Another US Company Decides to Add Bitcoin to Its Treasury: Following in the Footsteps of Strategy and Tesla

Las Vegas-based modular home manufacturer BOXABL has announced that it has added Bitcoin to its official treasury reserve strategy. The company says it will purchase Bitcoin with a portion of its assets, following in the footsteps of industry leaders such as Tesla, Coinbase, MicroStrategy and Michael Saylor.

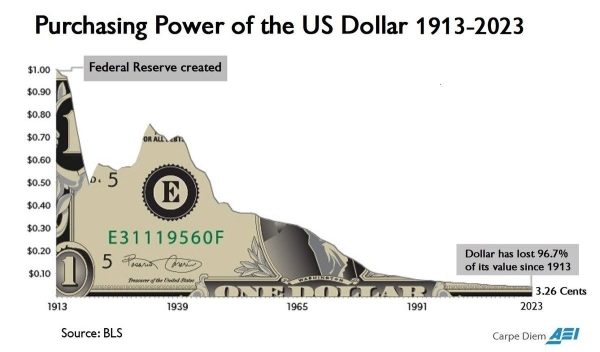

Company officials noted that cash reserves in US dollars could lose value due to inflation, and that Bitcoin offers long-term value-gaining potential. The fact that Bitcoin is as accessible as cash in terms of liquidity and gains value over time was an important factor in the company’s strategic move.

BOXABL embraces the use of cryptocurrencies not only in investment but also in sales. Customers who want to buy their products can pay with cryptocurrencies.

In its press release, the company cited the following as the reasons for adopting the BTC strategy:

- Protection against inflation and currency depreciation,

- Portfolio diversification,

- Capital appreciation,

- Liquidity and flexibility,

- Reducing counterparty risk,

- Financial innovation and capital formation,

- Resilience to economic shocks.

*This is not investment advice.