Bitcoin Price in a Crucial Zone: Holder Analysis Offers Directional Insights

Bitcoin price has been oscillating within the $105,000 price range for a couple of days now. While its performance may indicate strength against the downside, it also highlights a retest of BTC’s previous top zone.

Bitcoin Price Duality

The retest may manifest some resistance, which could potentially trigger some sell pressure. On the other hand, a demand resurgence could pave the way for more price discovery.

This duality of potential outcomes highlights the growing uncertainty. However, there are some interesting market observations that could offer more clarity on Bitcoin’s next possible move.

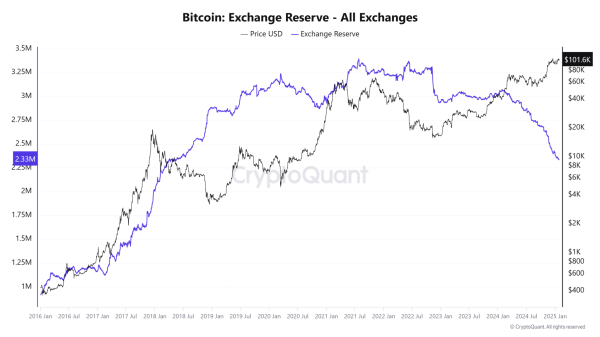

Bitcoin exchange reserves have maintained a downward trajectory and are currently at a multi-year low. There were roughly 2.334 million Bitcoins on exchanges at the time of observation. The last time that exchange reserves were this low was in 2018.

Bitcoin exchange reserves | Source: CryptoQuant

Bitcoin exchange reserves | Source: CryptoQuant

The declining Bitcoin exchange reserves underscore the possibility of a supply crunch if demand is sustained. Such an outcome could trigger the next bullish wave, possibly sending Bitcoin price above $110,000.

Major Bitcoin Holders Maintain Bullish Resolve

HODL for longer appears to be the current name of the game among the big players in Bitcoin. This is what a recent CryptoQuant analysis revealed recently, based on the SOPR ratio assessment.

The analysis noted that the Bitcoin SOPR ratio demonstrated higher growth in the previous major bull runs. In other words, the SOPR ratio has been hitting lower highs compared to previous bull runs.

It also theorized that the lower SOPR ratio, especially in the current bull run, underscores the growing shift from a short-term profit strategy. Many have been adding Bitcoin to their portfolios as long-term assets.

The CryptoQuant analysis stated that the shifting investor dynamics may have contributed greatly to lower exchange reserves. It signals that investors, especially large holders, have recently not been eager to take a lot of profits off the table.

Bitcoin Traders are Declining

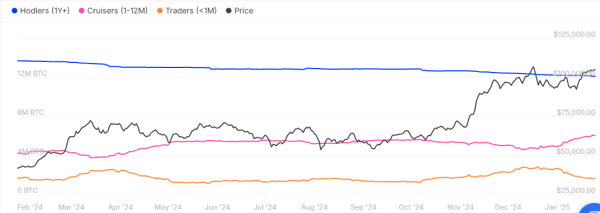

The aforementioned shift is evident in Bitcoin balance by time held. Bitcoin holders are categorized into three categories: Hodlers, Cruisers, and Traders. The Hodlers are those that hold Bitcoin for longer durations, usually more than a year.

Cruisers hold Bitcoin for shorter periods, such as weeks or months. Meanwhile, Traders trade Bitcoin in the shortest time frames, such as day and intra-day. It turns out traders have been declining from 2.84 million BTC on 20 December to 1.62 million on 25 January.

Bitcoin balance by time held | source: IntoTheBlock

Bitcoin balance by time held | source: IntoTheBlock

At the same time, Bitcoin cruisers grew considerably from 4.61 million BTC on 11 December to 6.08 million BTC on 25 January. It confirmed that more investors were switching in favor of long-term gains.

Meanwhile, long-term holders, AKA hodlers, have been securing some profits. Their balances were down from 12.45 million BTC on 1 December to 12.13 million BTC on 25 January.

All these observations support the possibility of a supply shock sometime in the near future. Such an outcome could fuel another rally toward the $115,000 price range. While the numbers underscore market optimism, it may also yield short-term dips if sell pressure intensifies and outshines demand.