Analyst Says Bitcoin Growth Ahead, Identifies Catalyst for a Rally to $180,000 This Year

A recent analytical commentary has identified a recurring pattern in Bitcoin price action, setting the precedent for further upside to unprecedented prices.

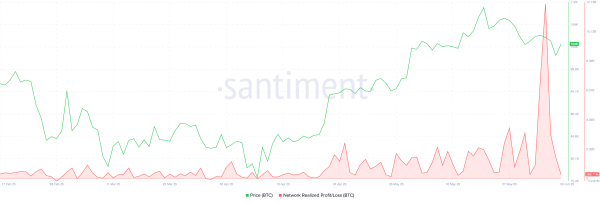

Bitcoin’s wick dropped to $100,000 yesterday, shaking off nearly $1 billion worth of leveraged positions in the past 24 hours. While many panicked, an earlier analysis had forewarned of the possible correction.

Meanwhile, Bitcoin has rebounded from the dip, reclaiming $103,000 at the time of writing. Interestingly, according to a recent analysis from crypto researcher Klarch, it is still up only for Bitcoin, as he discloses its target for the bull cycle.

Bitcoin Cycles Are Identical

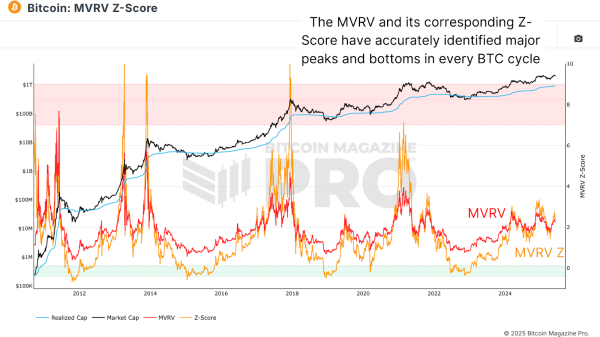

In the Thursday post, Klarch identified a recurring pattern of price appreciation following the Bitcoin halving. The pre-programmed, fully automated halving event has historically been accompanied by price upside for the crypto leader, and data indicates the asset is still in its early stages of this bullish phase.

For perspective, the market watcher noted that Bitcoin rallied 280% a year after the 2016 halving event and posted an even higher surge of 550% in 367 days after the 2020 halving. While Bitcoin has fallen short of these numbers with just a 70% growth 416 days post-halving, Klarch insisted that there is growth ahead.

Bitcoin’s Halving Performance / Klarch

Furthermore, he clarified that Bitcoin’s multiple all-time highs this year do not signal the top. The asset reached a new all-time high of $109,350 on Inauguration Day in January and again at $112,000 on May 22, and the analyst believes it is the second of many for this cycle, rather than a sign of the top.

Analyst Says $180,000 is Bitcoin’s Target.

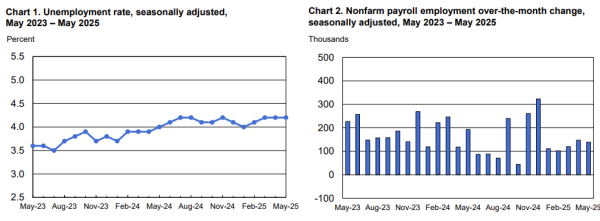

Meanwhile, Klarch highlighted key factors suggesting that Bitcoin would rally to new highs, specifically up to 74% from the current price to $180,000. One of these factors is the continuous influx of liquidity into the crypto market.

Bitcoin remains an asset in high demand, with institutional traction further adding to the catalyst’s impact. Incessant purchases from Strategy and other firms, as well as from US Bitcoin spot ETFs, have made the leading cryptocurrency relatively scarce.

As a result, the analysis suggests Bitcoin would rally on this propellant, potentially targeting $180,000. Furthermore, he noted that considering the length of historical cycles, there is still more time for Bitcoin’s bull season.

First, he highlighted that Bitcoin’s up season typically lasts between 12 months and 18 months after the halving event. More interesting is that the asset is still in its growth stage.

An accompanying chart illustrates that Bitcoin undergoes three distinct phases in each cycle: accumulation, growth, bubble, and crash stages. As the name implies, the bubble phase is characterized by massive price upticks that quickly burst, often followed by a market crash.

Bitcoin Cycle Phases / Klarck

However, Bitcoin is currently in the growth stage and is on the cusp of entering the euphoria phase. As a result, the rally to $180,000, a target he shares with asset manager VanEck, remains a possibility this bull cycle.