Bitcoin Price Watch: Oversold Conditions Hint at a Bounce—But Is It Enough?

Bitcoin is trading at $84,926 to $85,125 over the last hour with a market capitalization of $1.68 trillion and a 24-hour trading volume of $39.79 billion, while the intraday price range has fluctuated between $83,232 and $86,517, signaling key technical levels that traders are closely monitoring.

Bitcoin

On the 1-hour chart, bitcoin (BTC) shows signs of consolidation after a strong rebound from the $78,000 level, with resistance forming near $86,000. Volume has started to decline, suggesting a potential slowdown in momentum, and if price action remains above $85,000, further upside could be expected. However, if the price fails to maintain this level, a pullback toward $83,000 becomes likely. The relative strength index (RSI) at 28 indicates oversold conditions, which supports the possibility of a short-term bounce, though the moving average convergence divergence (MACD) level at -3,515 remains in bearish territory.

BTC/USD 1H chart on March 1, 2025, via Bitstamp.

BTC/USD 1H chart on March 1, 2025, via Bitstamp.

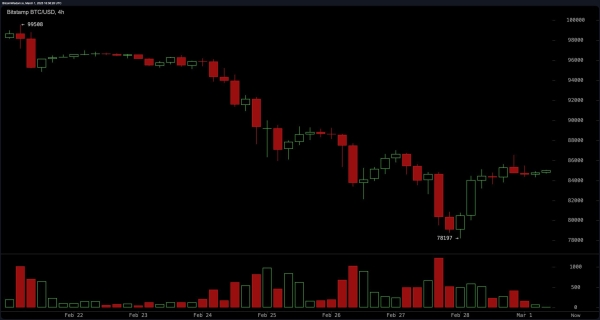

On the 4-hour chart, bitcoin has established support around $82,000–$83,000, while resistance remains at $86,000–$87,000. The trend remains bearish overall, as all key moving averages, including the exponential moving average (EMA) 50 at $95,236 and simple moving average (SMA) 50 at $97,706, indicate strong downward pressure. If bitcoin can hold above $83,000, it may attempt a recovery toward the $87,000 mark. However, failure to break above resistance could result in a retest of the $80,000 support zone, reinforcing the broader downtrend.

BTC/USD 4H chart on March 1, 2025, via Bitstamp.

BTC/USD 4H chart on March 1, 2025, via Bitstamp.

The daily chart further confirms the macro bearish trend, with bitcoin consistently trading below all major moving averages. The EMA 200 at $85,615 suggests that bitcoin is struggling near a critical level, while the SMA 200 at $82,120 provides a long-term support zone. The commodity channel index (CCI) at -135 signals a potential buy, but momentum at -11,702 reflects ongoing selling pressure. For any significant bullish reversal to occur, bitcoin would need to reclaim $87,000 with strong volume, otherwise, continued downside remains a risk.

BTC/USD 1D chart on March 1, 2025, via Bitstamp.

BTC/USD 1D chart on March 1, 2025, via Bitstamp.

Oscillator indicators present a mixed outlook, with the RSI and CCI suggesting that bitcoin may be oversold, while the MACD and momentum indicators continue to favor bearish sentiment. If bitcoin can reclaim key resistance levels, a short-term recovery could be in play, but the weight of the moving averages suggests that the dominant trend remains downward. A confirmed break above $87,000 could indicate a reversal, whereas a drop below $80,000 would likely accelerate further selling pressure.

Traders should closely watch volume trends, as decreasing volume could weaken any potential rally. Short-term price action favors a cautious approach, with potential bullish confirmation above $87,000 or renewed bearish momentum if bitcoin loses support at $83,000. The market remains in a pivotal zone where price direction could be determined by upcoming technical breakouts or breakdowns.

Bull Verdict:

Despite the prevailing bearish trend, bitcoin shows signs of potential recovery if it can break above the $87,000 resistance level with strong volume. Oversold conditions indicated by the relative strength index (RSI) and commodity channel index (CCI) suggest a possible short-term bounce. If buying pressure increases and bitcoin holds above key support at $83,000, a move toward $90,000 could be in play, shifting momentum back in favor of the bulls.

Bear Verdict:

Bitcoin remains in a firm downtrend, with all major moving averages signaling continued selling pressure. The moving average convergence divergence (MACD) and momentum indicators reinforce the bearish outlook, and failure to break $87,000 could result in another leg downward. If support at $83,000 is lost, a deeper correction toward $80,000—or even $78,000—becomes likely, keeping bears in control of the market.