Analytics Company Evaluates New Developing Signal in Its Special Metric, Predicts Bitcoin Price’s Course in the Coming Days

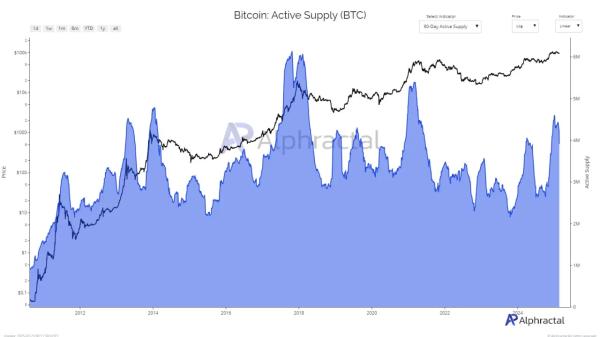

Cryptocurrency analytics firm Alphractal has offered an updated assessment of the Bitcoin market, drawing on key insights from its 90-day Active Supply metric. This indicator provides a lens into market demand and sentiment by measuring the total amount of BTC that has been traded at least once over the past 90 days.

Historically, higher values for this metric have reflected increased interest from new investors and typically indicate periods of high demand, according to the analytics firm. However, Alphractal notes that it has also become a sentiment indicator, with rising values typically coinciding with changes in market sentiment, particularly near market peaks.

Currently, the 90-day Active Supply is trending down, indicating that distributions by short-term holders may have already come to an end. This decline indicates that interest from new market participants is decreasing. According to Alphractal, if this trend continues, Bitcoin’s price action could enter a prolonged consolidation phase or experience further declines.

*This is not investment advice.