Bitcoin Bulls Ignore the Drop! Analyst: “If This Level Is Broken, BTC Will Go to $100K Quickly!”

Bitcoin and crypto markets opened lower on Monday morning in Asia as they await a speech by Fed Chair Jerome Powell and unemployment data.

While BTC and altcoins gave back some of the rise they experienced last week, the BTC price dropped to the level of $64,000.

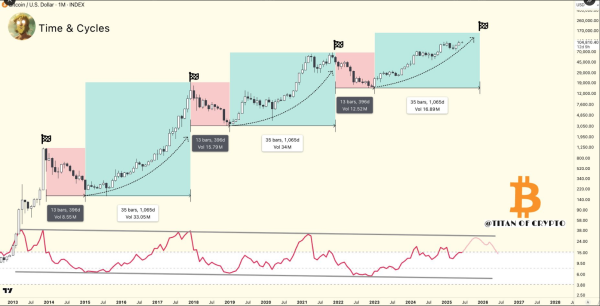

Despite the decline, Bitcoin is in its first three-week uptrend since February. The rally is being supported by investors buying call options, which offers the potential for a rally above $75,000, according to Amberdata.

Speaking to Coindesk, Amberdata Derivatives Director Greg Magadini said that BTC has been on a three-week uptrend, rising by over 3% in the past week through September 29, continuing the 7% gains seen in the previous two weeks.

Stating that this rise was supported by option investors, Magadini said that option investors purchased a significant amount of call options at the $75,000 expiration price and higher levels on Deribit.

Magadini noted that a potential breakout above $75,000 in Bitcoin could quickly push the price to $100,000.

“This flow pattern from the options market indicates an upward trend for spot prices (due to put sales) while also predicting an acceleration in price action.

A call buyer is indirectly bullish on the market, while a put buyer is bearish on the market to protect against price fluctuations.

“A breakout above $75,000 could lead to a rapid rally from the $73,000 ATH in March to $100,000. $100,000 is where the final tranche of call buyers are concentrated at the December 27, 2024 expiration date.”

Finally, the analyst added that a potential breakout in Bitcoin would mean a resumption of the broader uptrend from the sub-$30,000 lows in October 2023.

*This is not investment advice.