AI sets date when Bitcoin will hit $100,000

AI sets date when Bitcoin will hit $100,000

![]() Cryptocurrency Nov 2, 2024 Share

Cryptocurrency Nov 2, 2024 Share

With Bitcoin (BTC) failing to hold above the $70,000 mark, market attention remains on whether the flagship cryptocurrency can reach the highly anticipated $100,000 all-time high.

Notably, Bitcoin’s recent rally was initially seen as a trigger for a six-figure valuation. Now, an artificial intelligence (AI) tool has offered insights into when it might hit this milestone.

Bitcoin is consolidating below $70,000, trading at $69,590 as of press time. Over the past 24 hours, it has gained 0.20%; on the weekly chart, it is up almost 4%.

Picks for you

Beware: Ripple prepares for largest XRP monthly dump in 7 years 17 mins ago 2 cryptocurrencies to reach 100 billion market cap by year-end 16 hours ago Here’s what awaits gold after the U.S. presidential elections 19 hours ago Ripple v. SEC case update: November 1, 2024 19 hours ago  Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Meanwhile, Bitcoin continues to show bullish potential as it trades above its 50-day and 200-day simple moving averages.

AI sets timeline for Bitcoin’s path to $100,000

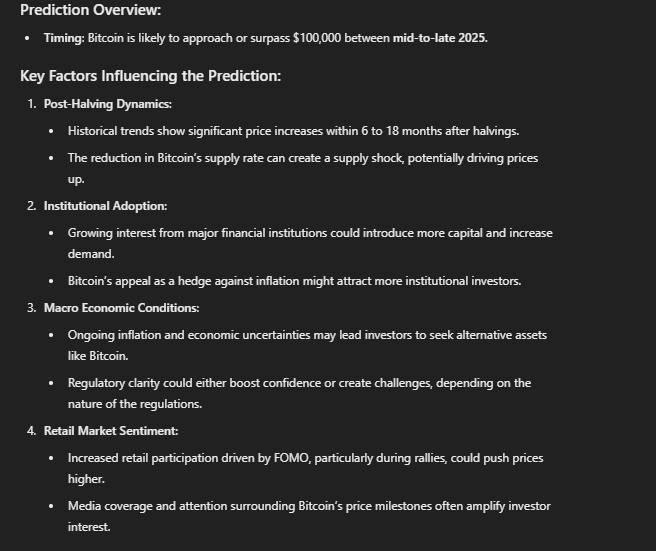

For insights on when Bitcoin might reach $100,000, Finbold consulted OpenAI’s ChatGPT-4o. According to the AI platform, Bitcoin’s path to $100,000 will likely be influenced by several factors, including the impact of the 2024 halving, support from institutional investors, and macroeconomic conditions like interest rates and inflation.

According to the tool, Bitcoin’s price could be volatile due to unexpected economic, regulatory, or market events.

Based on these factors, ChatGPT-4o predicted that Bitcoin could hit $100,000 by mid-to-late 2025. This would require Bitcoin to rally by over 40% at current levels.

Factors driving Bitcoin’s price to $100,000. Source: ChatGPT-4o

Factors driving Bitcoin’s price to $100,000. Source: ChatGPT-4o

It’s worth noting that Bitcoin was previously on track to target $100,000 after closing in October, with its highest monthly gains at 12%. However, the cryptocurrency failed to maintain this momentum into the new month. Several factors influenced the recent rally, including the upcoming U.S. presidential election.

Republican candidate Donald Trump has pledged to make Bitcoin a U.S. strategic reserve, potentially shifting the asset’s demand-supply dynamics in its favor.

The bullish sentiment surrounding the election partly stems from historical performance. Historically, Bitcoin has tended to slide in the days before election day despite a general belief that U.S. election cycles are bullish for the asset.

According to data shared by crypto analyst Ash Crypto, in 2016, Bitcoin fell 10.2% before the election, while in 2020, it saw a smaller yet notable decline of 6.1%. So far 2024, Bitcoin has been down by 6.3% as election day nears. Despite these declines in pre-election, broader market sentiment remains optimistic.

Bitcoin price performance in relation to US elections. Source: Ash Crypto

Bitcoin price performance in relation to US elections. Source: Ash Crypto

Meanwhile, according to a Finbold report, financial experts have shared their predictions for Bitcoin’s performance during the 2024 elections.

What next for Bitcoin

Some analysts believe Bitcoin could surpass $100,000 in the coming year. For instance, in an X post on November 2, an analyst with the pseudonym CryptosRus highlighted that Bitcoin is testing a significant technical level: the “neckline” of a large inverse head-and-shoulders pattern.

A successful breakout above this neckline could trigger substantial buying momentum, with an upside target of approximately $200,000 by 2025 if the pattern completes as expected. However, Bitcoin must maintain momentum and clear this resistance to confirm a bullish setup.

Bitcoin price analysis chart. Source: CryptosRus

Bitcoin price analysis chart. Source: CryptosRus

Currently, Bitcoin faces the challenge of breaching the $70,000 resistance and possibly aiming for $70,500. Failure to break through $70,000 could lead to bearish momentum, with $68,500 as a critical support level to watch.