Bitcoin price falls to $61k as Iran attacks Israel – Crypto crash next?

Bitcoin price falls to $61k as Iran attacks Israel – Crypto crash next?

![]() Cryptocurrency Oct 2, 2024 Share

Cryptocurrency Oct 2, 2024 Share

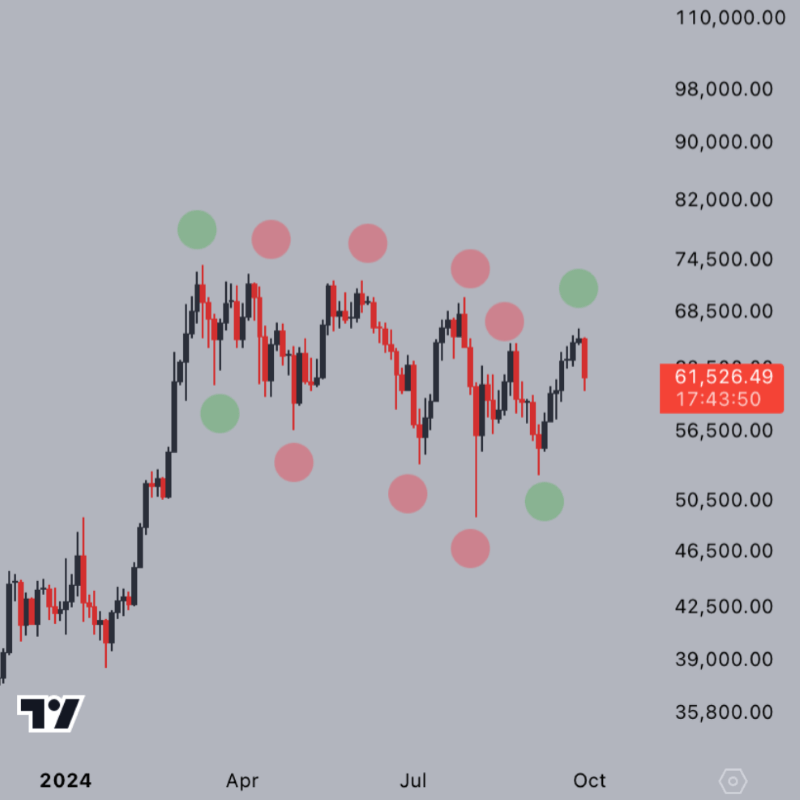

Following the recent turn of events in which Iran fired a volley of about 180 ballistic missiles at Israel, the price of the maiden cryptocurrency, Bitcoin (BTC), retrieved to the $61,000 zone, retracing the previous advances that saw it surpass the psychological level at $66,000 in the past week.

Indeed, following its best September in history, Bitcoin got off to a shaky start to what is typically one of its strongest months, having earned the moniker ‘Uptober,’ and the heightening tensions in the Middle East could be one reason, sparking fears it could spread to other assets in the crypto market.

Bitcoin price analysis

As it happens, Bitcoin was at press time changing hands at the price of $61,160, reflecting a decline of 3.96% in the last 24 hours, losing 3.70% across the previous seven days while recording a 4.63% increase over the past month, according to the latest data on October 2.

Picks for you

Crypto traders lost over half a billion dollars in market crash 47 mins ago AI predicts Bitcoin price for October 31, 2024 1 hour ago ‘Rich Dad’ R. Kiyosaki reveals which investment is recommended by Jesus himself 4 hours ago Sell-off alert: Ripple to dump 200 million XRP in October 4 hours ago  Bitcoin price 7-day chart. Source: Finbold

Bitcoin price 7-day chart. Source: Finbold

Notably, the price dump occurred after the flagship decentralized finance (DeFi) asset closed September at $63,333, its best monthly performance during the ‘September Effect’ to date, registering gains of 7.29%, sparking hopes for an even better October, as Finbold reported on October 1.

‘Uptober’ or ‘dumptober’?

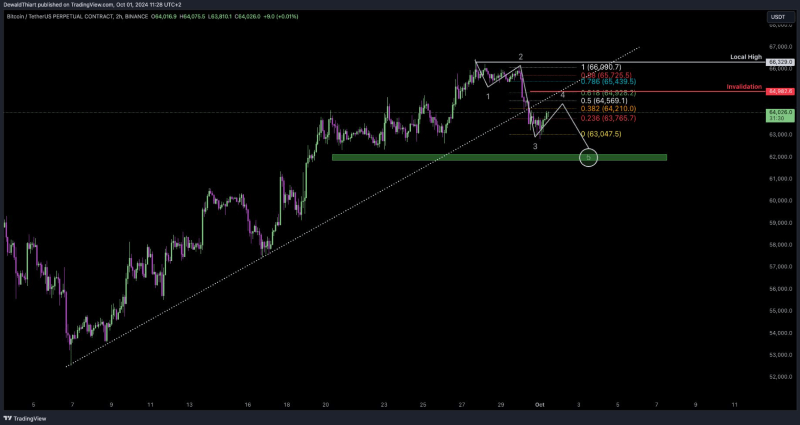

That said, although Iran’s attack might have contributed to the uncertainties, some analysts believe they are also the result of technical analysis (TA) indicators, including Bitcoinsensus, who explained that he had already expected a leg to the downside, regardless of the geopolitical situation.

In fact, as the analyst noted earlier, Bitcoin has lost its trend and needed to reclaim the 0.618 Fibonacci level around $65,000, which served as the invalidation point, to increase the chance of reaching the local high. Otherwise, Bitcoinsensus opined that a further downside was in the cards.

Bitcoin price performance analysis and prediction. Source: Bitcoinsensus

Bitcoin price performance analysis and prediction. Source: Bitcoinsensus

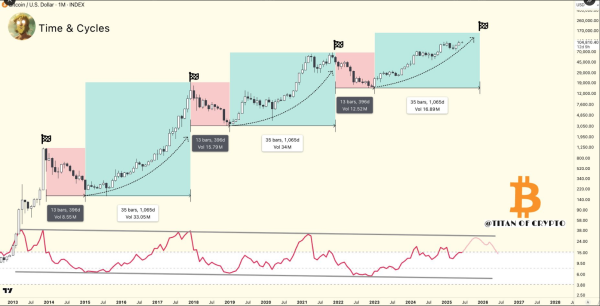

More recently, another pseudonymous crypto trading expert, Jelle, observed that Bitcoin could be in for a higher low in the coming days, after which he expects “new all-time highs for Bitcoin in the next 2-3 weeks,” justifying his prediction with the seasonality and historical patterns.

Bitcoin price performance analysis. Source: Jelle

Bitcoin price performance analysis. Source: Jelle

All things considered, the widespread tensions in the world right now might have some effect on Bitcoin and the crypto market as a whole. However, the recent moves might be the natural course of events given its technical indicators and far from falling victim to developments outside their scope.

That said, trends in the crypto industry can easily change, so doing one’s due diligence, including understanding and carefully weighing all the risks and keeping up with any relevant news, is critical when investing a significant amount of money in any asset, crypto or otherwise.