Bitcoin (BTC) Faces One-Month Countdown to Potentially Lucrative Q4

Bitcoin’s (BTC) price has experienced varying levels of return for each quarter of the last five years. However, one thing synonymous with these periods is how the coin produces a positive return between October and December.

With September approaching, BTC could be close to another season where the price might go on a parabolic rally. Will it be the same this time?

What History Says About Bitcoin Performance in Q4

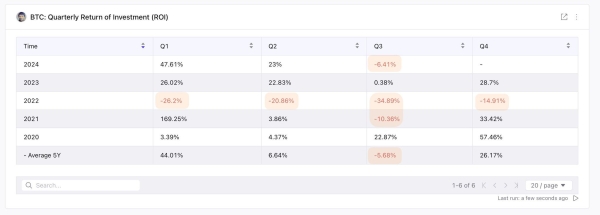

Historically, Bitcoin’s price tends to underperform in the third quarter (Q3). However, according to a chart shared by analyst Axel Adler, Bitcoin has seen an average increase of 26% every fourth quarter (Q4) since 2019.

For example, in October 2023, BTC traded around $26,000. By December, it had surged to $44,000. In contrast, Bitcoin didn’t achieve such gains in 2022 due to the FTX contagion, which pushed the market into a bear phase.

In 2021, Bitcoin rose from $40,000 to $69,000 between September and November, before experiencing a slight decline in December. A similar pattern occurred in 2020 when BTC’s price doubled during Q4.

Read more: What Is Bitcoin? A Guide to the Original Cryptocurrency

Bitcoin Historical Performance. Source: Axel Adler via X

Bitcoin Historical Performance. Source: Axel Adler via X

If this pattern holds true, Bitcoin’s price could be poised for a significant increase once September ends. To gauge this potential, it’s crucial to evaluate the current market conditions surrounding the coin.

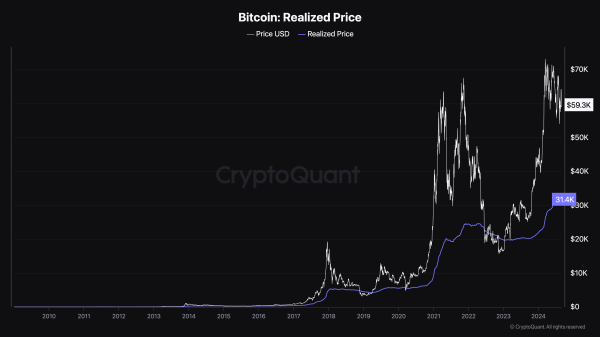

BeInCrypto specifically examines the Realized Price, which represents the average price the entire market paid for Bitcoin. Historically, this metric has served as an on-chain support or resistance level for BTC.

At press time, Bitcoin’s Realized Price is $31,400. This value appears to be providing support for the cryptocurrency, as indicated by the CryptoQuant chart below. For the Realized Price to act as resistance, it would need to align with or exceed Bitcoin’s current market value.

Bitcoin Realized Price. Source: CryptoQuant

Bitcoin Realized Price. Source: CryptoQuant

When this happens, the value tends to decrease afterward. Therefore, the current value of the metric suggests that Bitcoin still has a good upside potential. Hence, a significant price increase could be likely by Q4 and before the end of this year.

BTC Price Prediction: The Coin Hints at a 24% Gain, But First…

As of this writing, Bitcoin is trading at $59,551, down from $64,452. Notably, this price is hovering around the 200-day Exponential Moving Average (EMA), a key technical indicator that measures trend direction. The 200 EMA (blue) offers insights into the long-term trend.

When the 200 EMA rises above Bitcoin’s price, it often stalls the uptrend or pulls it down. Conversely, when the 200 EMA is below the price, it creates room for Bitcoin to grow. Currently, if BTC fails to climb above this indicator, its price could drop to $57,818 or potentially as low as $54,474.

The Chaikin Money Flow (CMF), which tracks the flow of liquidity into a cryptocurrency, also supports the possibility of a decline. The CMF reading has dropped, signaling a decrease in buying pressure.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin Daily Analysis. Source: TradingView

Bitcoin Daily Analysis. Source: TradingView

However, if past performance is any indication, BTC could rise by 24% in the early months of Q4, pushing the coin’s price to $71,974. On the other hand, if the broader market experiences a significant decline in capital inflow, this prediction could be invalidated, potentially causing Bitcoin’s price to fall to $49,068.