Bitcoin Price Analysis: Will the $80K Support Level Hold BTC After Recent Rejection?

Bitcoin’s price was rejected this week, showcasing the insufficient bullish momentum in the market.

Nevertheless, the asset faces a substantial support range at the $80K mark, which is expected to hold the price in the short term.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin has recently experienced a notable rejection after briefly breaking above the 100-day MA, signaling a false breakout and insufficient bullish momentum. This failure to break through reinforces the prevailing bearish sentiment in the market.

Nevertheless, BTC is approaching a substantial support range, including the psychological $80K level and the 0.5 ($84K) – 0.618 ($78K) Fibonacci retracement zone. This crucial region is expected to act as a support zone, potentially leading to a new consolidation phase around the $80K mark.

Given these conditions, Bitcoin is likely to continue its decline toward $80K in the short term, where price action will determine the next significant move.

The 4-Hour Chart

On the lower timeframe, Bitcoin encountered increased selling pressure at the upper boundary of its descending channel, leading to a strong rejection. The price is currently testing short-term support at $83K, aligning with a prior swing low. While some buying interest may emerge at this level, overall market conditions lack bullish momentum, and sellers remain dominant.

As a result, BTC is likely to break below $83K and move toward the channel’s mid-boundary at $80K, which is a critical inflection point. While it may support the price and initiate a consolidation phase, a breakdown below this level could trigger a deeper decline toward the $77K threshold.

On-chain Analysis

By Shayan

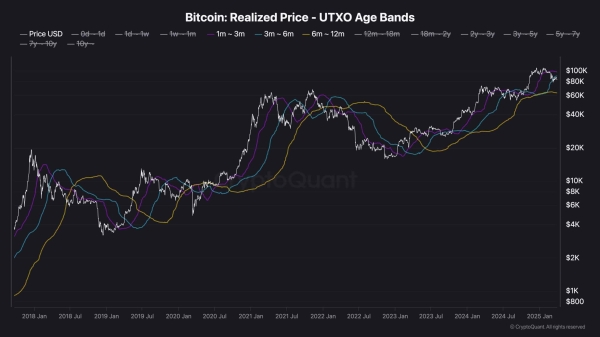

Bitcoin’s interaction with the Realized Price of long-term holders’ UTXOs has historically been a key indicator of market direction, as it represents the average acquisition cost of these holders. Bear markets typically begin when the price drops below the realized price of the 6-12 month cohort, signaling losses and potential distribution by these big investors.

Currently, BTC is trading below the realized price of the 3-6 month cohort at $88K but remains above the 6-12 month cohort’s realized price of $62K. This suggests that while the market is undergoing a deep correction, it is too early to confirm the onset of a bear market.

Bitcoin is likely to continue its corrective retracement within this range until new demand enters the market. The $88K level remains a critical threshold, where a breakout above it could signal the start of a fresh uptrend.