Bitcoin and S&P 500 massive crash reveals key insights, according to analyst

Bitcoin and S&P 500 massive crash reveals key insights, according to analyst

![]() Cryptocurrency Aug 6, 2024 Share

Cryptocurrency Aug 6, 2024 Share

On August 4, 2024, both Bitcoin (BTC) and the S&P 500 experienced a significant drop, with Bitcoin falling by 7.5% and the S&P 500 by 3%.

This comes amidst mounting recession fears and notable market volatility. On August 2, $2.9 trillion vanished from the stock markets, marking the worst day of trading since the COVID-19 crash in 2020.

The crypto markets were also heavily impacted, with Bitcoin dropping by 18%, Ethereum (ETH) by 27%, and more than $381.26 million in futures positions liquidated in 24 hours.

Picks for you

Ethereum set for a major low: Here’s when to seize the next ‘big buying’ opportunity 51 mins ago Is VP candidate Tim Walz good for Bitcoin? 2 hours ago VP candidate Tim Walz's portfolio revealed 3 hours ago BTC price imminent rally? Bitcoin whales go on $1.6 billion buying spree 3 hours ago

The Fear & Greed Index has now shifted dramatically from greed last week (67) to extreme fear (17) as of August 6, 2024.

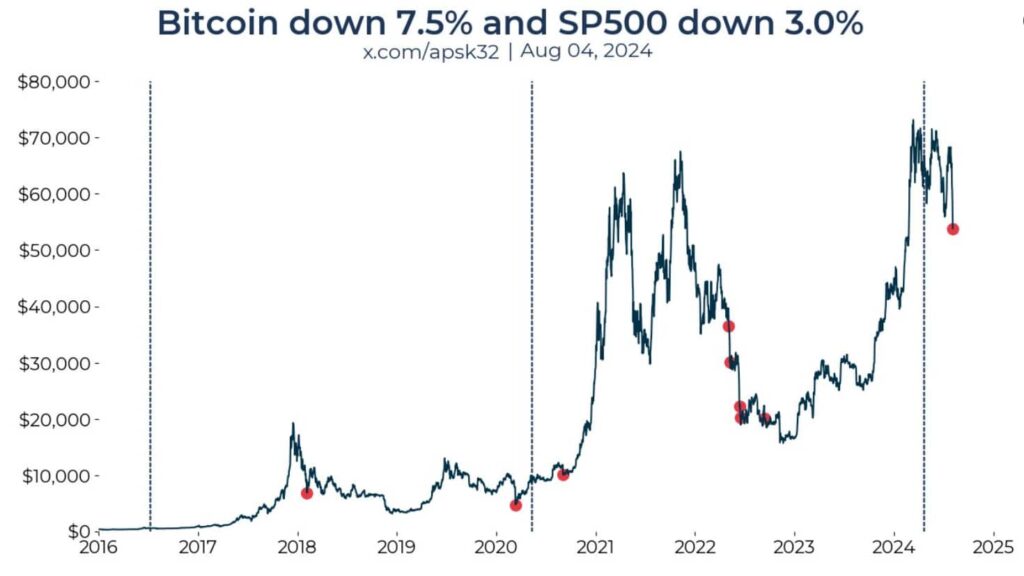

In a recent post on August 6, analyst apsk32 indicated that this marks one of the few times in history where both markets have experienced such substantial drops simultaneously. Historically, these simultaneous declines have often been followed by significant market movements.

Contributing factors and market impact

Several factors have contributed to this market downturn. The US nonfarm payrolls report on August 2 showed a steep slowdown in hiring, signaling potential economic trouble.

Additionally, the Bank of Japan’s (BOJ) decision to raise its interest rates for only the second time since 2007 had a global ripple effect.

The slight interest rate increase from 0% to 0.25% sparked significant market reactions, particularly impacting the yen carry trade. This strategy involves borrowing yen at low interest rates to invest in higher-yielding assets.

This shift in BOJ policy has added to the market’s instability, leading to widespread sell-offs and heightened volatility.

Historical context and potential opportunities

According to analyst apsk32, occurrences around Bitcoin halving events provide useful context for understanding potential market movements.

Bitcoin and S&P 500 comparison over the past eight years. Source: apsk32/X

Bitcoin and S&P 500 comparison over the past eight years. Source: apsk32/X

On March 12, 2020, and September 3, 2020, these dates coincided with the period around the Bitcoin halving event, known for its market volatility and subsequent price increases.

Investors who capitalized on these dips saw six-month returns of 109.8% and 375.7%, respectively. On February 5, 2018, a decline occurred during a temporary recovery phase within the halving cycle.

The market saw a seven-day return of 28.3%, a one-month return of 42.7%, but only a modest six-month return of 1.1%.

On May 5 and 9, June 13 and 16, and September 13, 2022, these declines happened during the 2022 bear market, characterized by prolonged downturns.

The six-month returns were significantly negative, with May 5 and 9, 2022, showing -43.9% and -29.4%, respectively.

Analysis and recommendations

Given the historical data, the current simultaneous drop in Bitcoin and the S&P 500 may present potential buying opportunities, albeit with caution.

The historical patterns suggest varied outcomes based on the market context. If the market follows the pattern observed around the 2020 halving, significant short-term gains could be on the horizon, as evidenced by historical seven-day and one-month returns.

Conversely, if the market mirrors the 2022 bear market pattern, investors might face prolonged downturns with significant negative returns over a six-month period.

Diversifying investments and establishing clear exit strategies can help mitigate risks and enhance potential returns. While past events around Bitcoin halvings have led to significant returns, prolonged bear markets have also resulted in considerable losses.

Investors should carefully analyze the current market conditions and historical patterns to make informed decisions, balancing the potential for short-term gains with long-term uncertainties.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.