Bitcoin (BTC) Price to Explode If This Happens

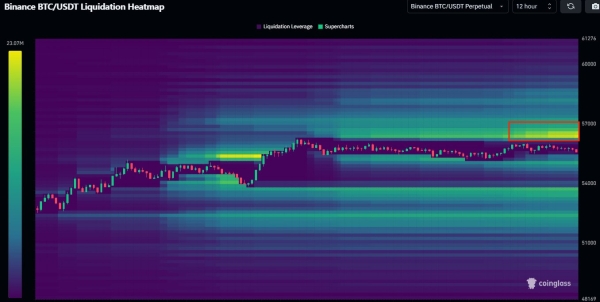

Although there has recently been a notable decline in the price of Bitcoin, there are indications that a significant upswing may be imminent. There are roughly $23 million worth of orders stacked up around the $56,000 mark, according to the liquidation heat map. This is an important price range because it is where a short squeeze could cause Bitcoin to surge in the event of liquidations.

In a short squeeze, short sellers are forced to buy back their positions in order to prevent further losses when the price of an asset that has been heavily shorted begins to rise. A quick and notable price recovery may result from this buying pressure, pushing the price even higher.

The accumulated liquidation orders at $56,000 in the case of Bitcoin imply that a breakthrough at this point might cause such a squeeze, driving up the price. Bitcoin is trading near this crucial level right now at about $55,190. The price might reverse the recent downtrend if it breaks above $56,000 as a result of a short squeeze that would happen afterward.

In this case, the price recovery would probably be amplified by drawing in additional buyers. But it is imperative to exercise caution. An optimistic outlook is provided by the possibility of a short squeeze, but the recent significant price decline may cause the downtrend to continue. If sellers are not worn out, the market sentiment could continue to be bearish.

It is imperative to keep a close eye on the dynamics of the market, especially the activity surrounding the $56,000 price range. More broadly, a number of factors such as macroeconomic conditions, institutional behavior and market sentiment impact the price action of Bitcoin.

Investors must remain ready for any changes as the market remains volatile. Given the accumulation of liquidation orders and the potential for a short squeeze, Bitcoin’s price has the potential to soar if it breaks through the $56,000 barrier.