Bitcoin Price Prediction – Is a Rebound Around the Corner?

Bitcoin’s price has been going up and down a lot recently, making people wonder if it’s about to bounce back. In this Bitcoin price prediction article, we’ll look at what’s causing these changes and whether a recovery is on the way.

How has the Bitcoin Price Moved Recently?

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

Bitcoin is currently priced at $96,386, with a 24-hour trading volume of $74.38 billion, a market capitalization of $1.91 trillion, and a market dominance of 56.72%. Over the past day, its value has increased by 0.49%.

The cryptocurrency reached its all-time high of $108,239 on December 17, 2024. Its all-time low was $0.05, recorded on July 17, 2010. Since the peak, Bitcoin’s lowest price has been $92,450 (cycle low), while the highest since then was $99,940 (cycle high). The current market sentiment for Bitcoin is neutral, with the Fear & Greed Index indicating a score of 74, reflecting a state of greed.

Bitcoin’s circulating supply stands at 19.80 million BTC, out of a maximum supply of 21 million BTC.

Bitcoin Price Prediction: Is a Rebound Around the Corner?

BTC price recent metrics and market activity provide a promising outlook for a potential rebound. Over the past year, its price has risen by an impressive 123%, outperforming 75% of the top 100 crypto assets and even Ethereum, underscoring its dominance and investor confidence.

The fact that BTC price is trading above the 200-day simple moving average (SMA) is a strong technical indicator, signaling a sustained uptrend and broader market support. Additionally, its high liquidity relative to its market cap ensures price stability, making it a less volatile investment compared to many other cryptocurrencies.

However, the short-term indicators present a mixed picture. With only 14 green days in the past 30 days (47%), Bitcoin appears to be in a consolidation phase, possibly due to profit-taking or cautious market sentiment. Corrections of this nature are typical and often precede stronger upward moves, particularly when underpinned by bullish fundamentals.

The Role of Binance Taker Buy Volume

Bitcoin: Taker Buy Volume: Source: CryptoQuant

Bitcoin: Taker Buy Volume: Source: CryptoQuant

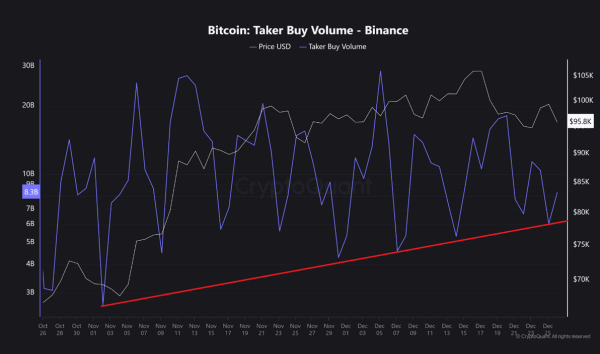

The Binance Taker Buy Volume, which has reached $8.3 billion, is a key metric to watch in assessing Bitcoin’s trajectory. This metric reflects the total volume of buy transactions executed by takers—market participants who purchase at current prices listed in the order book, utilizing the available market liquidity. A consistent increase in this volume is a strong indicator of heightened investor interest and growing buying pressure.

Over the past 60 days, Binance Taker Buy Volume has consistently formed higher lows. This trend reveals an underlying strength in demand, with more buyers willing to step in at progressively higher price points. Such a pattern often signals strong market confidence and is a precursor to upward price movement. High taker buy volume generally reflects strong demand, which can drive prices higher, even in the face of temporary market corrections or consolidation phases.

Considering the rise in Binance Taker Buy Volume alongside Bitcoin’s performance metrics, a rebound seems likely in the near term. The increasing buying pressure observed through this volume suggests that investor sentiment remains positive, despite short-term market fluctuations. As demand continues to outpace supply, Bitcoin could gain momentum and break out of its consolidation phase.

While the market may currently appear overheated, with intermittent corrections, these are part of a healthy growth cycle. The combination of strong fundamentals, technical indicators, and robust demand reflected in the Binance Taker Buy Volume positions Bitcoin well for a potential price increase in the coming days or weeks.

So, while short-term volatility persists, Bitcoin’s long-term indicators and rising taker buy volume suggest that a rebound is not only possible but increasingly probable. Investors should monitor these metrics closely, as they provide critical insights into market behavior and potential price movements.