.02 billion, Fidelity now owns a significant amount of Bitcoin.

A total of 2,485 ETH, or roughly $6.38 million, went into Ethereum ETFs on the Ethereum side. Leading the pack was the iShares Ethereum Trust, which added 5,453 ETH valued at $14.01 million, increasing its total ETH holdings to 419,621 ETH, which is now valued at over $1 billion.

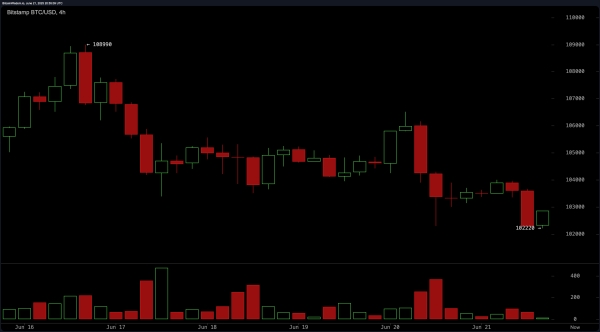

Due to regulatory clarity and the growing recognition of Bitcoin and Ethereum as valuable investment vehicles, there has been an increase in institutional interest in both of these digital assets, as evidenced by the spike in ETF activity. Significant inflows are being driven especially by Bitcoin ETFs, indicating a resurgence of interest in the asset. Bitcoin’s price is likewise showing encouraging momentum from a technical standpoint.

Bitcoin has now broken out of a protracted downturn that lasted for more than 220 days – after hitting the crucial resistance level of $67,000. Because it creates the possibility of additional price growth, this breakout is a noteworthy development for cryptocurrencies. Even though this breakout is positive, bulls must continue to have confidence above $67,000 in order to verify the beginning of a new uptrend.

The next levels to watch are $62,000, which is probably now going to act as a strong support level, and $70,000, which might operate as psychological resistance. If momentum continues at these levels, additional price growth may be possible as institutional adoption of ETF investments grows.