Bitcoin Analyst Predicts Final Correction Before All-Time High Push

Michael Van de Poppe, a prominent cryptocurrency analyst has reaffirmed their bullish outlook on Bitcoin (BTC), stating that the leading digital currency is poised for a slight correction before rallying towards a new all-time high. This forecast comes amid volatile market conditions and ongoing liquidity movements observed in the crypto space. In a recent tweet, the analyst shared their view on Bitcoin’s price action, maintaining that the cryptocurrency will experience one final dip before the next upward momentum.

To me, #Bitcoin still remains to have the same theory.

I think we’ll correct slightly, the final correction, and then, from next week onwards, pushing towards a new all-time high. pic.twitter.com/vCnFIQqqas

— Michaël van de Poppe (@CryptoMichNL) October 17, 2024

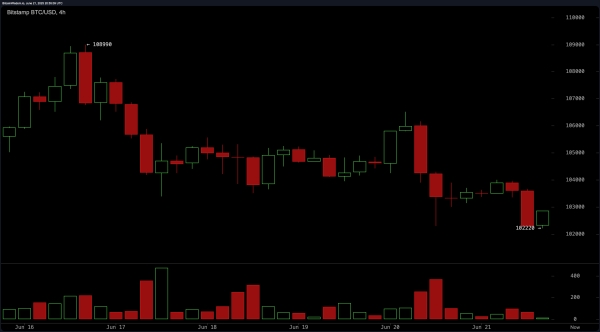

His sentiment reflects a belief in a temporary setback followed by a significant surge that could see Bitcoin challenge its previous price records. Accompanying the analyst’s commentary is a detailed chart showing Bitcoin’s recent price movements. The chart highlights several key liquidity areas where price action is expected to consolidate before making a decisive move. Notably, liquidity has already been taken at certain levels, with the next likely zone to be targeted positioned slightly lower. The analyst suggests Bitcoin could drop into this zone before resuming its bullish trajectory.

The chart further indicates an “area to hold for support” around the $57,000 mark, which could serve as a crucial level for buyers looking to accumulate before the anticipated price surge. Above this support, the price action suggests that Bitcoin may aim for liquidity near $67,000, after which it could push towards even higher levels.

Market Sentiment: Optimism Amidst Uncertainty

Despite recent corrections and fluctuations, the overall sentiment surrounding Bitcoin remains optimistic. The analyst’s outlook aligns with broader expectations that Bitcoin could reach a new all-time high by the end of 2024, primarily as macroeconomic conditions and institutional interest continue to support the cryptocurrency market.

The path to this bullish scenario, however, may take more work. Bitcoin has been known for its volatility, and any unforeseen market developments could delay or alter the trajectory forecasted by the analyst. Nevertheless, the chart’s liquidity indicators suggest that Bitcoin could be setting up for a significant move upward soon.