Analyst Says “My Target is 100 Thousand in Bitcoin, $6,500 in Ethereum”, Lists 9 Reasons

The cryptocurrency market experienced a revival today, with Bitcoin (BTC) reaching its highest price in nearly a month. This rally comes as the world grapples with a major cyber disruption.

Earlier this week, cryptocurrencies were hit in tandem with a stock sell-off in the US. However, today’s rise comes as major stock indices continue their downward trend. The resilience of decentralized systems such as public blockchains was highlighted by some crypto watchers after a software update by cybersecurity service provider CrowdStrike caused widespread computer outages around the world, shutting down airlines, banks and businesses.

Charles Edwards, founder of crypto hedge fund Capriole Investments, stated that Bitcoin’s rapid rise coinciding with the traditional US market opening potentially indicates buying offers from institutional investors. “As global technology and banking systems fail on the Microsoft blue screen, has an institution woken up and decided that Bitcoin is a safe haven, a decentralized store of value?” asked.

Mads Eberhart, a crypto analyst at Steno Research, expressed a bullish outlook for crypto assets in the second half of the year. Eberhart’s optimism is fueled by a host of support factors, including impending US interest rate cuts, increased liquidity, regulatory clarity in Europe and an increased chance of more crypto-friendly US leadership.

Eberhart set price targets at $100,000 for Bitcoin and $6,500 for Ethereum. Eberhart reiterated his bullish stance on crypto for the second half of the year, citing reasons such as:

- A huge increase in dollar liquidity.

- FED’s possible first interest rate cut.

- Both Bitcoin and Ethereum have a US spot ETF, and Bitcoin ETFs have already broken every record.

- A clear regulatory framework with the European Union’s MiCA.

- Constantly decreasing stock market balances.

- Strong seasonal trends.

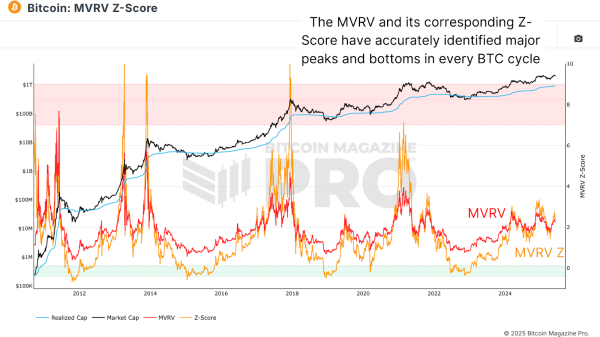

- The period after the fourth Bitcoin halving, a period in which Bitcoin has always thrived.

- Every major bank will try onchain Real World Assets.

- In November, the first US pro-crypto President is likely to be elected.

*This is not investment advice.